-

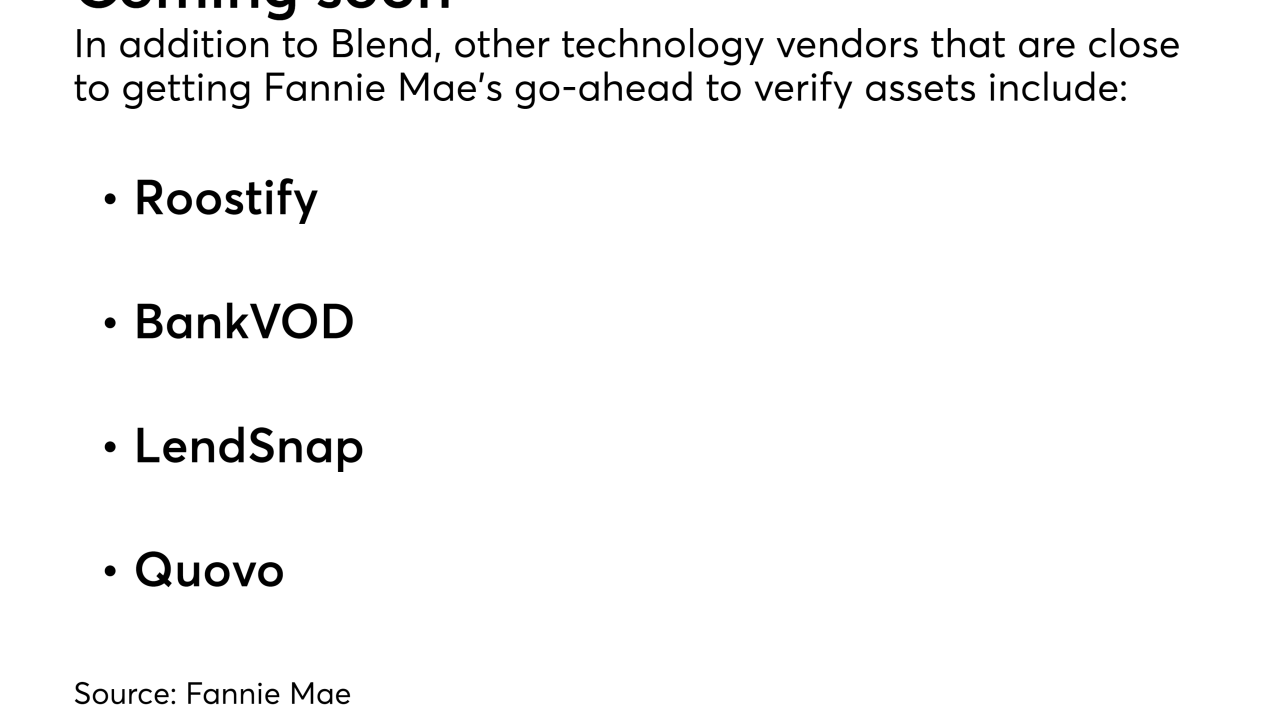

Fannie Mae is doing more to expand its list of Day 1 Certainty report suppliers, naming Blend as the first online point of sale system to directly offer asset validations.

February 13 -

Ellie Mae's fourth-quarter and full-year revenue increased over the corresponding prior periods following its acquisition of Velocify.

February 9 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

It is unclear whether the Consumer Financial Protection Bureau is abandoning its supervisory oversight of Equifax or just taking a back seat to the Federal Trade Commission as the latter investigates the credit bureau.

February 5 -

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

From government grants to automating branch management tasks, lenders are using their knowledge of real estate, finance, and government incentives to maximize the resources they invest in facilities.

January 29 -

Credit score damage is a chief regret among consumers, but among financial goals it impedes, buying a home lies further down the food chain than other priorities.

January 29 -

Roostify has integrated its mortgage transaction technology into LendingTree's lead generation system, creating a seamless path from product search through closing.

January 26 -

While the majority of lenders feel mortgage industry data initiatives have been valuable, their cost is clouding some originators' viewpoint, a Fannie Mae survey found.

January 24 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney has cited hundreds of confirmed and suspected data breaches as justification for his halting the bureau's data collection activities last month.

January 19 -

The CFPB's recent freeze on collecting any personally identifiable information from companies it supervises is slowing investigations and could ultimately cripple the agency's enforcement function — and that may be the point.

January 10 -

The two senators are set to introduce a bill that would force such firms to pay $100 per customer whose personal information was compromised.

January 10 -

From consolidation to tech innovation, here's a look at some of the top challenges and trends that mortgage executives from lenders, servicers and vendors are focused on for 2018.

December 28 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

As digital mortgage technology helps consumers take a more hands-on approach to the mortgage process, lenders are stepping up their adoption of automation and machine learning through artificial intelligence capabilities.

December 26 -

A breach at Alteryx that exposed sensitive information from more than 100 million U.S. households could add to fraud risks in housing finance

December 22 -

To succeed in an era of increasingly narrow margins and broad competition, mortgage lenders must be methodical about loan fulfillment and take a "less is more" approach to designing workflows.

December 18 cloudvirga

cloudvirga -

Maxwell Financial Labs, a provider of a digital cloud-based platform used by the mortgage industry, is getting a new $3 million round of funding led by Anthemis Group's investment arm.

December 6 -

Block One Capital has signed a binding term sheet to acquire 40% of the equity of Finzat, a private entity aiming to develop a blockchain system to create a safer, more compliant digital mortgage process.

December 6 -

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4