-

The House passed a bill that assigns Qualified Mortgage status to loans that banks hold in portfolio.

June 9 -

Credit unions continue to press the Consumer Financial Protection Bureau for regulatory relief, arguing that existing exemptions have not gone far enough.

June 1 -

From a few employees at Hutchinson Credit Union who spent part of their day focusing on better servicing of local home mortgages, Member Mortgage Services has grown in just 13 years into a separate company with 37 employees.

April 26 -

Learn how some of the industry's most successful loan originators get it done with these tricks of the trade from the 2017 Top Producers rankings' top 20 loan officers of the South.

April 25 -

Learn how the some of the industry's most successful loan originators get it done with these tricks of the trade from the 2017 Top Producers rankings' top 20 loan officers of the Midwest.

April 19 -

Changes in the housing market are creating new opportunities and challenges for credit unions, including how they market themselves to potential borrowers.

February 14 -

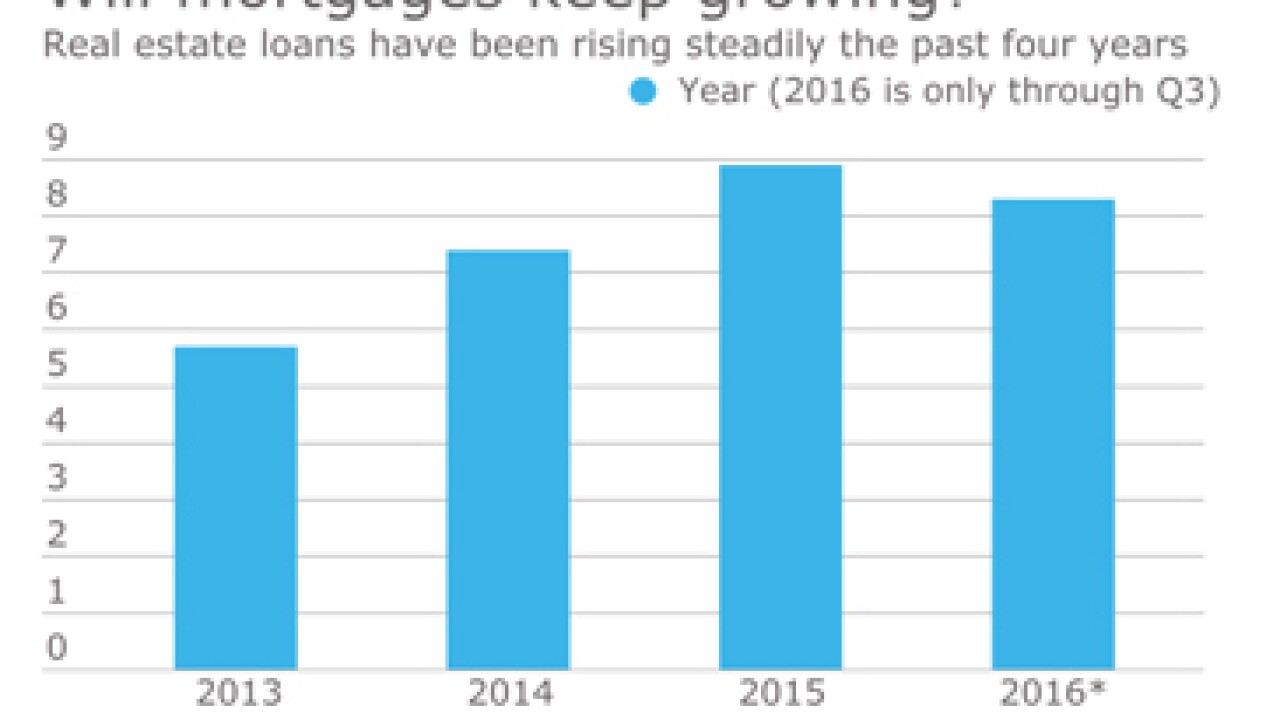

Real estate loans have been growing over the last few years despite a number of headwinds, but can credit unions build on that trend as interest rates rise?

February 13 -

Stringent regulations put in place after the recession have been unevenly enforced across the industry, to the detriment of small financial institutions. Here's hoping that changes with the new administration.

February 9 Members Mortgage Co.

Members Mortgage Co. -

The newly installed chairman of the Federal Communications Commission voted against 2015 rules that largely rejected the banking industry's entreaties.

