-

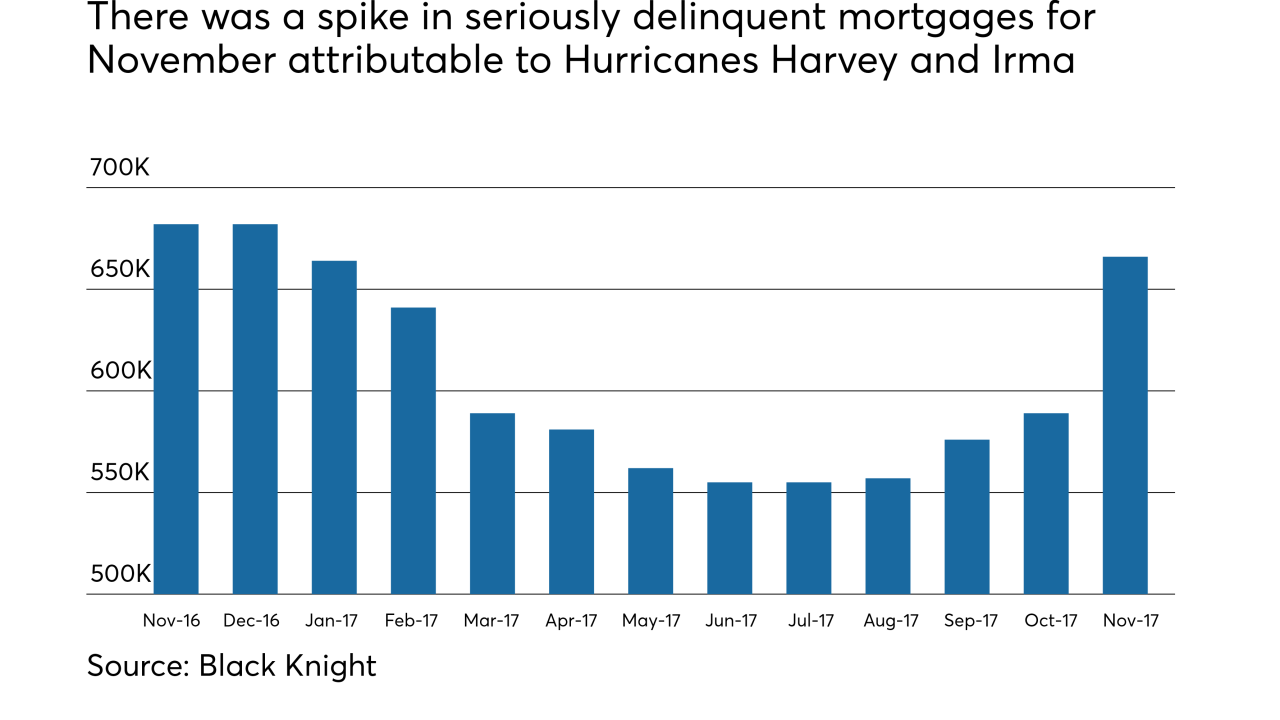

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

PHH Mortgage was the first mortgage servicer to be fined by the New York Department of Financial Services for failing to maintain a "zombie" property.

December 14 -

Late payments from borrowers living in areas hardest hit by Hurricanes Harvey and Irma were responsible for October's increase in loan delinquencies.

November 21 -

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

Nationstar Mortgage Holdings posted net income of $7 million for the third quarter, its first under the new Mr. Cooper consumer-facing brand.

November 2 -

Ocwen Financial Corp. will move its servicing portfolio to Black Knight's LoanSphere MSP system of record, following years of regulatory scrutiny of its existing technology provided by Altisource Portfolio Solutions.

November 1 -

Damage from Hurricane Irma could potentially put billions of dollars in commercial mortgage-backed securities at risk, according to Morningstar Credit Ratings.

September 14 -

If Fannie Mae's clear-boarding requirements prove effective, New York may follow Ohio's lead and move forward with a bill requiring it to be used more broadly on zombie properties.

September 8 -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

Defaults on second-lien mortgages have crept up on a year-to-year and a consecutive-month basis; and first-lien defaults are above where they were the previous month, but still below year-ago levels.

August 15 -

Test your knowledge of these key terms from the servicing sector of the mortgage industry.

June 30 -

The proposed site in Danvers, Mass., of a Registry of Motor Vehicles office is scheduled to be sold in a foreclosure auction, casting doubt on when, or if, the registry will actually end up there.

June 29 -

The share of mortgaged properties underwater is inching down toward 6% but in certain areas like Las Vegas the percentage is more than twice as high, according to CoreLogic.

June 9 -

Fay Servicing will pay $1.15 million in borrower restitution and possible disgorgement to settle CFPB allegations that it engaged in so-called foreclosure dual tracking and failed to keep borrowers informed about loss mitigation efforts.

June 7 -

Maryland Gov. Larry Hogan has signed a bill that will expedite foreclosures of vacant and abandoned properties this fall.

May 26 -

Fidelity National Financial has acquired Hudson & Marshall, a real estate auction company, and in a related move its ServiceLink subsidiary introduced a foreclosure auction product.

May 23 -

Foreclosure filings in April were at their lowest level since November 2005 at 77,049 properties, down 7% from March's 83,145 and 23% from April 2016.

May 11 -

The National Association of Realtors sent a letter to the Senate backing the temporary resumption of a tax break for homeowners with mortgage forgiveness.

May 11 -

The days of vacant, distressed homes covered in sheets of plywood appear numbered, as Fannie Mae and Freddie Mac move toward greater adoption of polycarbonate "clear boarding" to secure foreclosure properties.

May 9 -

Foreclosure activity continues to subside and most of the regulatory reforms created to protect distressed borrowers have been implemented. Yet mortgage servicers still haven't fully resolved the operational challenges facing their business.

April 28