-

A federal appeals court upheld a ruling that barred hedge funds from suing to overturn the U.S. government's 2012 decision to capture billions of dollars in the profits generated by the mortgage guarantors Fannie Mae and Freddie Mac after their bailout.

February 21 -

New Residential Investment Corp. had net income of $225 million in the fourth quarter, more than double the $103 million reported for the same period in 2015.

February 21 -

The Chicago Federal Home Loan Bank experienced a significant jump in mortgage originations in 2016 due to a "re-introduction" of its traditional Mortgage Partnership Finance loan product.

February 17 -

Freddie Mac is ramping up its use of credit risk transfers, completing $215 billion in single-family transfers last year, up to $600 billion since 2013.

February 17 -

The change of power in the White House will not affect Fannie Mae's focus for 2017 in bringing innovations similar to the Day 1 Certainty program to its customers, CEO Timothy Mayopoulos said in an interview.

February 17 -

International Document Services has updated its idsDoc technology to support upcoming changes to Home Mortgage Disclosure Act reporting.

February 17 -

Jared Kushner relinquished control of his family's multibillion-dollar real estate business in January to eliminate conflicts of interest when he became a top White House adviser to his father-in-law, President Donald Trump.

February 17 -

Fannie Mae reported higher net income in the fourth quarter over the previous year.

February 17 -

Rising mortgage balances and home prices in Home Mortgage Disclosure Act data will be heartening for consumers that want to sell, but reflect challenges for those who want to buy.

February 16

-

Fannie Mae has priced its first resecuritization of multifamily mortgages on energy-efficient buildings.

February 16 -

Mortgage interest rates fell slightly for the second consecutive week, according to Freddie Mac.

February 16 -

Freddie Mac's net income increased to $4.8 billion in the fourth quarter, more than double what it earned a quarter earlier, the government-sponsored enterprise announced Thursday.

February 16 -

The Basel III capital requirements are making it hard for banks to stay in the servicing business, said David Motley, president of Colonial Savings. Their exodus from the market indirectly hurts consumers, he argued.

February 15 -

Senate Banking Committee Chairman Mike Crapo said Wednesday that although he plans to begin working on housing finance reform and changes to the Dodd-Frank Act, the poor relationship between Democrats and Republicans will slow any progress.

February 15 -

Fannie Mae is making technological updates and implementing policy and operational changes as part of an effort to improve servicing.

February 15 -

The government-sponsored enterprises should target their affordable housing efforts to strengthening the single-family market, rather than investing in private equity giants.

February 15 Center for American Progress

Center for American Progress -

The sale will include Fannie Mae's sixth "community impact" pool of loans.

February 14 -

JPMorgan Chase is known to eschew selling conforming mortgage loans to Fannie Mae and Freddie Mac, preferring to securitize them in the private-label market.

February 13 -

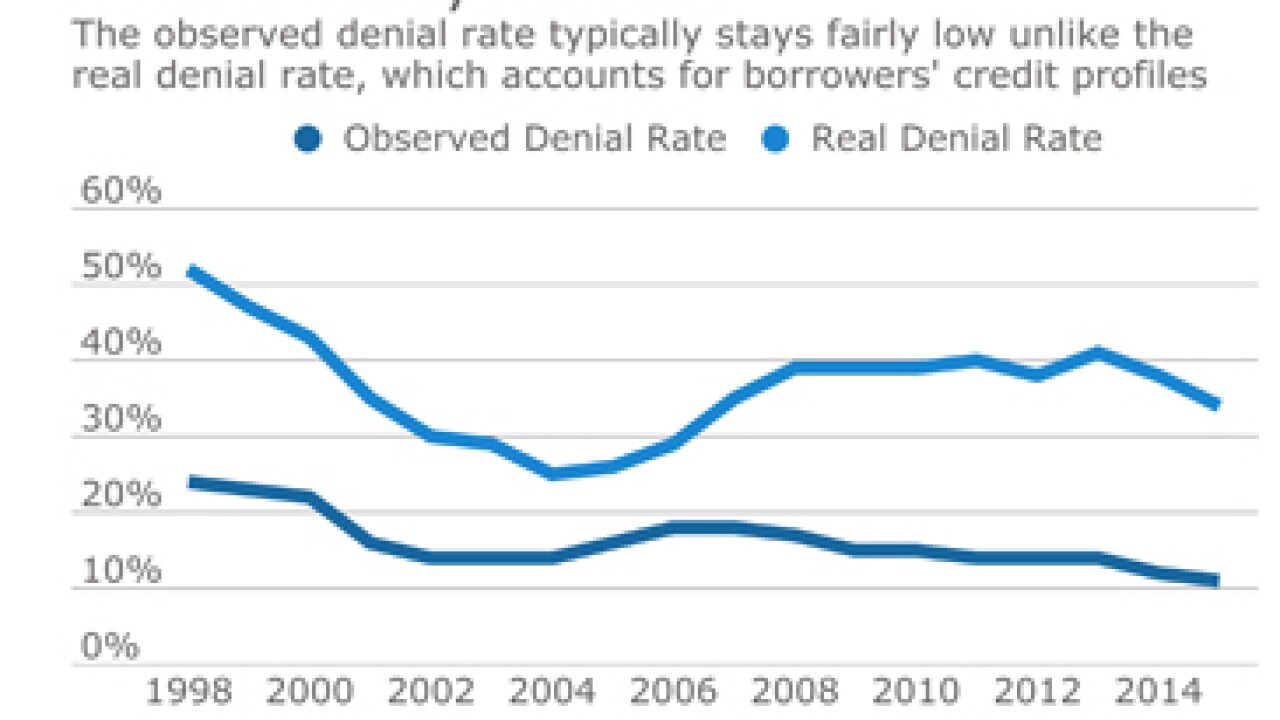

The denial rate traditionally used by the mortgage industry is hiding the fact that fewer borrowers with lower credit are applying for loans, according to the Urban Institute.

February 13 -

While lenders support the intent of a proposal to encourage the growth of private flood insurance, they claim a regulatory proposal doesn't give lenders enough flexibility and remains too complicated.

February 10