-

Foreclosure rates in Pima County, Ariz., last year dropped to their lowest level since the start of the housing crash.

January 22 -

Foreclosure filings were reported on 676,535 properties nationwide in 2017, marking the lowest level of foreclosure activity since 2005.

January 18 -

Two adjoining houses on Sixth Street in Niagara Falls were demolished last week as part of the city's ongoing battle against zombie houses.

January 16 -

The payments resolve a number of cases that date back to 2011 and were among the largest coordinated U.S. enforcement efforts in the years following the crisis.

January 12 -

Franklin County, Ohio, foreclosures fell to the lowest level on record last year, according to figures released by the county clerk's office.

January 10 -

A decade after the housing market crashed, foreclosures in Dallas-Fort Worth have slowed to a trickle.

January 9 -

Despite the overall mortgage delinquency rate being down in October, early-stage mortgage delinquencies increased following an active hurricane season, according to CoreLogic.

January 9 -

The Denver judge, who last spring ruled that former foreclosure king Larry Castle and his law firm did not violate state laws designed to protect consumers against fraudulent charges, was biased and made several missteps during the three-week bench trial leading up to his decision, the Colorado attorney general's office asserts in its appeal of the verdict.

January 8 -

Two major shopping centers in Keene, N.H., are scheduled for sale at foreclosure auctions in January, according to ads taken out by an auction company.

January 5 -

Sen. Sherrod Brown called on the Trump administration to support the Consumer Financial Protection Bureau's enforcement action against PHH Corp., which agreed to a

$45 million settlement this week related to foreclosure abuses.January 4 -

Behind a tall iron fence lies one of the most unusual gated communities in Tampa Bay. And within that lies the most expensive and unusual bank-owned house for sale between Crystal River and Sarasota.

January 4 -

PHH Corp. agreed to a $45 million settlement to resolve allegations from 49 states and the District of Columbia that it engaged in "foreclosure process abuses" involving "inconsistent signatures" in its servicing business from 2009 to 2012. The settlement comes as the nonbank mortgage company continues its legal challenge to a separate regulatory action by the CFPB.

January 3 -

Pioneer Savings Bank is seeking to foreclose on commercial property located off of Route 146 in Clifton Park, N.Y., claiming that the owner owes the bank more than $1.9 million in mortgages and loans.

January 2 -

The foreclosure rate in Minnesota is now at the lowest level in more than a decade, and far below the national average.

December 29 -

Two New Jersey programs that provide financial assistance to homeowners on the brink of foreclosure are temporarily suspending acceptance of applications, a state official said this week.

December 29 -

The largest residential mortgage servicers will get even larger in 2018, benefiting from consolidation and the outsourcing of servicing rights acquired by companies without their own platforms.

December 26 -

Development company NRP Group has sued the owner of the Lone Star Brewery for not refunding a $550,000 deposit after a deal to buy land for an apartment complex at the site fell through.

December 26 -

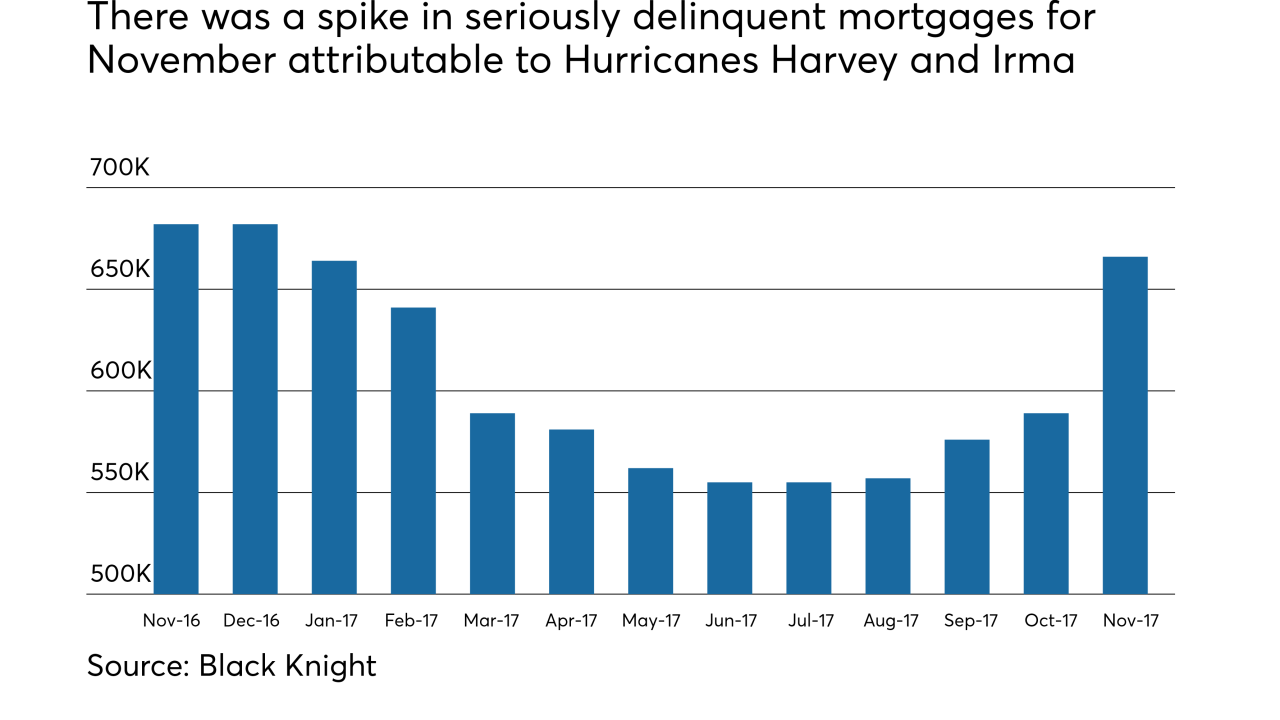

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

Michigan residents are being urged to take advantage of a federally-funded state program designed to prevent foreclosures, while the money is still available.

December 22 -

The Great Recession, the most painful downturn since the Great Depression, destroyed more than 248,000 jobs in metro Atlanta — about one of every 10 — and led to a quarter-million foreclosures.

December 21