-

Purchases of new homes unexpectedly jumped in July to the highest level in almost nine years, led by soaring demand in the nation's South and adding to signs of persistent housing-market strength.

August 23 -

Daniel Mudd ended a five-year fight with the U.S. government Monday after the former head of Fannie Mae agreed to pay $100,000 to settle allegations that he misled investors about the mortgage backers exposure to subprime loans during the run-up to the financial crisis.

August 22 -

Mortgage rates edged downward this week as the market anticipated Wednesday's release of the minutes from the Federal Open Market Committee's July meeting, Freddie Mac reported.

August 18 -

The hole at the corner of 15th and L streets, in downtown Washington, is deep and getting deeper.

August 18 -

Fannie Mae is prepping servicers to handle the issues homeowners may face in the wake of severe flooding across Louisiana.

August 16 -

Fifth Third Bancorp, Ohio's largest lender, fired Chief Legal Officer Heather Russell last month after she disclosed a romantic relationship with the chief executive officer of Fannie Mae, Timothy Mayopoulos, The Wall Street Journal reported.

August 11 -

Mortgage lenders can expand their businesses by catering to borrowers who aren't proficient in English, but doing so requires strategic recruiting and hiring and compliance with federal and state regulations.

August 11 -

Mortgage rates were little changed from the previous week as they rose two basis points on better-than-expected economic news, according to Freddie Mac.

August 11 -

Fannie Mae has released the details of its next nonperforming loan sale, which will include its fifth "community impact" pool.

August 10 -

Farmer Mac posted lower net income than during the second quarter of 2015 on a loss on financial derivatives and hedging activities.

August 9 -

Freddie Mac has released a new online tool for lenders that determines whether a borrower's income qualifies them for a low down payment mortgage on a particular property.

August 9 -

Marketplace lender Lending Club has added Fannie Mae Chief Executive and President Timothy Mayopoulos to its board of directors.

August 8 -

Deval LLC in Dallas has received Fannie Mae servicer approval.

August 8 -

Fannie Mae and Freddie Mac could need as much as $126 billion in bailout money from taxpayers in a severe economic downturn, according to stress test results released by their regulator.

August 8 -

Fannie Mae reported that the Home Purchase Sentiment Index rose 3.3 points in July to 86.5, an all-time survey high.

August 8 -

The former officers and directors for Midwest Bank & Trust have reached a $26.5 million settlement with the Federal Deposit Insurance Corp. over charges of negligence during the financial crisis.

August 8 -

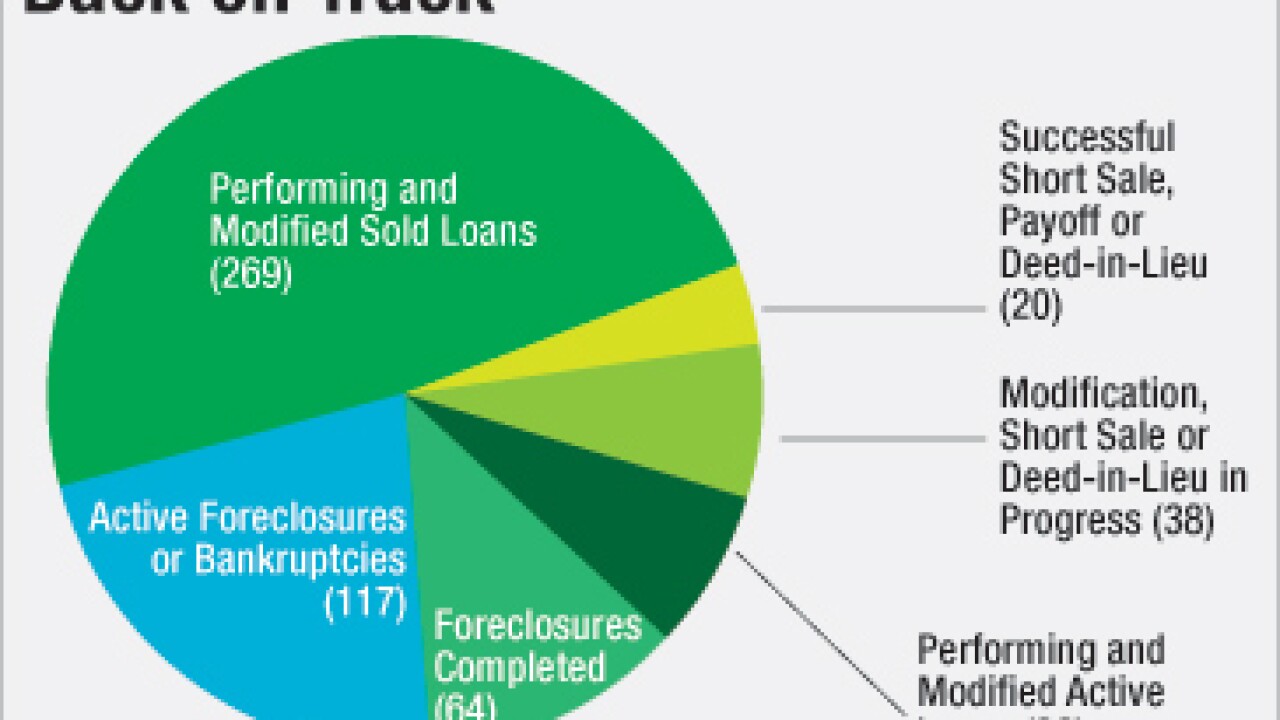

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

The U.S. asked a federal appeals court to reconsider its May decision to toss out an almost $1.3 billion judgment against Bank of America's Countrywide Financial unit, claiming the panel overlooked "a wealth of evidence."

August 5 -

Returning Fannie Mae and Freddie Mac to their status as privately owned public utilities is consistent with their mandate and makes the most policy sense.

August 4

-

Incenter Mortgage Advisors is brokering the sale of an $8.9 billion Ginnie Mae bulk residential mortgage servicing rights portfolio.

August 4