-

For banks with assets between $10 billion and $100 billion, the average exposure is 165% of capital.

June 24 -

An Idaho court has ruled against a Treasure Valley resident for his role in a Ponzi scheme that bilked millions from real estate investors.

June 19 -

Starwood Capital Group missed two monthly payments on securitized debt tied to five shopping malls anchored by bankrupt department stores including Sears and J.C. Penney.

June 18 -

But deal sponsors are primarily restricting property assets to the lower risk multifamily and office buildings that lenders are more confident will weather the economic strains brought by the coronavirus pandemic.

June 12 -

As brick-and-mortar shopping centers steadily lost market share to online competitors, the family behind three of the four biggest malls in North America built a thriving business by infusing their properties with heavy doses of entertainment.

June 9 -

Cited the current capital markets and economic environment as the reasons for pulling out of the transaction.

May 25 -

Sellers are currently willing to concede discounts of around 5%, while bidders are hoping for about 20% off pre-pandemic prices. That estimated gap, which is likely wider in specific cases, has put a freeze on deals.

May 19 -

The global hospitality industry is facing the worst downturn in its history, and New York, the epicenter of the coronavirus outbreak in the U.S., is poised for a painful recovery.

May 15 -

Goldman Sachs and Morgan Stanley are backing the first commercial mortgage-backed securities activity in two months, through two deals that exclude hotel or department store retail assets that are most exposed to pandemic-related stresses.

May 6 -

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

May 4 -

Delinquencies in U.S. commercial mortgage-backed securities jumped in April, with the economy battered by the coronavirus pandemic.

April 30 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

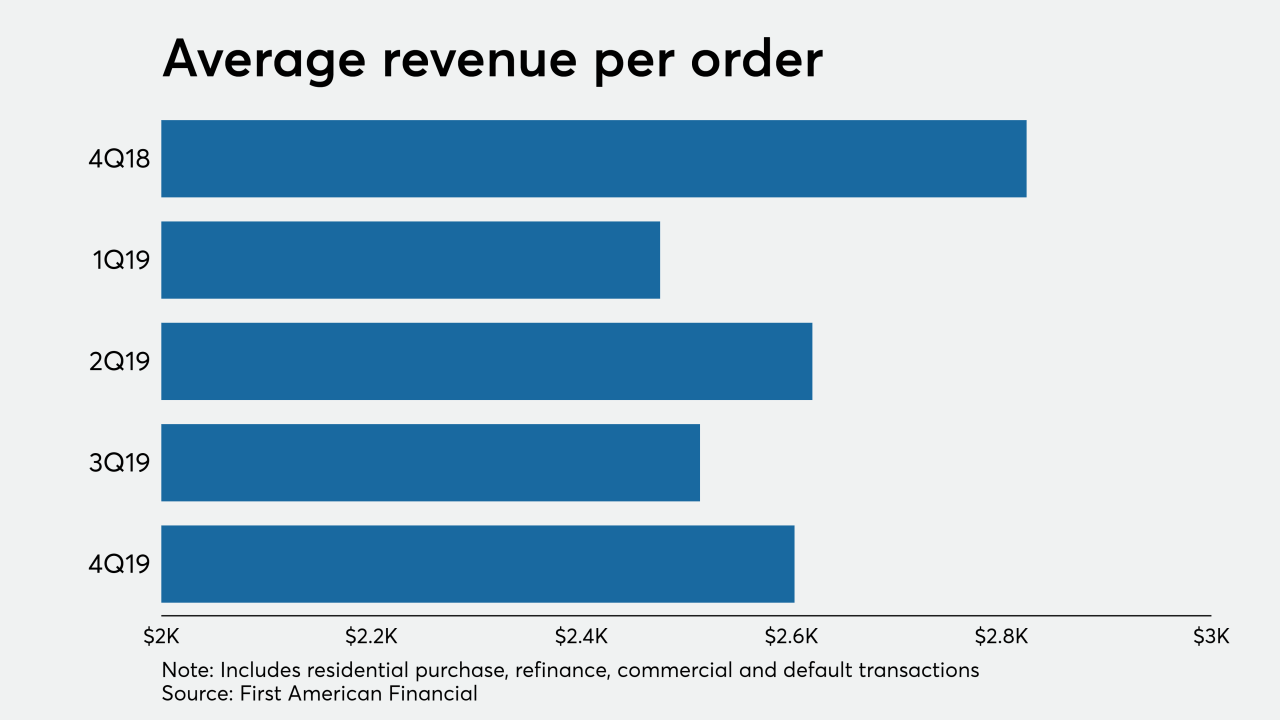

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Simon Property Group agreed to buy rival shopping-mall operator Taubman Centers for about $3.6 billion, a combination that comes as e-commerce continues to roil brick-and-mortar retail.

