-

Behind a tall iron fence lies one of the most unusual gated communities in Tampa Bay. And within that lies the most expensive and unusual bank-owned house for sale between Crystal River and Sarasota.

January 4 -

PHH Corp. agreed to a $45 million settlement to resolve allegations from 49 states and the District of Columbia that it engaged in "foreclosure process abuses" involving "inconsistent signatures" in its servicing business from 2009 to 2012. The settlement comes as the nonbank mortgage company continues its legal challenge to a separate regulatory action by the CFPB.

January 3 -

Pioneer Savings Bank is seeking to foreclose on commercial property located off of Route 146 in Clifton Park, N.Y., claiming that the owner owes the bank more than $1.9 million in mortgages and loans.

January 2 -

The foreclosure rate in Minnesota is now at the lowest level in more than a decade, and far below the national average.

December 29 -

Two New Jersey programs that provide financial assistance to homeowners on the brink of foreclosure are temporarily suspending acceptance of applications, a state official said this week.

December 29 -

The largest residential mortgage servicers will get even larger in 2018, benefiting from consolidation and the outsourcing of servicing rights acquired by companies without their own platforms.

December 26 -

Development company NRP Group has sued the owner of the Lone Star Brewery for not refunding a $550,000 deposit after a deal to buy land for an apartment complex at the site fell through.

December 26 -

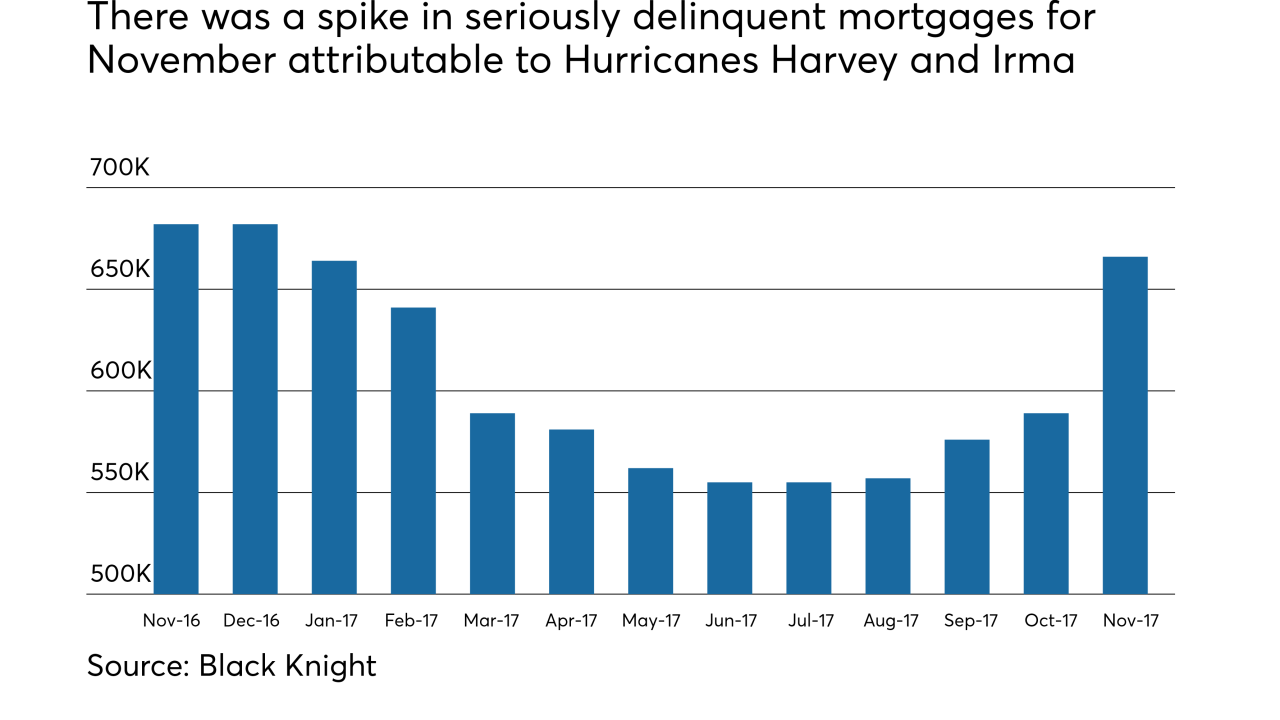

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

Michigan residents are being urged to take advantage of a federally-funded state program designed to prevent foreclosures, while the money is still available.

December 22 -

The Great Recession, the most painful downturn since the Great Depression, destroyed more than 248,000 jobs in metro Atlanta — about one of every 10 — and led to a quarter-million foreclosures.

December 21 -

A Stratford, Conn., man faces up to five years in prison after he pleaded guilty to bankruptcy fraud, according to the Department of Justice.

December 20 -

In 2010, Florida was in the throes of an unprecedented housing crisis. One in every eight homes was in some stage of foreclosure. Today, the foreclosure rate is one in every 83.

December 18 -

Tampa Bay has seen two booms in house flipping — one in the mid 2000s, when prices appeared on a steadily upward trajectory and again from 2011 to 2014, when the market was flooded with cheap foreclosures.

December 15 -

PHH Mortgage was the first mortgage servicer to be fined by the New York Department of Financial Services for failing to maintain a "zombie" property.

December 14 -

The council is exploring legislation to collect around $492 million in delinquent real estate taxes that could aid the city’s school district.

December 14 -

A Milwaukee landlord who continued to buy foreclosed properties at auction after being sanctioned, must pay $64,550 in municipal court fines that he has been effectively dodging as far back as 2009, a Wisconsin Court of Appeals judge ordered.

December 13 -

Secretary of the Commonwealth William F. Galvin has charged a Milton, Mass., man with using a fraudulent house-flipping scheme to convince friends and investors to lend him money that he then used on restaurants, hotels and groceries.

December 12 -

Early-stage mortgage delinquencies had their largest year-over-year gain during September in over eight years, a direct result of Hurricanes Harvey and Irma.

December 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

There are fewer Albuquerque-area homeowners underwater on their mortgages compared with last year.

December 11