-

CEO Douglas Gordon credited the relationship between Waterstone Financial and the mortgage subsidiary for the boost in net income.

July 28 -

The company's second-quarter net income was $116 million, with mortgage banking revenue of $239 million.

July 28 -

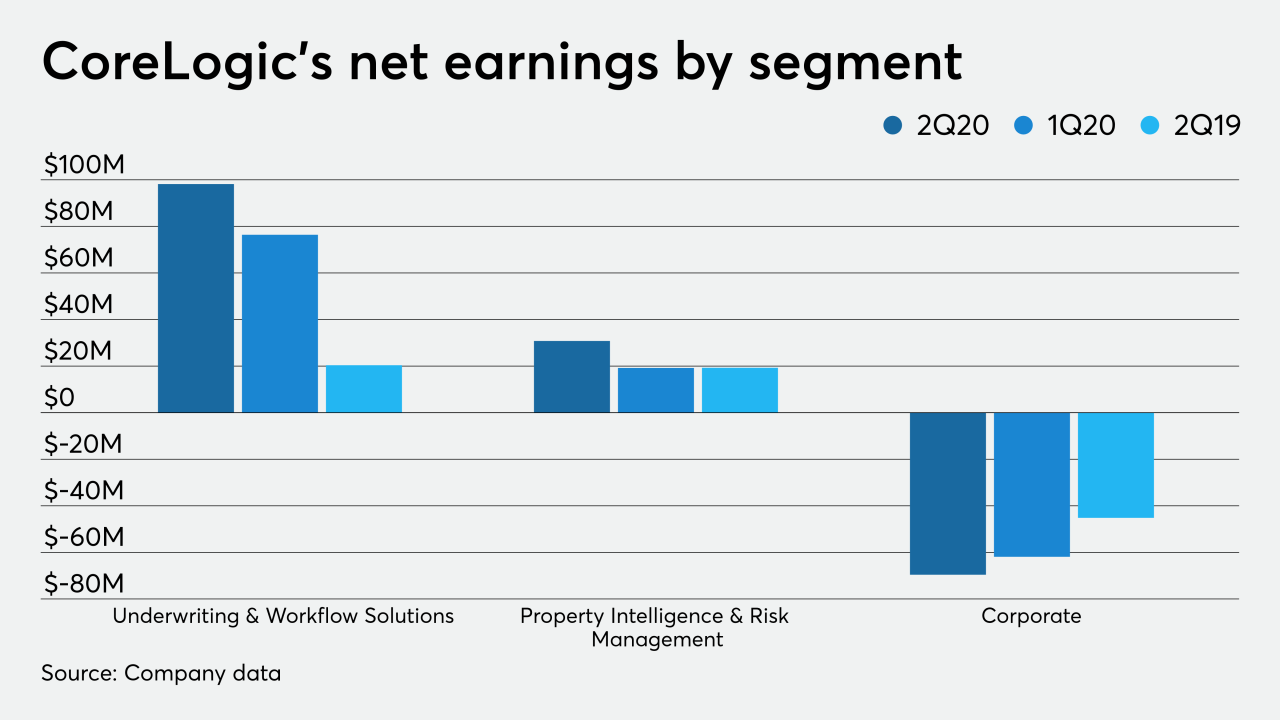

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

Fannie Mae could be worthless to public shareholders, according to its newest analyst.

July 22 -

The domestic mortgage insurer could have a portion of its equity sold as an initial public offering if the China Oceanwide transaction were to be terminated.

July 21 -

The technology company reiterated its call for the hostile bidders to raise their $65 per share offer.

July 20 -

Ocwen Financial's preliminary second-quarter results put it back in the black, and it is positioning its growing distressed-servicing expertise and pandemic-induced exposures as a net positive.