February 10 -

Galvanized by the Moms 4 Housing standoff that drew national attention to the region's affordability crisis, Oakland officials may soon overhaul the way homes are bought and sold and other Bay Area cities are considering similar measures.

February 10 -

Negotiations went to the brink of a foreclosure trial for a Bradenton, Fla., mall, before a settlement was reached between the owners and the lender.

February 3 -

A bankruptcy court judge denied a lender's motion to foreclose on properties controlled by an Austin real estate investor. But the judge then issued a warning, saying an exit plan better be ready by Feb. 2.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

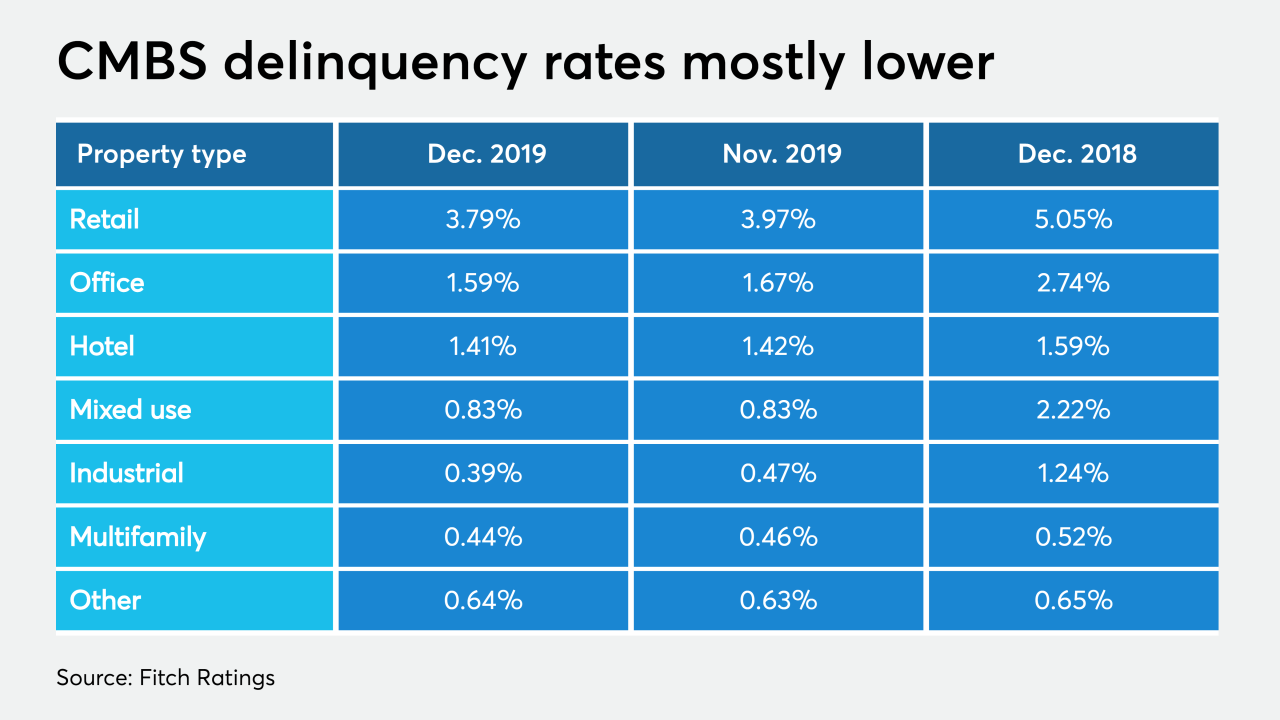

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10