-

VA- and FHA-backed mortgages helped drive the increase in property volume, but sales did not maintain the same pace, according to Auction.com.

January 29 -

Foreclosure filings were reported on more than 360,000 properties in the United States last year, up 14% from 2025 and 3% from 2023, according to Attom.

January 15 -

The national mortgage delinquency rate jumped to 3.85% in November, up 15% month over month and 2.79% year over year, according to ICE Mortgage Technology.

December 23 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

Higher unemployment has driven these indications of distress higher but most loans that financial institutions hold in their portfolios are still performing.

December 16 -

The decision in a New York case that is also undergoing federal review puts pressure on related parties to get things right within a statute of limitations.

December 9 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

Uncooperative neighbors, vicious pets and threats of violence are some of the dangers mortgage field employees run into when on assignments.

November 24 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

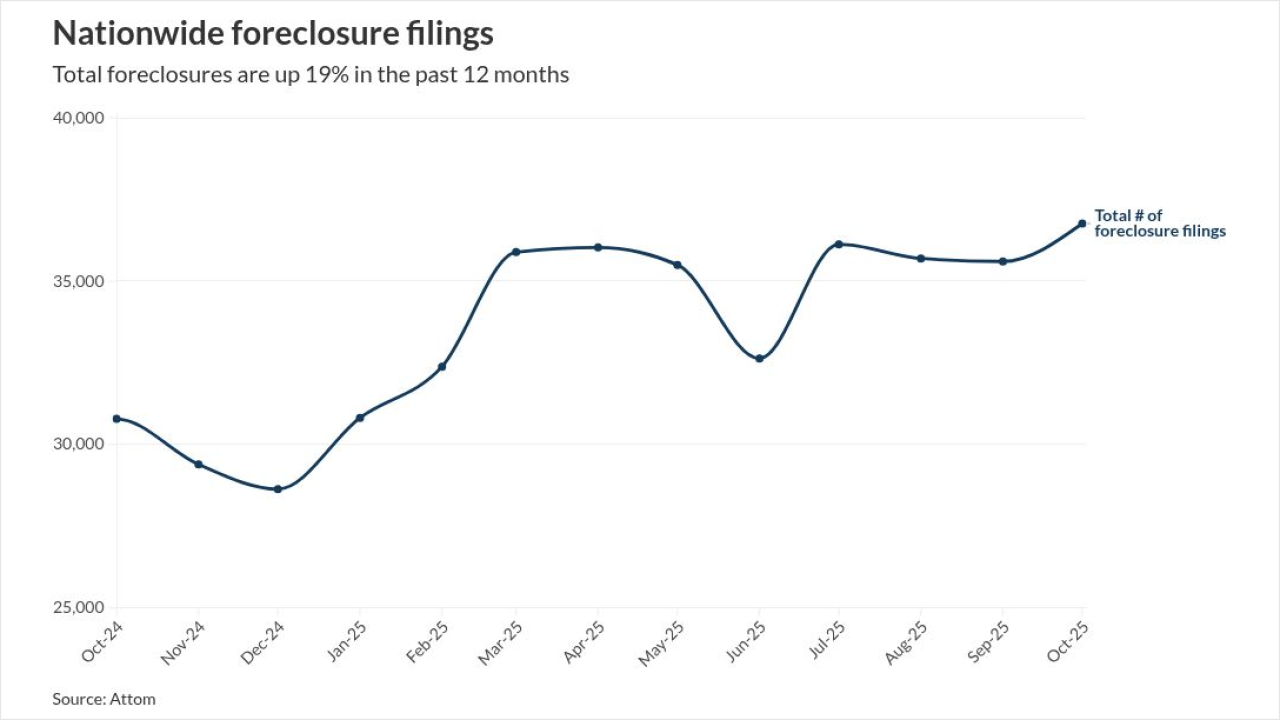

Total foreclosures rose 3% from September and 19% from the same time a year ago in October, marking the eighth straight month of increases.

November 13 -

FHA loans accounted for about half of the annual rise in foreclosure starts and 80% of the rise in active foreclosures in September, according to ICE.

October 24 -

Retroactive interpretations have bedeviled mortgage servicers and the market for older loans. The industry will be watching other cases in New York closely now.

October 15 -

Roughly 100,000 properties in the United States had a foreclosure filed in the third quarter this year, an increase on a quarterly and yearly basis, ATTOM said.

October 9 -

The latest reports from ICE Mortgage Technology and VantageScore appear to be in line with hints at growing borrower pressure officials are eyeing in policy.

September 24 -

Properties with default notices, scheduled auctions and REOs are up by double digits compared to last summer as buyers are mired in a high-cost environment.

September 11 -

The Foreclosure Abuse and Prevention Act has reportedly stopped one company from buying loans in the New York, others are said to be paying less for them.

September 9 -

Mortgage delinquency rates increased versus the second quarter of 2024, with certain markets, especially in the South, reporting higher levels of difficulty.

September 5 -

By looking at the payment-to-income ratio on credit cards, as well as student loans and HELOCs, Transunion says servicers can predict future delinquency trends.

August 29 -

The share of investor-owned properties sitting empty is greater than the vacancy rate for the nation's housing market, according to Attom Data Solutions.

August 22 -

Between rising home costs and the end of mortgage relief programs, many homeowners are struggling to stay above water, especially in the South and West.

August 14