January 31 -

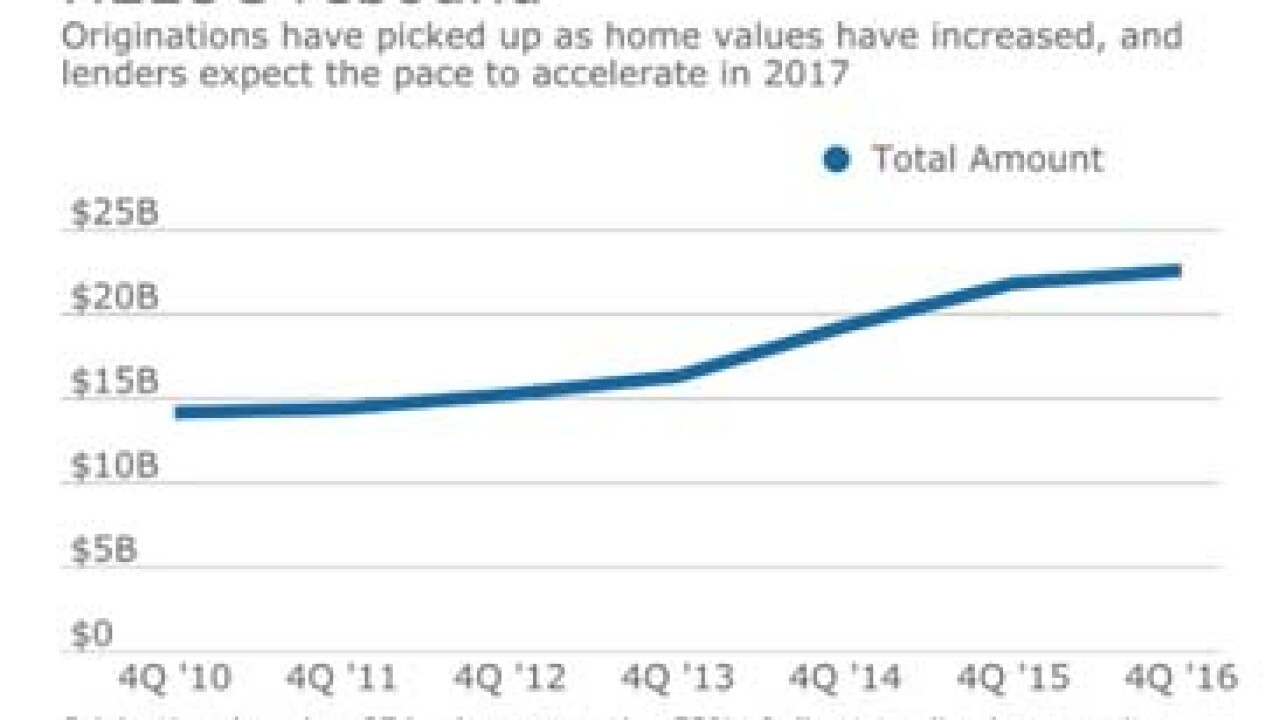

With home values and interest rates rising, homeowners finally seem ready to tap into their homes' equity to fund long-delayed home-improvement projects.

January 30 -

Two Republican senators sent a letter to Vice President-elect Mike Pence calling for the removal of Consumer Financial Protection Bureau Director Richard Cordray.

January 10 -

Credit Suisse Group must face New York Attorney General Eric Schneiderman's $10 billion lawsuit accusing the bank of fraud in the sale of mortgage-backed securities prior to the 2008 financial crisis, a state appeals court ruled Tuesday in a split decision.

December 14 -

Banking and credit union trade groups are urging Congress to consider repealing any upcoming Consumer Financial Protection Bureau rules governing arbitration, payday lending, debt collection and prepaid cards by using its authority under the Congressional Review Act.

December 7 -

Five credit unions in three states have partnered with myCUmortgage, a provider of outsourced origination and servicing programs.

November 16 -

The Consumer Financial Protection Bureau's contentious rulemakings on arbitration and payday lending may be in jeopardy with the change in administrations and continued GOP control of Congress.

November 14 -

The regulator's settlement with Nomura is tied to the failures of two corporate credit unions, though Nomura did not admit fault as part of its settlement.

November 3 -

Bethpage Federal Credit Union, Holston Methodist Federal Credit Union and United Heritage Credit Union have all selected the FirstClose Report for instant title search, flood certification, valuation and property information tied to mortgage and home equity loan products.

October 31 -

Arch Capital Group's mortgage insurance business had underwriting income of $37.4 million in the third quarter, an increase of 119% compared with the $17.1 million one year prior.

October 26 -

Navy Federal Credit Union, the largest credit union in the country, agreed Tuesday to pay $28.5 million to settle regulatory allegations it engaged in illegal debt collection practices.

October 11 -

Royal Bank of Scotland Group agreed to pay $1.1 billion to settle the first of three major U.S. mortgage-backed securities probes the bank must overcome before it can resume dividend payments.

September 28