-

The trial of a former Cantor Fitzgerald mortgage-backed securities trader charged with lying to his clients turned contentious as his lawyer aggressively questioned one of his alleged victims about methods his firm uses to invest.

April 26 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 Public Citizen

Public Citizen -

Former Cantor Fitzgerald managing director David Demos is on trial, accused of deceiving clients about the prices his firm could sell or pay for mortgage-backed securities.

April 23 -

A special agent who used to work for an investigative arm of Immigration and Customs Enforcement pleaded guilty to defrauding Freddie Mac and SunTrust Mortgage through a short sale.

April 23 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23 -

The New York State Department of Financial Services is warning that alternative home purchase finance agreements might be a cover for predatory mortgage lending practices by unlicensed entities.

April 16 -

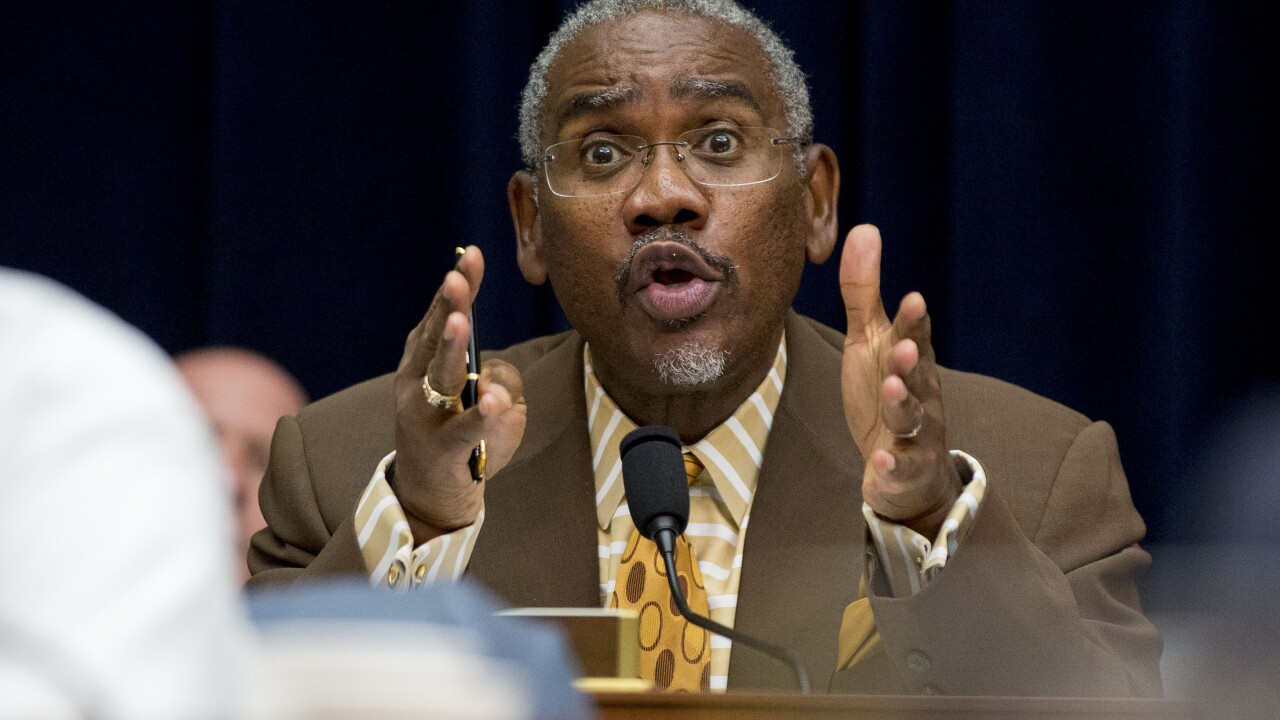

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

The financial services industry and community reinvestment advocates both praised the Treasury Department’s recommendations for reforming Community Reinvestment Act enforcement.

April 3 -

Heads of a large real estate investment company with offices in Alaska and California have agreed to pay $3 million in fines for what a federal agency says was a scheme to "bilk" hundreds of investors out of millions of dollars.

March 29 -

Lenders should not get so desperate chasing volume by originating lower credit non-qualified mortgage products that they are inviting the next regulatory crackdown, said David Stevens, the Mortgage Bankers Association's CEO.

March 28 -

UBS agreed to pay $230 million to resolve a New York state probe into the Swiss bank's marketing and sales of residential mortgage-backed securities before the financial crisis, boosting the state's recoveries in the investigation to almost $4 billion.

March 21 -

From mixed messages about enforcement to complexities about which loans have to be reported, here's a look at five pitfalls to avoid when adjusting to the new HMDA compliance requirements.

March 20 -

CoreLogic will have to provide property data to Attom Data Solution's RealtyTrac unit for three additional years to resolve allegations it did not adhere to a 2014 agreement with the Federal Trade Commission.

March 16 -

Sen. Elizabeth Warren, D-Mass., introduced a bill to create a permanent law enforcement unit to investigate criminal activity at large banks, just as the Senate was close to passing a regulatory relief package.

March 14 -

The eventual pick will likely encounter heavy scrutiny from senators and, if confirmed, would take the helm of an agency still defined by turmoil nearly seven years after its creation.

March 12 -

The Dodd-Frank Act consolidated massive authority under the Consumer Financial Protection Bureau, but acting Director Mick Mulvaney wants the bureau to take a back seat to states and other federal regulators.

March 7 -

Lonnie Brantley Jr. avoided prison by striking a plea deal for lying to federal housing regulators during an investigation into his troubled mortgage lending business.

March 2 -

The Consumer Financial Protection Bureau is among several agencies that "continue to investigate events related to" last year's Equifax brief, the credit reporting firm said in a securities filing.

March 2