-

Former Cantor Fitzgerald managing director David Demos is on trial, accused of deceiving clients about the prices his firm could sell or pay for mortgage-backed securities.

April 23 -

A special agent who used to work for an investigative arm of Immigration and Customs Enforcement pleaded guilty to defrauding Freddie Mac and SunTrust Mortgage through a short sale.

April 23 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23 -

The New York State Department of Financial Services is warning that alternative home purchase finance agreements might be a cover for predatory mortgage lending practices by unlicensed entities.

April 16 -

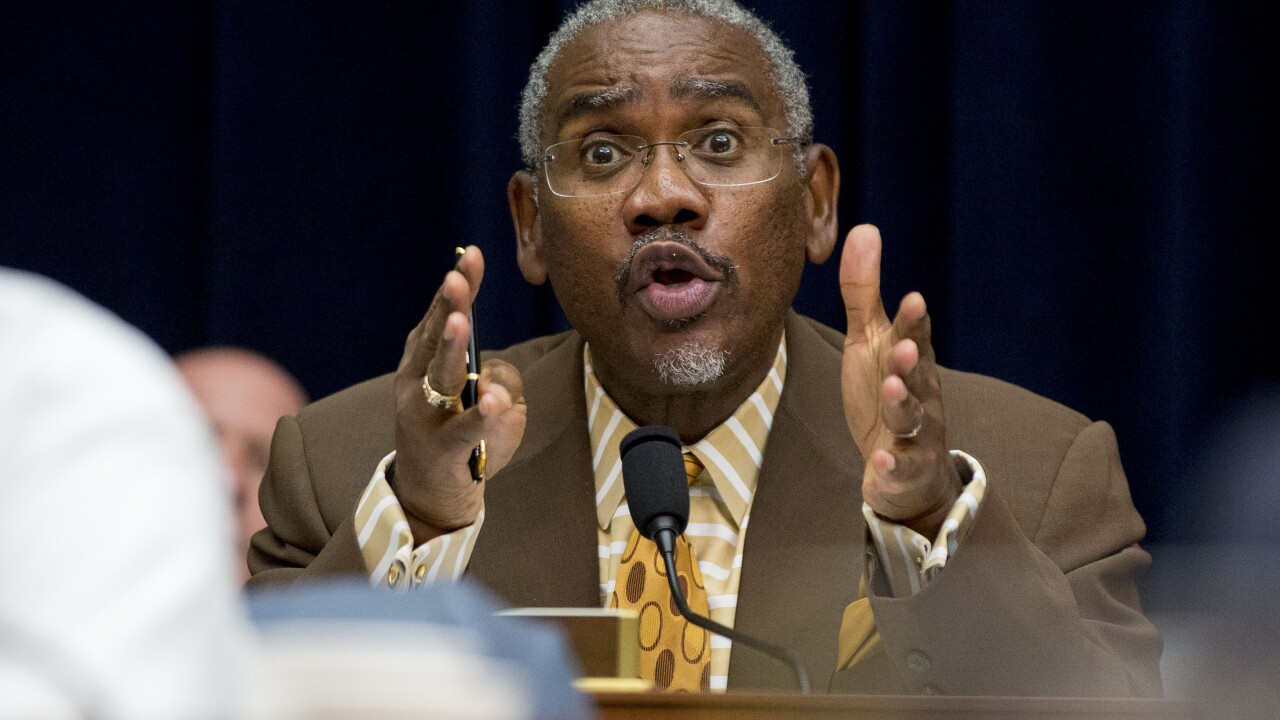

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

The financial services industry and community reinvestment advocates both praised the Treasury Department’s recommendations for reforming Community Reinvestment Act enforcement.

April 3 -

Heads of a large real estate investment company with offices in Alaska and California have agreed to pay $3 million in fines for what a federal agency says was a scheme to "bilk" hundreds of investors out of millions of dollars.

March 29 -

Lenders should not get so desperate chasing volume by originating lower credit non-qualified mortgage products that they are inviting the next regulatory crackdown, said David Stevens, the Mortgage Bankers Association's CEO.

March 28