-

Continued favorable loss development trends allowed MGIC Investment Corp. to beat analyst estimates for the second-quarter earnings report.

July 18 -

A new round of expense reductions is getting underway at Nationstar Mortgage as the company moves toward its acquisition by WMIH Corp., a shell company holding Washington Mutual legacy businesses.

July 17 -

This year's sluggish spring home buying season led to generally softer mortgage-related second quarter results at Wells Fargo, JPMorgan Chase, Citigroup and PNC Financial Services Group, but First Republic Bank bucked the trend.

July 13 -

Public builder Beazer Homes USA plans to buy privately held Venture Homes for $65 million in a move that could make mortgage lending in Atlanta more competitive.

July 10 -

The shareholders of Nationstar Mortgage Holdings and WMIH Corp. each voted to approve a $1.9 billion acquisition plan that will see the parent company of nonbank lender and servicer Mr. Cooper combine with the successor to S&L and subprime mortgage lender Washington Mutual.

June 29 -

Ditech Holding Corp. is considering selling itself, just over four months after the lender emerged from bankruptcy protection.

June 29 -

The Fed’s rate hike and its signal of two more increases to come this year will only add to investors’ worry that the U.S. housing market is getting too expensive.

June 13 -

Ditech Holding Corp. returned to profitability in the first quarter, benefiting from accounting adjustments related to its emergence from bankruptcy protection in February.

June 6 -

Ocwen Financial Corp.'s Chief Financial Officer Michael Bourque has resigned, becoming the second top executive to leave the company after it agreed to acquire PHH Corp.

May 29 -

Ditech Holding Corp. has received a second notice from the New York Stock Exchange warning its common stock could be delisted for not being in compliance with the exchange's requirements.

May 29 -

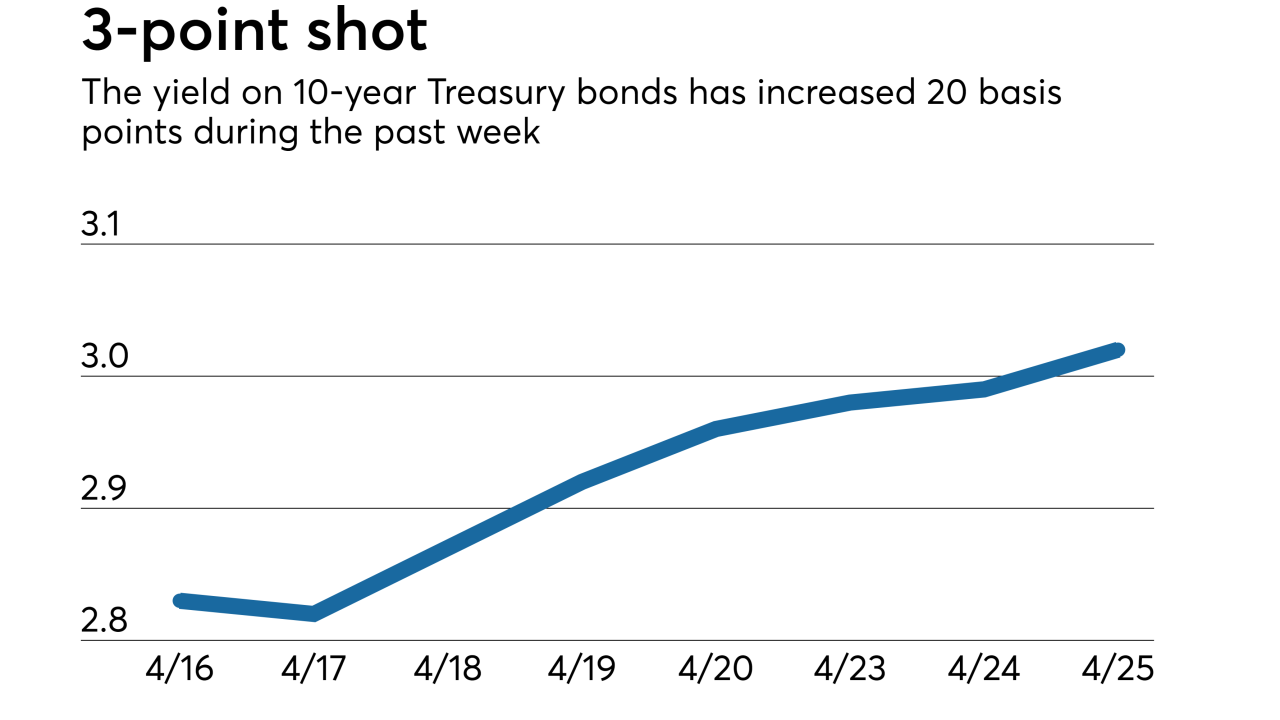

The 10-year U.S. Treasury yield rose to its highest level since 2011, extending a selloff in the world’s biggest bond market and raising fresh questions about how high America's borrowing costs will climb.

May 15 -

PHH Corp. took a net loss in the first quarter but was able to surpass minimums for net worth and available cash necessary for Ocwen Financial to acquire the company.

May 9 -

Capital One Financial Corp. plans to repurchase shares following the sale of $17 billion in mortgages to a Credit Suisse subsidiary.

May 8 -

An increase in title orders opened helped Fidelity National Financial improve its first-quarter net income by 59% over the same period last year.

May 4 -

Arch Capital Group's mortgage insurance subsidiary slipped to No. 2 in market share just five quarters after completing the acquisition of former No. 1 United Guaranty Corp.

May 2 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Ellie Mae's first-quarter net income of a little over $2 million was lower than last year's due to some one-time expenses, but continuing operations numbers exceeded analysts' expectations.

April 27 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

If 10-year Treasury yields remain at or above 3%, the average 30-year fixed-rate mortgage could hit 5% sooner than previously expected.

April 25 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24