-

As the mortgage industry moves farther past the housing crisis, access to credit remains tight, especially for first-time homebuyers.

May 23 -

The company has also hit its goal of having half of total loans tied to customers around Atlanta.

May 21 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Preferred Bank's experience with an apartment developer is a reminder of how important strict underwriting terms will be as loan demand increases, rates rise and lenders try to outdo each other.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

Investors are growing worried about lackluster loan growth this year at community banks.

April 12 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

The Arkansas company has spent two years trying to reassure nervous investors and analysts that it can rapidly book real estate loans using conservative practices.

January 18 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

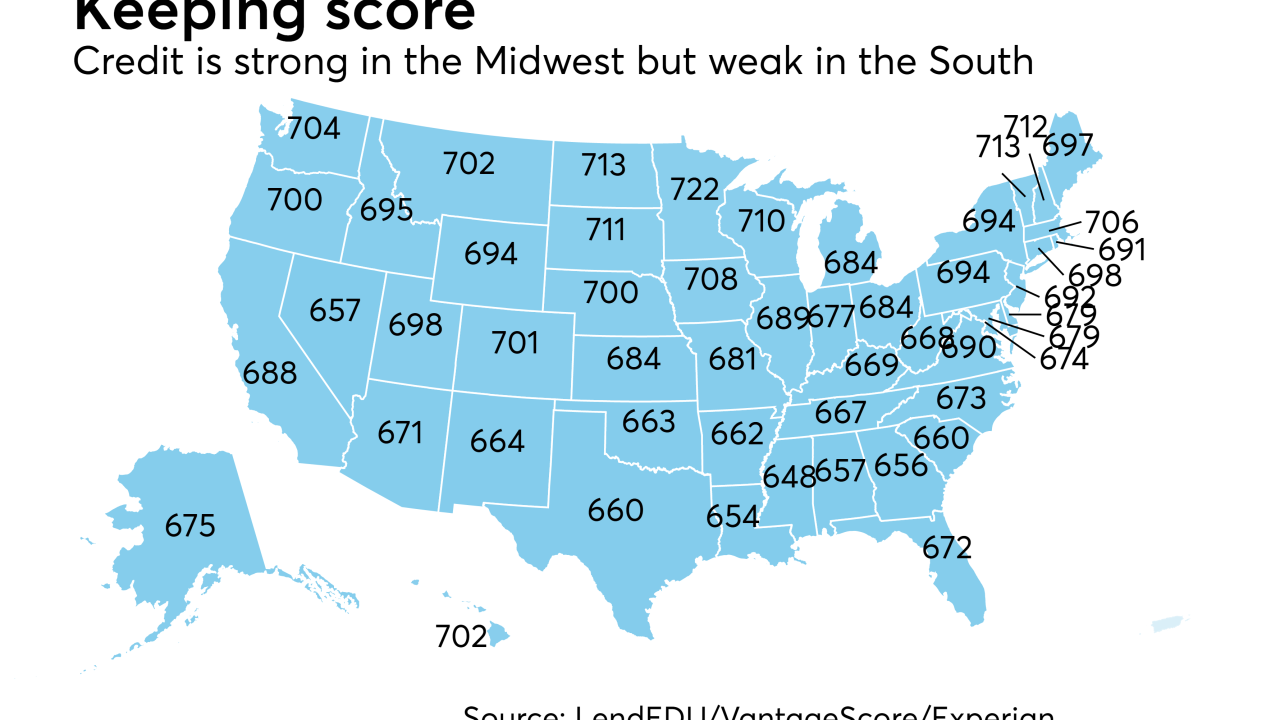

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17 -

The share of lenders easing credit for government-sponsored enterprise-eligible loans is at a high not seen since Fannie Mae started a survey to track it.

September 25 -

Default rates for first-lien mortgages rose slightly higher in August and remain lower year-over-year, but recent hurricanes could intensify loan performance concerns.

September 20 -

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

As head of Fannie Mae's single-family mortgage business, Andrew Bon Salle wants to ease the burden of loan-level price adjustments, streamline condo loan approvals and expand rep and warrant relief. But even he admits there are limits to his power.

September 7 -

Auto, personal and credit card originations have fallen as delinquencies have risen, but researchers called the slowdown a temporary rebalancing by lenders.

August 16 -

Executives at four former credit repair companies agree to pay $2 million for charging consumers millions in illegal advance fees.

June 27 -

The accounting board has scheduled a meeting that bankers hope will produce eleventh-hour modifications to reserving requirements.

June 6 -

An aggressive band of community, regional and investment banks is stepping into the commercial real estate void left by more cautious lenders, saying there are still good CRE loans to be made or bought.

June 2 -

This is a good time for bank risk managers and bank regulatory examiners to evaluate the effects of a deepening retail crisis on the financial services sector.

May 22 MRV Associates

MRV Associates