-

After lumber futures skyrocketed to an all-time high in mid-May, prices fell by more than half at the end of June.

July 2 -

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2 -

Estimates suggest public funds in aggregate may be adequate to cover arrears and potentially keep many in their homes as the eviction ban ends, but may not be evenly distributed.

July 1 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1 -

-

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

Edward Al-Hussainy, senior interest rate and currency analyst at Columbia Threadneedle, will discuss the economy, inflation and the Federal Reserve.

-

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

Contrary to the myth perpetrated by many in Washington, IMBs do not pose any real taxpayer financial risk or systemic risk, writes the CEO of Union Home Mortgage and member of the Community Home Lenders Association.

June 28

-

Dozens of digital tools are billed as democratizing finance. But a number of entrepreneurs still see massive gaps.

-

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

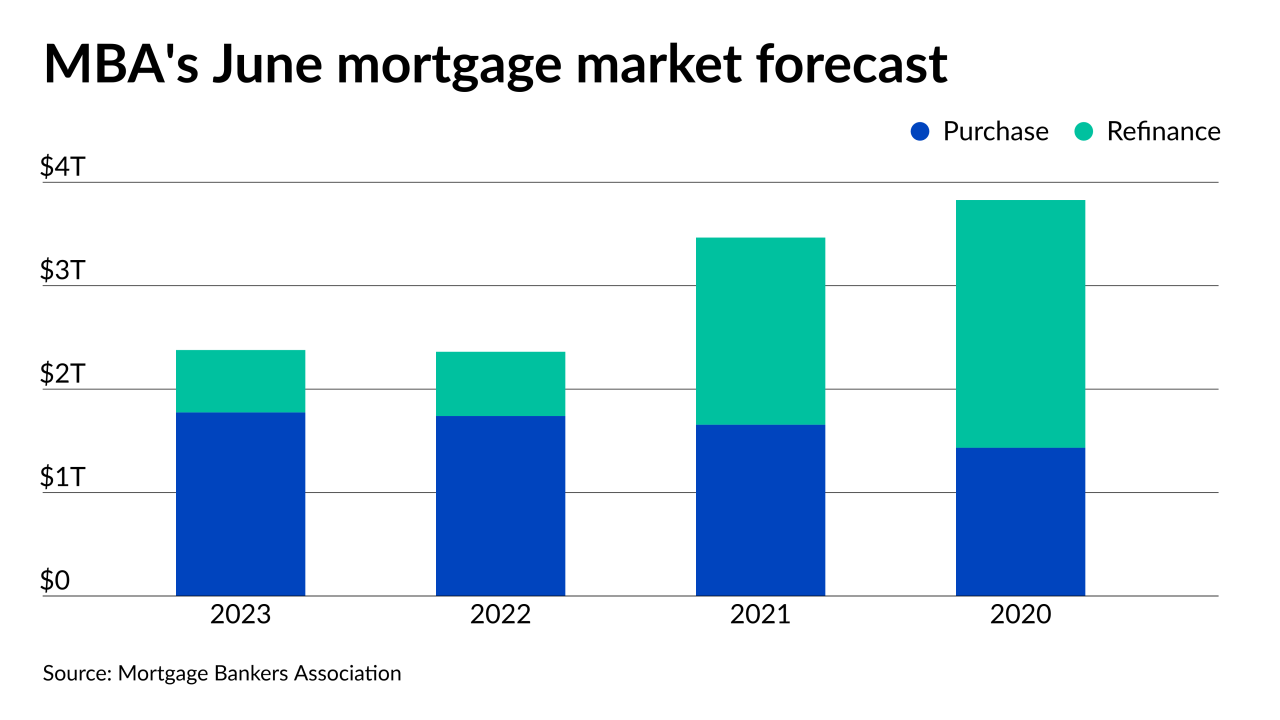

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

The Supreme Court decision cleared the way for further revisions to the agreements between the Federal Housing Finance Agency and the Treasury, which could include dismissing the January changes.

June 25 -

The Community Home Lenders Association has called for suspension of federal limits on the loan volumes that Fannie Mae and Freddie Mac can purchase from individual lenders. The demand came on the same day that the Biden administration fired FHFA Director Mark Calabria and started the process of nominating his successor.

June 24 -

Thompson, who was most recently the deputy director of the FHFA’s Division of Housing and Mission Goals, replaces Mark Calabria, who was fired Wednesday afternoon.

June 23 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

President Biden removed Mark Calabria as Federal Housing Finance Agency director hours after a Supreme Court ruling made the move possible. The administration is expected to offer up a nominee who will prioritize affordable housing and racial equity in housing instead of reforming Fannie Mae and Freddie Mac.

June 23 -

The president will oust Federal Housing Finance Agency Director Mark Calabria, a Trump appointee, now that the high court says the chief executive can do so at will. It's "critical that the agency implement the administration’s housing policies," said a White House official.

June 23 -

The justices on Wednesday threw out a key part of a challenge brought by firms including Paulson & Co., Pershing Square Capital Management and Fairholme Funds to the government’s collection of more than $100 billion in profits from Fannie Mae and Freddie Mac.

June 23 -

A majority of the justices concluded that the law establishing the Federal Housing Finance Agency violated the Constitution when it said a president may only remove the agency's chief "for cause."

June 23