-

Thomas H. Lee Partners is selling approximately 13% of its stake in Black Knight Financial Services in a secondary public offering.

May 9 -

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

CoreLogic's first-quarter net income was down 54% from the prior year as lower mortgage origination volume reduced the need for some of its services.

April 27 -

Radian Group earned $76.5 million for the first quarter, up 16% from $66.2 million one year prior, helped by a 25% year-over-year rise in new insurance written.

April 27 -

Arch Capital Group's 62% first-quarter earnings improvement was driven by its acquisition of United Guaranty Corp.

April 27 -

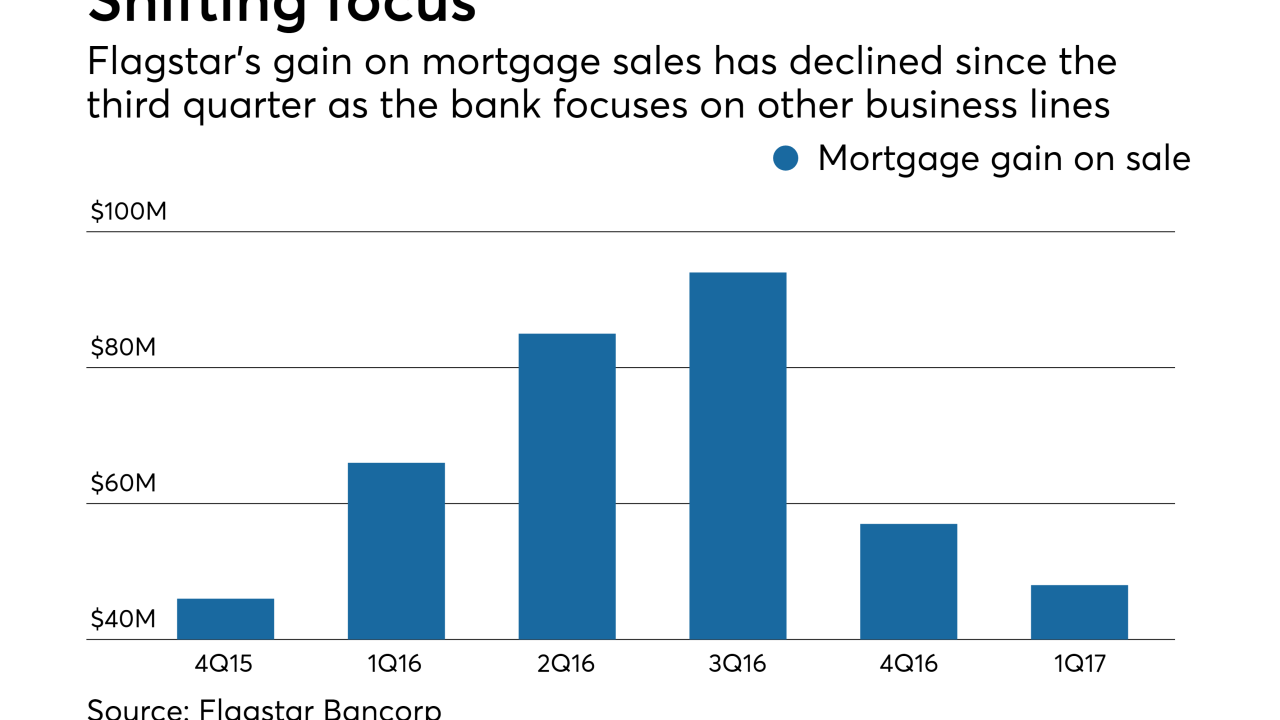

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Stewart Information Services Corp. posted net income in the first quarter of $4.1 million, a turnaround from the $11.2 million loss one year ago.

April 20 -

MGIC Investment Corp. had net income of $89.8 million for the first quarter, an increase of nearly 30% over the same period last year of $69.2 million.

April 20 -

Mortgage bankers' first-quarter earnings should be down from the fourth quarter in tandem with the reduction in origination volume.

April 19 -

Impac Mortgage Holdings sold $56 million of its common stock as part of a plan to securitize non-qualified mortgage loans.

April 19 -

Most Federal Reserve officials agree that they will begin shrinking their super-sized balance sheet later this year.

April 6 -

Consolidation among large independent mortgage bankers is likely as several lack the financial wherewithal to deal with the changing environment, Moody's said.

March 31 -

In a bitterly partisan Congress, two senators are making a rare push across party lines to solve a persistent riddle with huge implications for the U.S. housing market: What to do with Fannie Mae and Freddie Mac?

March 28 -

LoanDepot Inc. is exploring the possibility of reviving a stock offering after cancelling one in November 2015

March 16 -

Profits at Mill Valley, Calif.-based Redwood Trust shrank during the fourth quarter, reflecting lower interest income and net losses on the fair value of investments.

February 24 -

CoreLogic reported a 90% year-over-year decline in net income during the fourth quarter, as impairment charges more than offset the company's revenue gains.

February 23 -

Ocwen Financial Corp. reduced its net loss in the fourth quarter, a reflection of the company's efforts to reduce expenses.

February 22 -

A federal appeals court upheld a ruling that barred hedge funds from suing to overturn the U.S. government's 2012 decision to capture billions of dollars in the profits generated by the mortgage guarantors Fannie Mae and Freddie Mac after their bailout.

February 21 -

New Residential Investment Corp. had net income of $225 million in the fourth quarter, more than double the $103 million reported for the same period in 2015.

February 21 -

The change of power in the White House will not affect Fannie Mae's focus for 2017 in bringing innovations similar to the Day 1 Certainty program to its customers, CEO Timothy Mayopoulos said in an interview.

February 17