Earnings

Earnings

-

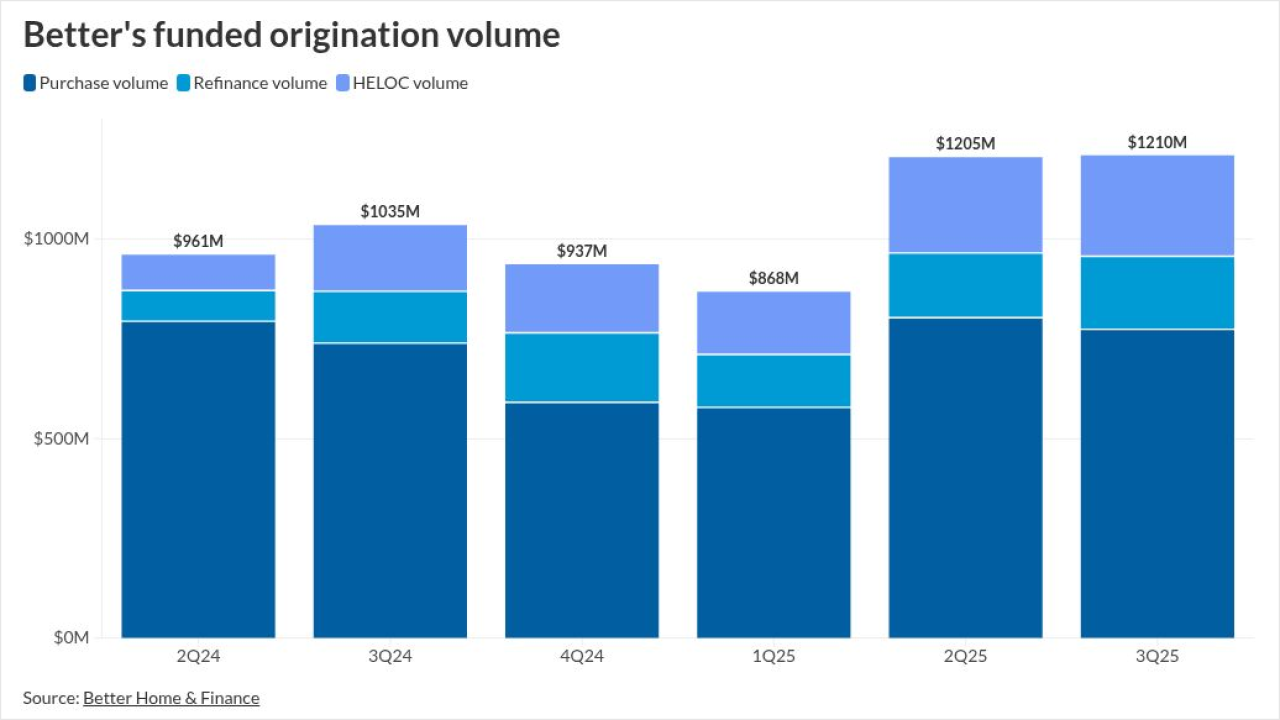

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

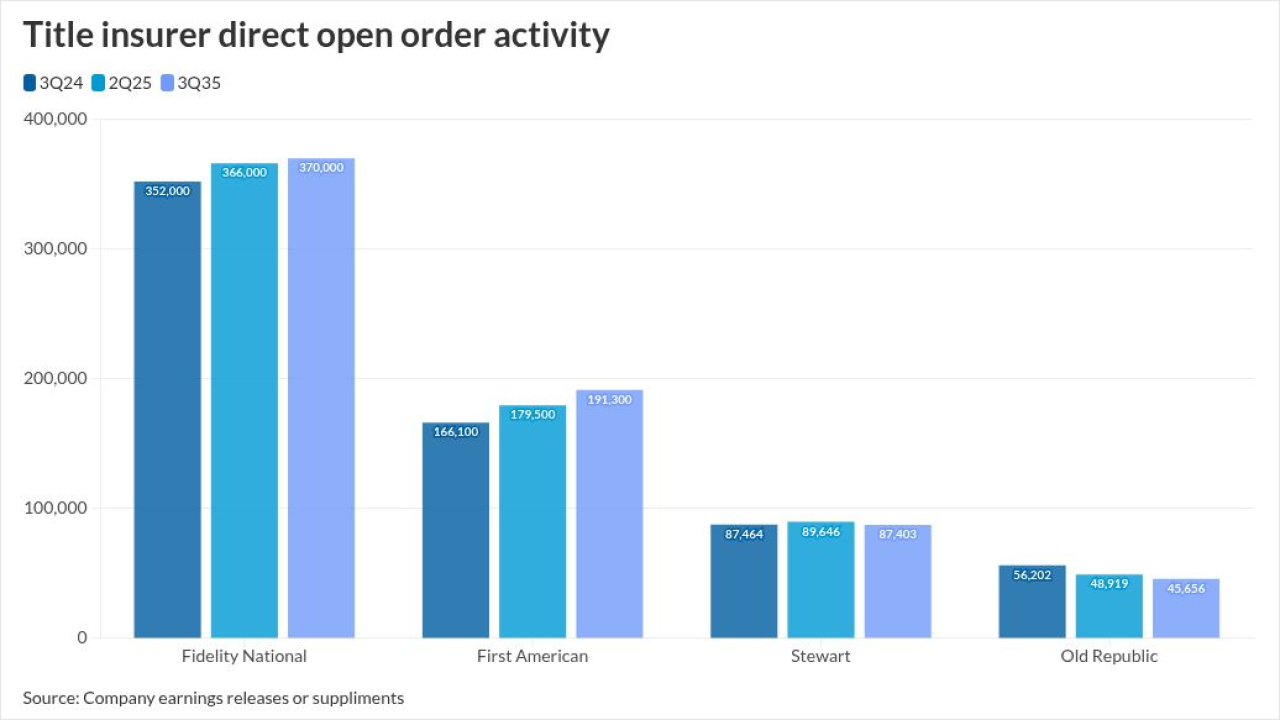

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6 -

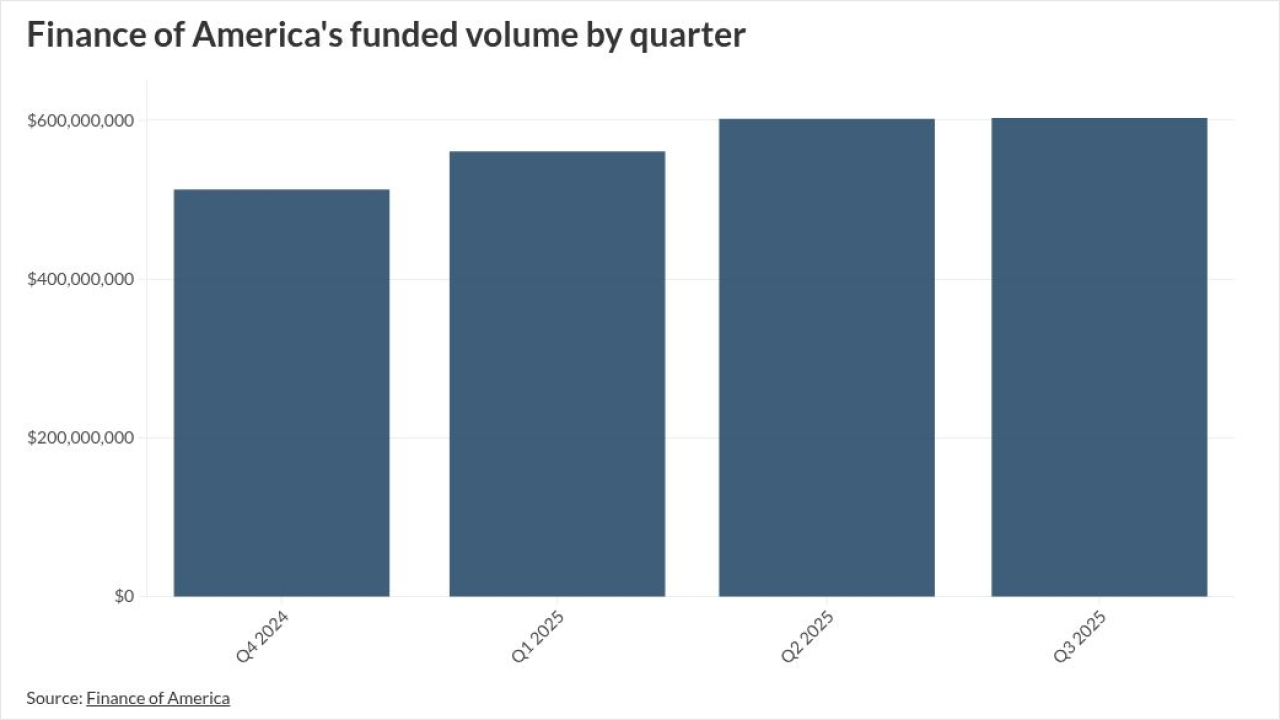

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.

October 31 -

Rocket Companies lost $124 million on a GAAP basis, but its management celebrated milestones regarding its Redfin and Mr. Cooper acquisitions.

October 30 -

The tech giant provided context around Flagstar and Pennymac's moves, as it reported more Encompass and MSP clients and greater mortgage income.

October 30 -

Company officials credited recent mortgage rate pullbacks, a nonagency servicing partnership and Improvements in technology behind recent momentum.

October 30 -

The government-sponsored enterprise's bottom line results, like Fannie Mae's, came in above the previous quarter's but below year-ago numbers.

October 30 -

Shareholders' equity topped $105 billion as net income rose 16% from the previous quarter and nearly matched year-ago results.

October 29 -

RoundPoint's corporate parent generated positive comprehensive income with the legal expense excluded and expanded its subservicing activity.

October 28 -

The Arkansas-based company spent nearly four years on the M&A sidelines, grappling with asset quality issues and litigation tied to its 2022 acquisition of Texas-based Happy State Bank. Now it's signed a letter of intent to buy an unnamed bank.

October 24 -

The mortgage unit of Hilltop Holdings lost $7.2 million pretax in the third quarter with lower volume, following making a small profit three months prior.

October 24 -

Companies reported positive numbers but see challenges in a sluggish housing environment, as federal pressure ramps up to address affordability.

October 24 -

On a year-over-year basis, Waterstone's mortgage business was able to grow pretax profits to $1.3 million in the third quarter, compared with $144,000 in 2024.

October 24