July 17 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

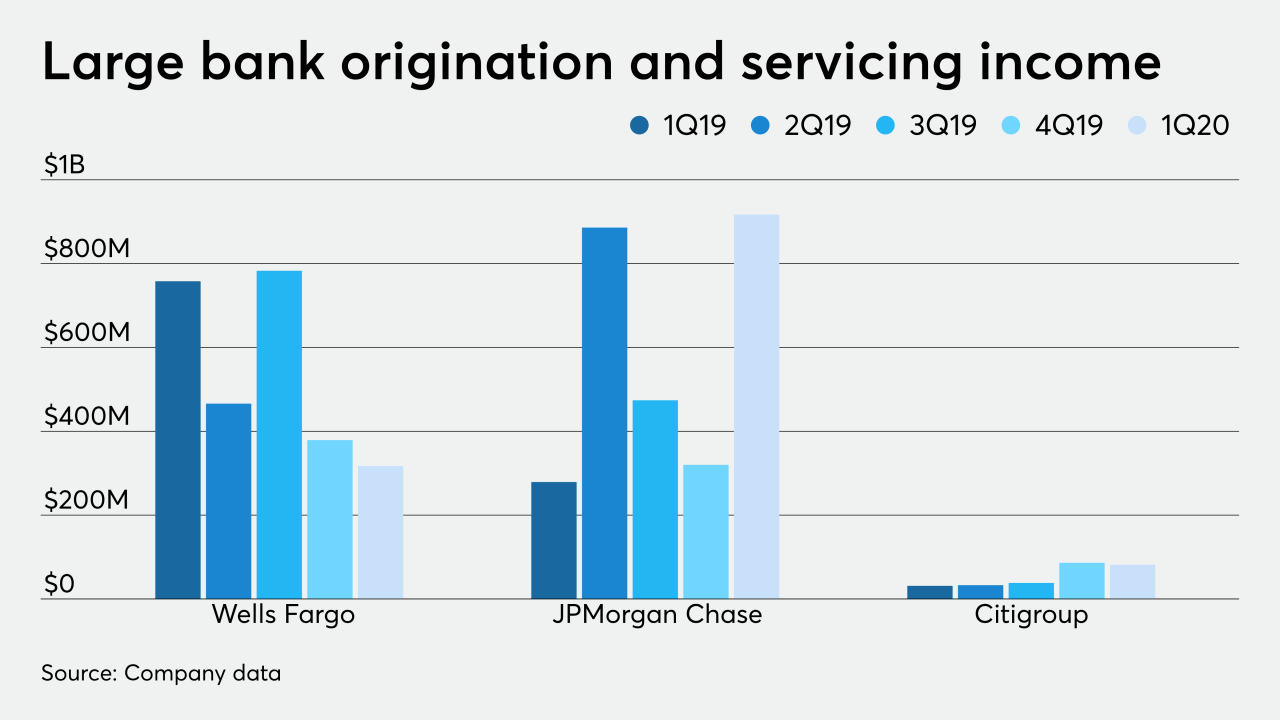

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

B. Riley FBR raised its ratings for both Fannie Mae and Freddie Mac to sell from neutral on the possibility the net worth sweep is declared illegal.

July 13 -

The lending giant's filing reveals what the company's internal structure will look like going forward.

July 8 -

Booming refinancing is expected to more than offset the tighter underwriting in second-quarter mortgage results.

July 8 -

A Detroit-based company, which owns Rocket Mortgage and Quicken Loans, listed the size of its upcoming offering in filing as $100 million, a placeholder amount that will likely change.

July 7 -

Reps called the offer "opportunistic" and said it did not address regulatory concerns regarding overlaps with Bill Foley's other businesses, Fidelity and Black Knight.

July 7 -

If the transaction does not go through, Genworth is looking at reviving a spin-out of its U.S. mortgage insurance business.

June 30 -

Cannae Holdings, a spinoff of Fidelity National Financial, is trying to stage an unsolicited takeover of the property data, analytics and services firm that once had ties to Fidelity's competitor.

June 26 -

The company formally reported a nearly $65 million loss in the first quarter as the coronavirus affected its operations in March.

June 26 -

Analysts think the company could be looking for an acquisition target.

June 17 -

The REIT will add $500 million in capital through a senior secured loan, and it received a $1.65 billion term facility.

June 16