-

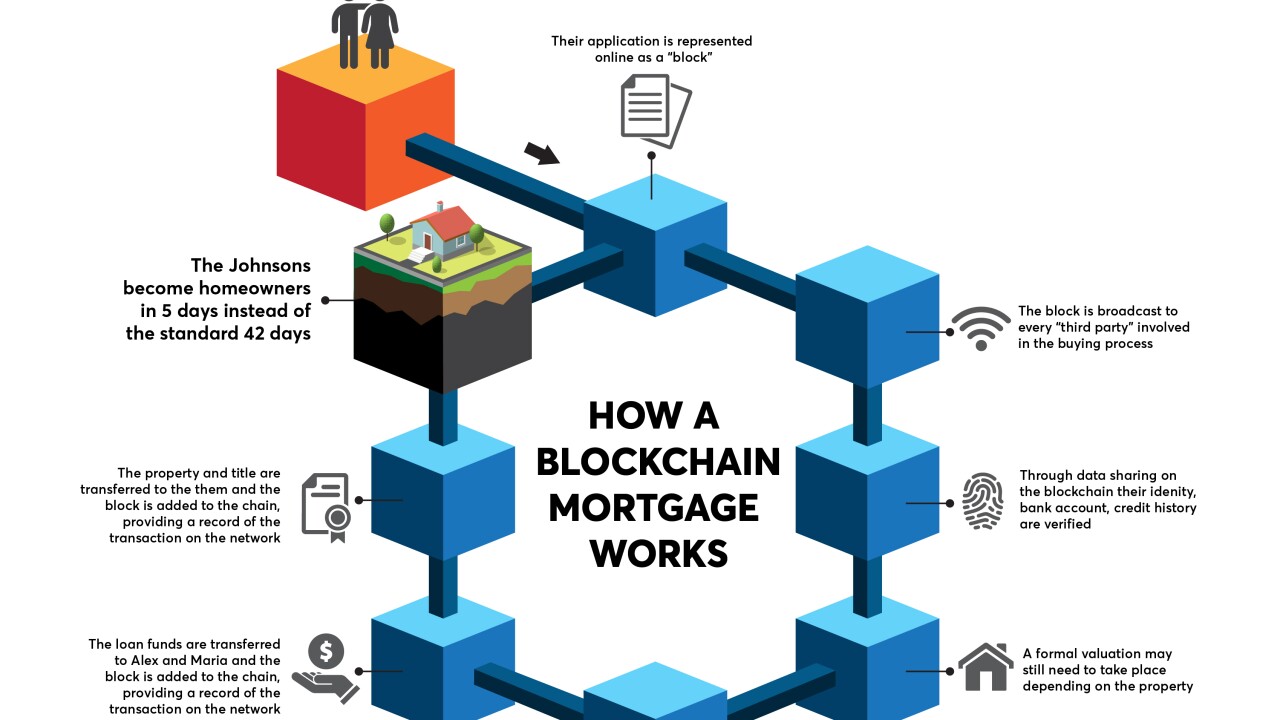

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

CoreLogic, which has already acquired several appraisal technology and services vendors, snagged another one with its purchase of a la mode technologies.

April 12 -

Automating the mortgage process will force tighter margins, but drive higher volume, for lenders.

April 12 HouseCanary

HouseCanary -

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

Lennar Corp.'s home finance subsidiary with the help of Blend rolled out its own digital mortgage platform, as another small lender tries to keep up with Rocket Mortgage.

April 9 -

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

Tech vendors Merscorp Holdings and eOriginal have developed a suite of tools for small and midsize mortgage lenders to close fully electronic loans.

April 6 -

Ranieri Solutions, a fintech investment firm in the mortgage space, has partnered with blockchain and smart contract company Symbiont to explore opportunities to implement blockchain technology in the mortgage industry.

April 6 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

While mobile applications have become increasingly present in the originations segment of the mortgage industry, they're now making their mark in the servicing space.

April 5 -

From mixed messages about enforcement to complexities about which loans have to be reported, here's a look at five pitfalls to avoid when adjusting to the new HMDA compliance requirements.

March 20 -

Home Captain, a fintech company that looks to increase mortgage-lead conversion rates, completed a Series A financing round led by Spring Mountain Capital.

March 20 -

CoreLogic will have to provide property data to Attom Data Solution's RealtyTrac unit for three additional years to resolve allegations it did not adhere to a 2014 agreement with the Federal Trade Commission.

March 16 -

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

The Consumer Financial Protection Bureau is among several agencies that "continue to investigate events related to" last year's Equifax brief, the credit reporting firm said in a securities filing.

March 2 -

Equifax, the credit-reporting firm that suffered a massive data breach last year, said it will notify an additional 2.4 million U.S. consumers that they were affected by the hack.

March 1 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16