-

The 2020 presidential hopeful removed the contentious provision from a previous version of the bill that had won praise from bankers but sparked fierce opposition from credit unions.

March 13 -

Community banks and credit unions fear a Senate plan and other legislative ideas will nullify steps taken by Fannie Mae and Freddie Mac that have made it easier for smaller institutions to compete.

February 28 -

Executives urged the consumer bureau at a public meeting to keep a closer eye on artificial intelligence innovations developed by fintech firms that are subject to less regulation.

December 6 -

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

The senator’s bill to reform the 40-year-old law and expand housing investments could gain clout as Democrats look to pick up congressional seats and she eyes a presidential run.

September 25 -

As part of a capital-formation bill, House lawmakers are attempting to sprinkle in a handful of provisions to ease the industry’s burden.

July 17 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

The two credit unions have combined assets of more than $115 million and serve nearly 16,000 members.

April 24 -

Acting CFPB Director Mick Mulvaney dismissed concerns by Sen. Elizabeth Warren, D-Mass., about his leadership of the consumer agency while supporting a lighter regulatory touch for credit unions.

February 27 -

Credit union executives talked up a pending regulatory relief effort while endorsing a radical shift in direction by the Consumer Financial Protection Bureau during a meeting with President Trump and other top White House officials on Monday.

February 26 -

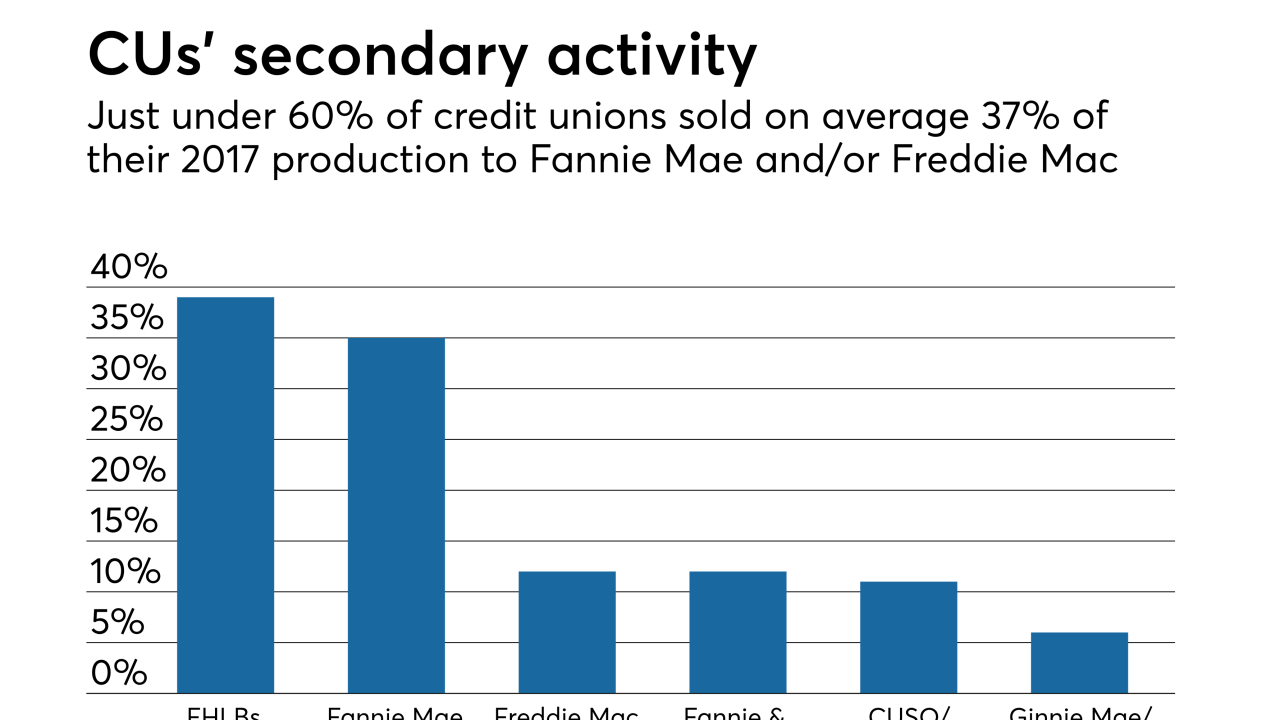

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

In his decision Thursday, U.S. District Judge Paul Gardephe said the lawsuit brought by the Lower East Side People's Federal Credit Union lacked standing.

February 2 -

The credit union service organization now serves almost 200 CUs across the continental United States.

January 23 -

National Credit Union Administration Chairman Mark McWatters has not even been announced as President Trump's pick to run the Consumer Financial Protection Bureau, but his potential nomination already is uniting diverse groups in opposition.

January 16 -

The Trump administration should not name J. Mark McWatters as head of the consumer agency, given his lack of experience overseeing commercial banks and his leadership of the National Credit Union Administration, a cheerleader for the industry it supervises.

January 5 Calvert Advisors LLC

Calvert Advisors LLC -

The long-running slide in mortgage payments 60 or more days past due will continue next year, and perhaps even longer as borrowers benefit from favorable economic conditions.

December 13 -

Colonial Savings founder James S. DuBose died after a yearlong battle with cancer. He was 93.

December 4