-

The past 12 months were chock full of impactful changes to the home lending industry but keep an eye on these in particular in the new year.

December 28 -

But the 15-year interest rate rose last week, in line with 10-year Treasury yields, as bond investors used a quiet week to reflect on broader trends.

December 22 -

But the lower rates of the past month did result in a $7-billion boost to its origination forecast for 2022.

December 19 -

Former Treasury Secretary Lawrence Summers said that the latest U.S. inflation numbers were encouraging and that the coming likely recession may arrive later than previously thought.

December 16 -

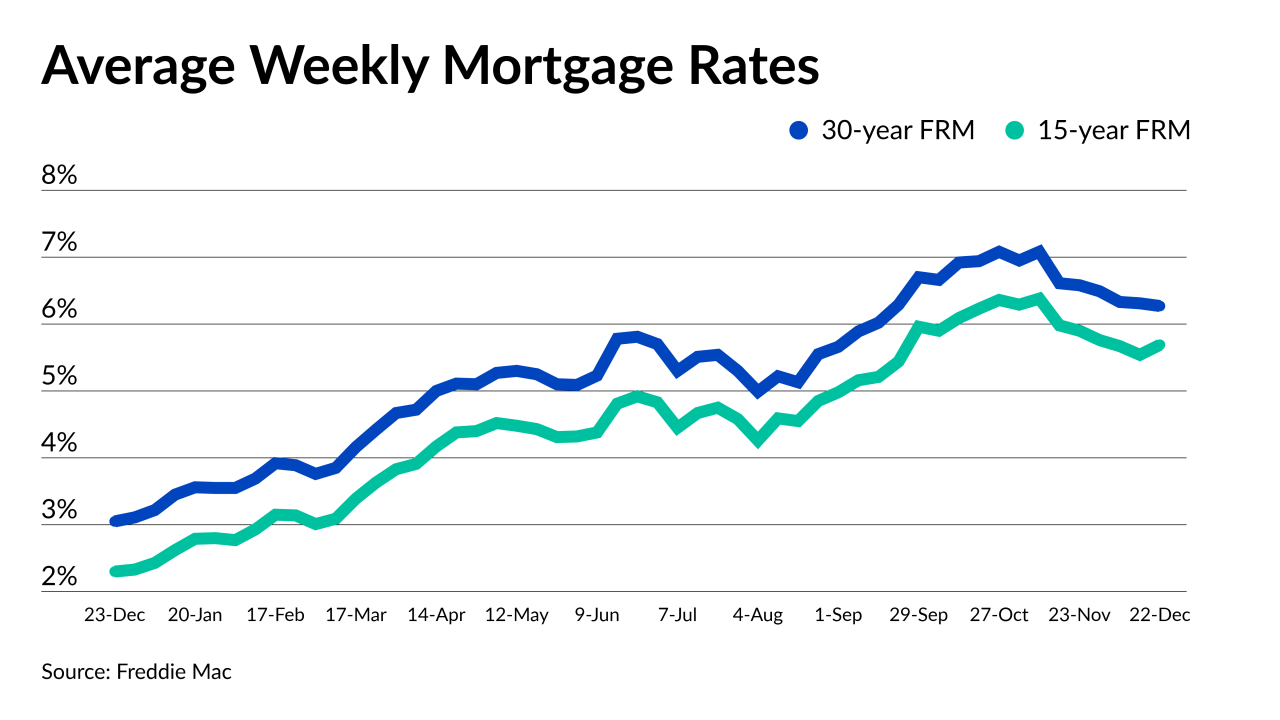

This was the fifth week in a row the Freddie Mac Primary Mortgage Market Survey reported a decline in the 30-year rate after peaking at 7.08%.

December 15 -

New data offered the strongest evidence yet that price pressures have peaked.

December 13 -

Nonbanks would have to inform the CFPB of any state or local court decisions against them involving consumer financial products, under a new proposed rule. That information would be pooled with data about federal violations and be made available to the public.

December 12 -

The cut occurred across departments and included the dismissal of the company's head of mortgage.

December 12 -

Following peaking at 7.08% on Nov. 10, the 30-year fixed has come down three-quarters of a percentage point, Freddie Mac said.

December 8 -

New York, Chicago and Philadelphia led the list of large metropolitan markets considered vulnerable to a downturn, based on analysis from Attom.

December 1