-

Freedom Credit Union has listed for sale the three downtown Springfield, Mass., office buildings it took back in November in a mortgage foreclosure.

January 2 -

First mortgage volumes continue to rise at credit unions, but home equity lines of credit have fallen dramatically in recent years.

December 20 -

The nonbank share of large mortgage servicing is growing, but smaller players tend to be depositories, the Consumer Financial Protection Bureau found in a new report aimed at examining regulatory impacts.

November 22 -

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

The National Credit Union Administration has unveiled a proposal to address a federal judge's concerns that its 2016 field-of-membership overhaul could discourage lending in low-income areas.

October 24 -

Draft legislation would amend the Bank Service Company Act to give the National Credit Union Administration third-party vendor oversight, a power it has been requesting for the better part of two decades.

October 18 -

The four prudential agencies, which will enforce the new credit loss methodology developed by the Financial Accounting Standards Board, said they want to promote consistency.

October 17 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

The National Credit Union Administration caught flak after it approved raising the threshold for appraisals on commercial real estate loans to $1 million.

July 18 -

Freedom Northwest in Idaho hopes a proposal from the NCUA will help it bring in more deposits to fund a fast-growing mortgage business. Banks are crying foul.

June 7 -

The 2020 presidential hopeful removed the contentious provision from a previous version of the bill that had won praise from bankers but sparked fierce opposition from credit unions.

March 13 -

Community banks and credit unions fear a Senate plan and other legislative ideas will nullify steps taken by Fannie Mae and Freddie Mac that have made it easier for smaller institutions to compete.

February 28 -

Executives urged the consumer bureau at a public meeting to keep a closer eye on artificial intelligence innovations developed by fintech firms that are subject to less regulation.

December 6 -

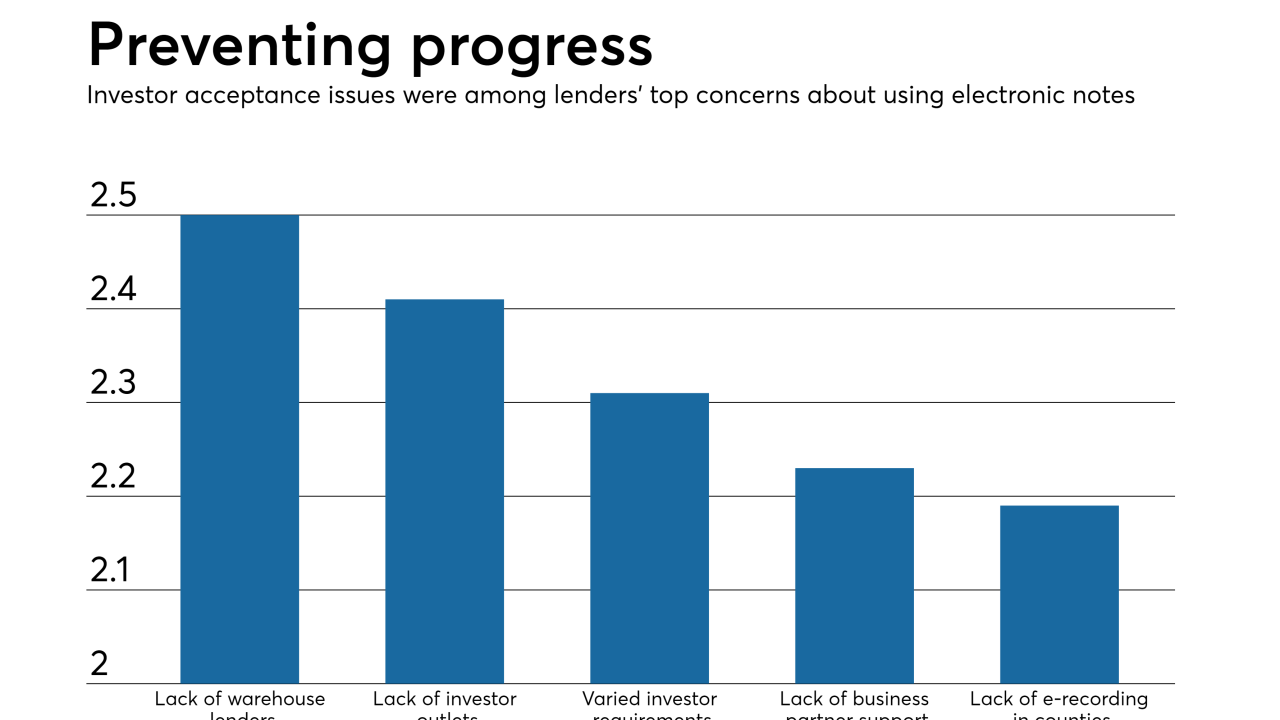

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

The senator’s bill to reform the 40-year-old law and expand housing investments could gain clout as Democrats look to pick up congressional seats and she eyes a presidential run.

September 25 -

As part of a capital-formation bill, House lawmakers are attempting to sprinkle in a handful of provisions to ease the industry’s burden.

July 17 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8