-

Marc Dann, a former Ohio attorney general, has a plan to publicly maintain the CFPB's consumer complaint database if acting Director Mick Mulvaney shuts it down.

June 14 -

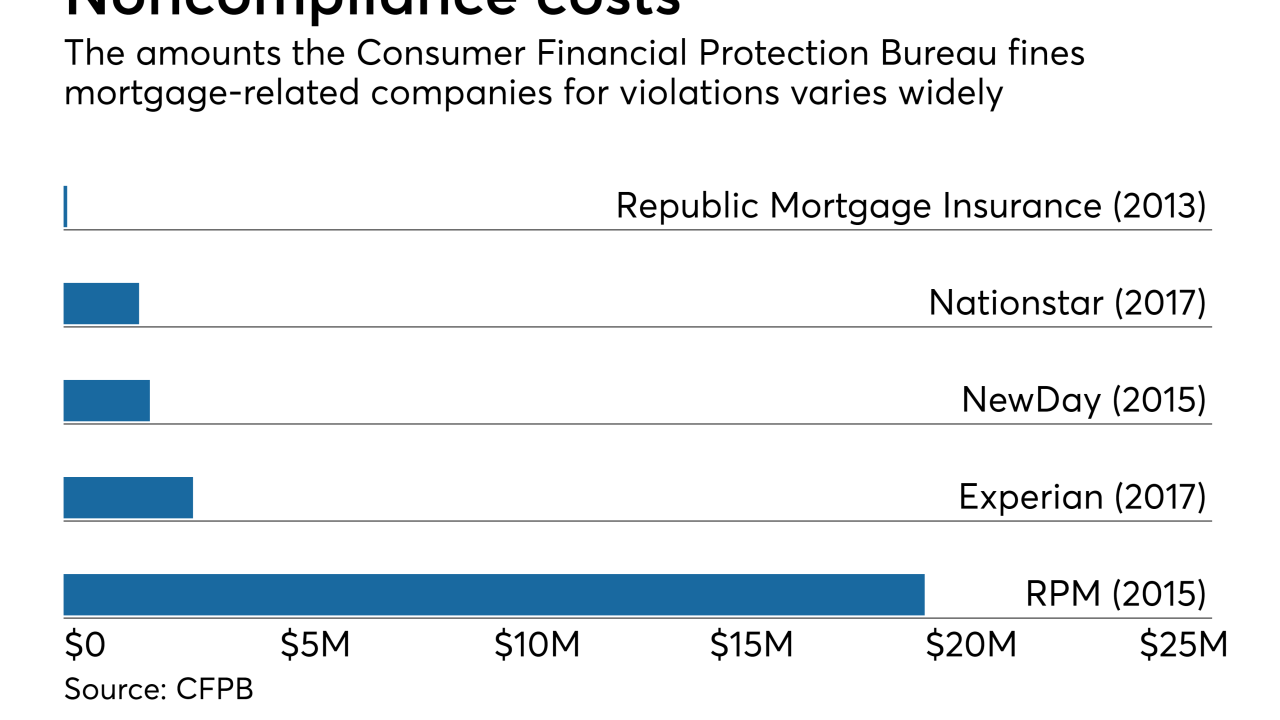

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

Banking and mortgage groups are asking the Federal Communications Commission to issue new Telephone Consumer Protection Act rules that would make consumer lawsuits over robocalls harder to win.

May 10 -

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

The Consumer Financial Protection Bureau has dropped an investigation into Altisource, a mortgage servicing technology firm with close ties to Ocwen Financial.

April 30 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

Months after President Trump vowed that Wells Fargo would pay a severe penalty, the CFPB and OCC hit the bank with a $1 billion fine to settle claims it overcharged customers for auto insurance and home loans.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

The New York Department of Financial Services is fining Nationstar Mortgage $5 million for failing to comply with servicing and origination regulations as it grew between 2012 and 2014.

April 11 -

A new settlement with Massachusetts resolves all outstanding administrative actions against Ocwen Financial Corp. by a group of 30 states, but two states' legal actions against the servicer remain outstanding.

March 23 -

In the joint report with the Federal Trade Commission on debt collection practices, the CFPB said it had initiated four enforcement actions last year, had resolved one case and has five others pending.

March 21 -

Royal Bank of Scotland Group has agreed to pay $500 million to the state of New York after a $5.5B agreement last year with the FHA, and another probe is pending.

March 6 -

The acting head of the Consumer Financial Protection Bureau has made clear he wants to rein in the bureau’s spending, but what exactly he plans to cut is a mystery.

February 28 -

The CFPB sought input Wednesday about the effectiveness of its supervisory activities and added more topics, including consumer complaint reporting, to a review of all aspects of the agency's operations.

February 14 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney is discarding many of the policies of his predecessor but none as important perhaps as the agency's targeting of "unfair, deceptive or abusive acts or practices."

February 14 -

The acting director of the Consumer Financial Protection Bureau on Tuesday had his first taste of the withering congressional criticism endured by his predecessor on trips to Capitol Hill.

February 13 -

Continuing to pull back the reins on the aggressive approach taken under former Director Richard Cordray, the agency's new five-year plan values consumer choice over heavy-handed enforcement.

February 12 -

Consumer advocates see acting CFPB Director Mick Mulvaney's restructuring as an attempt to reduce oversight and penalties for firms that discriminate against borrowers.

February 1 -

The Consumer Financial Protection Bureau is seeking comment on how it sues companies via an internal process rather than the traditional court system.

January 31