-

The Consumer Financial Protection Bureau's structure is an infringement on the authority of the executive branch, a New York federal judge said Thursday.

June 21 -

One-time Modesto City Council candidate Robert Farrace, an attorney and real estate broker, was sentenced to two years in federal prison for defrauding real estate lenders.

June 19 -

The man authorities called the mastermind behind a complex mortgage fraud scheme targeting distressed properties was arrested June 7 in South Carolina and charged with being a fugitive in violation of probation.

June 18 -

Bank of America Corp.'s Merrill Lynch unit will pay $15.7 million to settle a U.S. regulator's allegations that it failed to properly supervise traders who persuaded clients to overpay for mortgage bonds by misleading them about how much the firm paid for the securities.

June 12 -

Federal law enforcement authorities have arrested 74 people in this country and abroad, accusing them of participating in a wire fraud scam whose victims included real estate attorneys and settlement service providers.

June 12 -

Federal authorities charged a third real estate investor with bribery-related offenses in a long-running corruption probe of the process through which the Philadelphia Sheriff's Office sells seized and foreclosed properties.

June 8 -

Two Orange County, Calif., men were to federal prison for their part in a mortgage scheme that led to the fraudulent purchase of more then 100 condominium units and $10 million in losses.

June 7 -

Freedom Mortgage is being punished by a government-owned mortgage guarantor amid concerns that the Mount Laurel, N.J.-based company is helping to enable unnecessary refinances of veterans' loans.

June 4 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

Gary Klopp of Nottingham, Md., was ordered to pay more than $525,000 and temporarily barred from working in the mortgage industry by a U.S. District Court judge for violating a previous court order, according to Maryland Attorney General Brian Frosh.

May 24 -

The CFPB is looking to rescind Obama-era policy that allowed it to punish banks and financial firms for unintentional discrimination.

May 21 -

A ring of thieves illegally took ownership of more than 40 homes across South Florida in a multimillion-dollar plan — even stealing properties that belonged to the dead, authorities say.

May 11 -

The union representing employees at the CFPB is already fighting acting Director Mick Mulvaney's efforts to restructure the agency, and readying for a potentially larger conflict as rumors of layoffs swirl.

May 10 -

The New Jersey mortgage lender and servicer won a huge victory in January when an appeals court threw out its fine levied by the consumer agency, but the court ruled against the claim that the agency's structure is unconstitutional.

May 3 -

A former Cantor Fitzgerald managing director was cleared of charges that he defrauded customers by lying about prices of mortgage-backed securities.

May 3 -

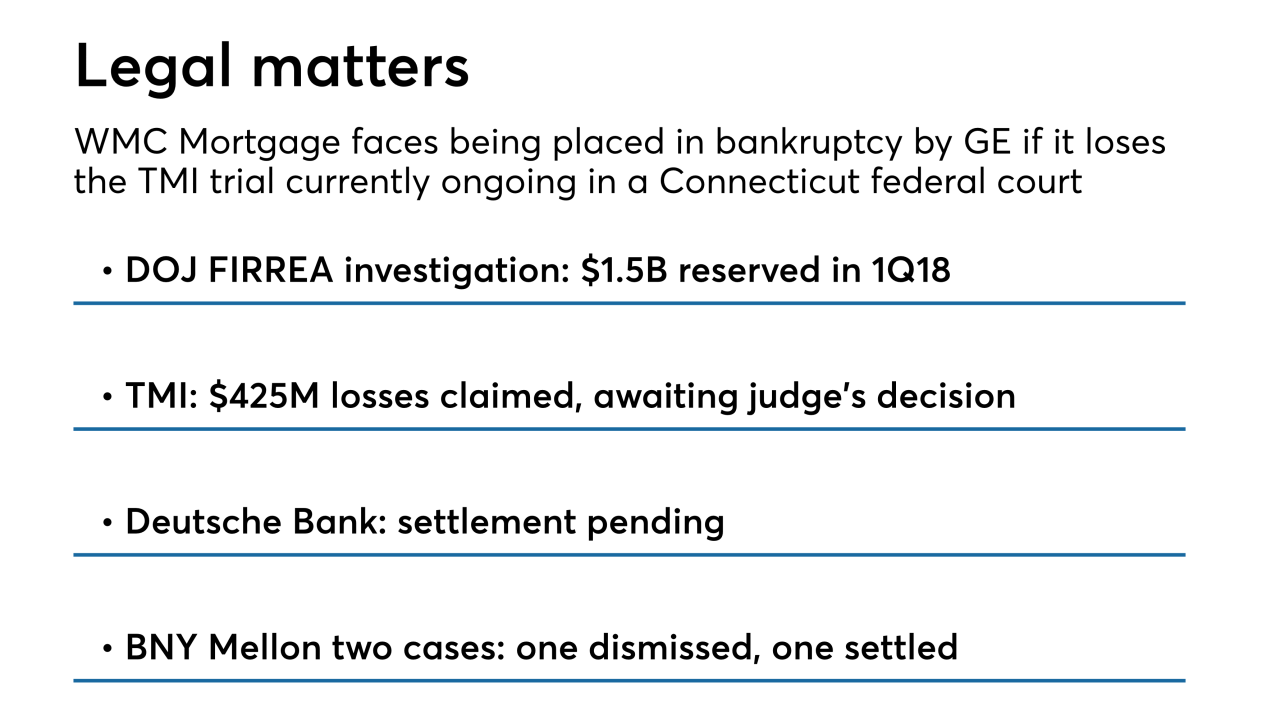

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

A federal jury is poised to determine whether a former Cantor Fitzgerald managing director's tactics in trading mortgage-backed securities constitute securities fraud.

May 1 -

A Texas lawyer pleaded guilty to his role in an elaborate $5 million mortgage fraud scheme involving pricey beach homes, according to the U.S. Attorney's Office in Houston.

May 1 -

After less than a week of trial, prosecutors rested their case against a former Cantor Fitzgerald trader accused of lying to his customers about bond prices.

April 30 -

A portfolio manager for an investment firm allegedly defrauded by a former Cantor Fitzgerald managing director said he might still work with a trader who lied to him — depending on the circumstances.

April 27