-

Fannie Mae has released the details of its next nonperforming loan sale, which will include its fifth "community impact" pool.

August 10 -

Nationstar is preparing its third securitization this year, and sixth overall, of nonperforming and inactive reverse mortgages under a Federal Housing Administration reverse mortgage program.

August 10 -

The foreclosure inventory at the end of June was at its lowest level since August 2007, according to data released Tuesday by CoreLogic.

August 9 -

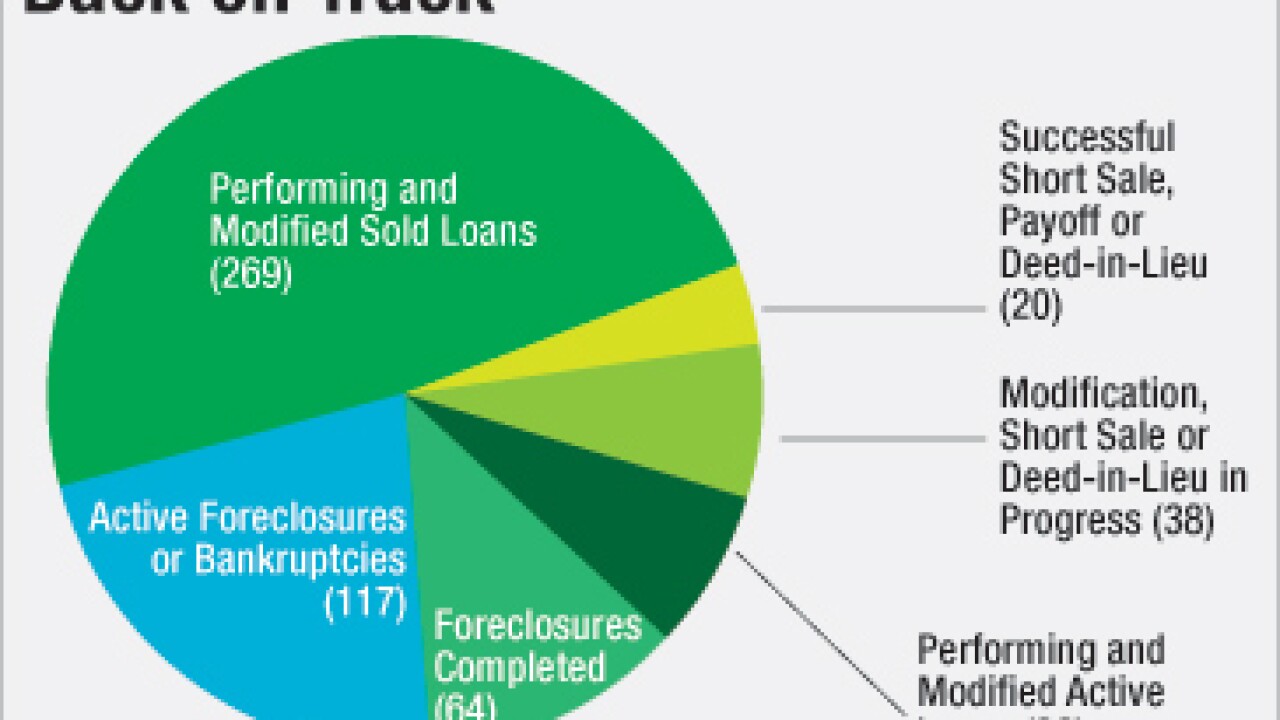

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

Incenter Mortgage Advisors is brokering the sale of an $8.9 billion Ginnie Mae bulk residential mortgage servicing rights portfolio.

August 4 -

The Consumer Financial Protection Bureau on Thursday finalized new requirements for mortgage servicers that provide more help to struggling borrowers and add consumer protections when loans are transferred.

August 4 -

The Consumer Financial Protection Bureau added its voice Tuesday to a chorus of other regulators in calling for sustainable foreclosure relief when the Home Affordable Modification Program expires at yearend.

August 2 -

Fannie Mae has selected Corona Asset Management XVIII as the winner of its fourth and latest "community impact" pool of nonperforming loans.

July 28 -

A lawsuit brought by the City of Miami has the potential to determine the reach of legal actions brought against lenders under the Fair Housing Act.

July 27 Baker Donalson

Baker Donalson -

As if high default costs haven't been challenging enough for mortgage servicers, a growing number of seriously delinquent loans are Federal Housing Administration products, which require significant upfront investment to resolve.

July 27 -

A drop in mortgage banking cut into Trustmark's second-quarter profit, as did the costs to extend buyouts to employees.

July 26 -

Federal regulators warned mortgage servicers Monday that they will still expect them to offer loan modifications to distressed homeowners even after the Home Affordable Modification Program expires at yearend.

July 25 -

The Federal Housing Administration released lender guidance spelling out the circumstances under which it will insure mortgages on properties encumbered by Property Assessed Clean Energy liens similar to tax assessments.

July 20 -

MGIC Investment Corp. earned $109 million in the second quarter, as an income tax provision for the period cut into net income.

July 19 -

RealtyTrac is renaming its parent company Attom Data Solutions as it rolls out a new property database that links different data sources into a centralized resource.

July 19 -

There was a decline in loan modification activity in May both for year-over-year and month-to-month comparisons, according to the Hope Now alliance.

July 18 -

Homes that were foreclosed on during the housing crisis have since gained nearly twice as much value when compared with other homes, according to Zillow.

July 13 -

Republican lawmakers put Department of Housing and Urban Development Secretary Julian Castro on the hot seat Wednesday, criticizing his decision to allow nonprofit community groups to bid on more nonperforming Federal Housing Administration loans.

July 13 -

Foreclosure inventory and the number of completed foreclosures both dropped in May compared with a year ago, according to CoreLogic.

July 12 -

Just 2.8 million borrowers remain in negative equity, a 13% decrease year-over-year, according to Black Knight Financial Services.

July 11