-

New approaches to credit scoring lower the standard of the criteria required to receive a mortgage loan, at greater risk to the industry.

January 9 FICO

FICO -

The House Financial Services Committee will see a shuffling of deck chairs among the leadership of its subcommittees in the new Congress as it also welcomes 10 new Republican members.

January 6 -

Ohio has prohibited the use of plywood to board up certain vacant or abandoned properties in foreclosure.

January 6 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

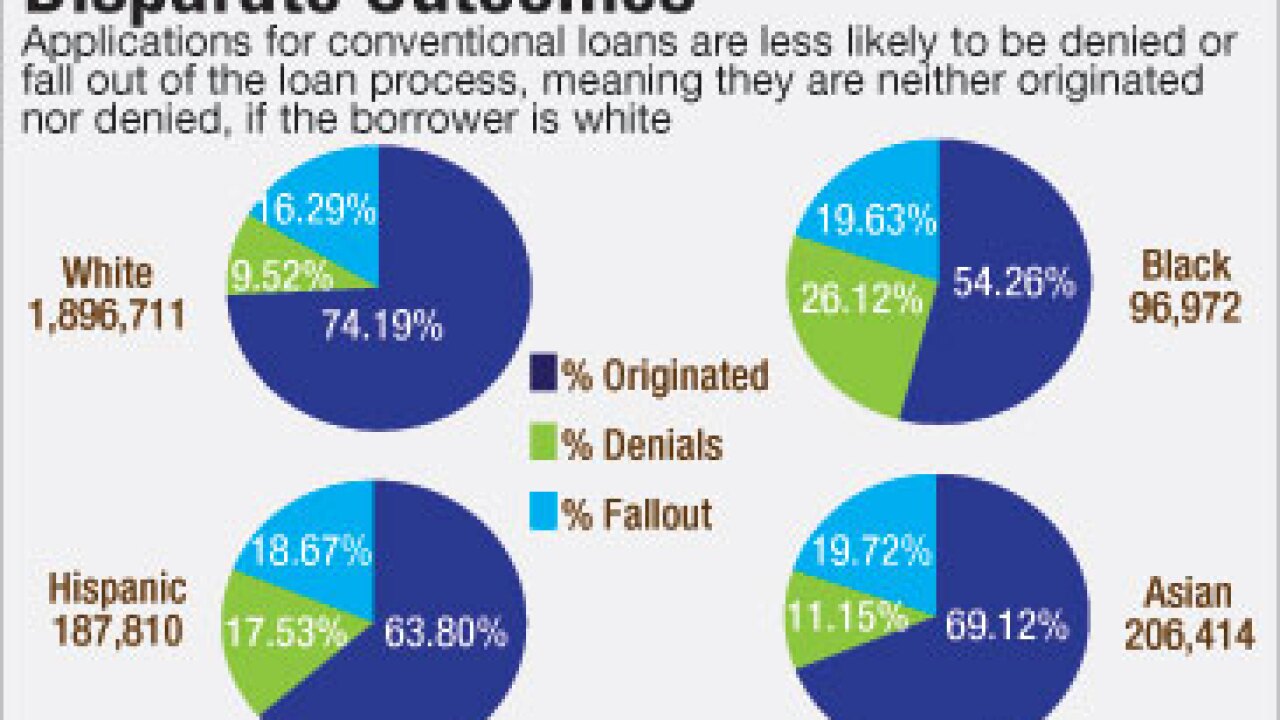

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Mortgage credit availability grew for the fourth consecutive month in December, the Mortgage Bankers Association reported.

January 5 -

Mortgage interest rates dropped for the first time since the presidential election in the first week of the new year, Freddie Mac reported.

January 5 -

Origin Bank in Addison, Texas, has begun offering warehouse financing for electronic mortgages.

January 4 -

In hindsight, the U.S. Treasury's support of Fannie Mae and Freddie Mac was structured in a way that proved to be counterproductive.

January 4

-

The Senate Banking Committee will have six fresh faces in the new Congress as Republicans grapple with a slimmer majority.

January 3 -

Freddie Mac obtained one final new insurance policy under its Agency Credit Insurance Structure program in 2016.

January 3 -

This was a year of shocks and surprises, including a multimillion-dollar verdict after one lender sued another, regulations putting a lender out of business, Brexit driving rates down and Donald Trump's election pushing them back up. Here are 10 events and trends from 2016 that changed the industry.

December 30 -

The Rural Housing Service is expanding its manufactured housing loan guarantee program to include more refinancings of used or existing manufactured homes.

December 30 -

Some of the most popular contributors to National Mortgage News' Voices community weigh in on what they see coming in the next year for origination, servicing, technology and regulation.

December 29 -

PHH is selling its remaining residential mortgage servicing portfolio to the real estate investment trust New Residential.

December 29 -

From selling servicing rights along with the loans to issuing private-label securities, a host of strategies from the past could return to the market as a result of the new political climate and interest rate environment.

December 29 -

Mortgage rates moved higher, closing the year with nine consecutive weeks of increases, according to Freddie Mac.

December 29 -

Fannie Mae's Day 1 Certainty initiative and automated verification tools at Freddie Mac are set to improve mortgage loan application defect and misrepresentation risk in 2017, according to a report from First American Financial Corp.

December 28 -

Proponents of "recap and release" misread the political risks and the depth of interest that key lawmakers have in determining the long-term future of Fannie Mae and Freddie Mac.

December 28 Mountain Lake Consulting

Mountain Lake Consulting -

A recent piece making light of GSE recapitalization is dangerously misleading.

December 28