-

Loan program revisions made by one large conventional mortgage investor led to a decrease in total residential home finance credit availability in February.

March 8 -

A Senate proposal calling for a federal guarantee on mortgage-backed securities would only benefit the largest banks and increase the risk of bailouts.

March 8

-

The success of the government-sponsored enterprises' credit risk transfer programs shows that they can be the basis for housing finance reform.

March 7 -

Incenter Mortgage Advisors is putting up for bid a $712.8 million package of government-sponsored enterprise and Ginnie Mae mortgage servicing rights concentrated in the Southeast.

March 2 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1 -

NMI Holdings' common stock sale puts the company in a stronger position for future fundraising efforts, such as a now-delayed debt offering.

February 28 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

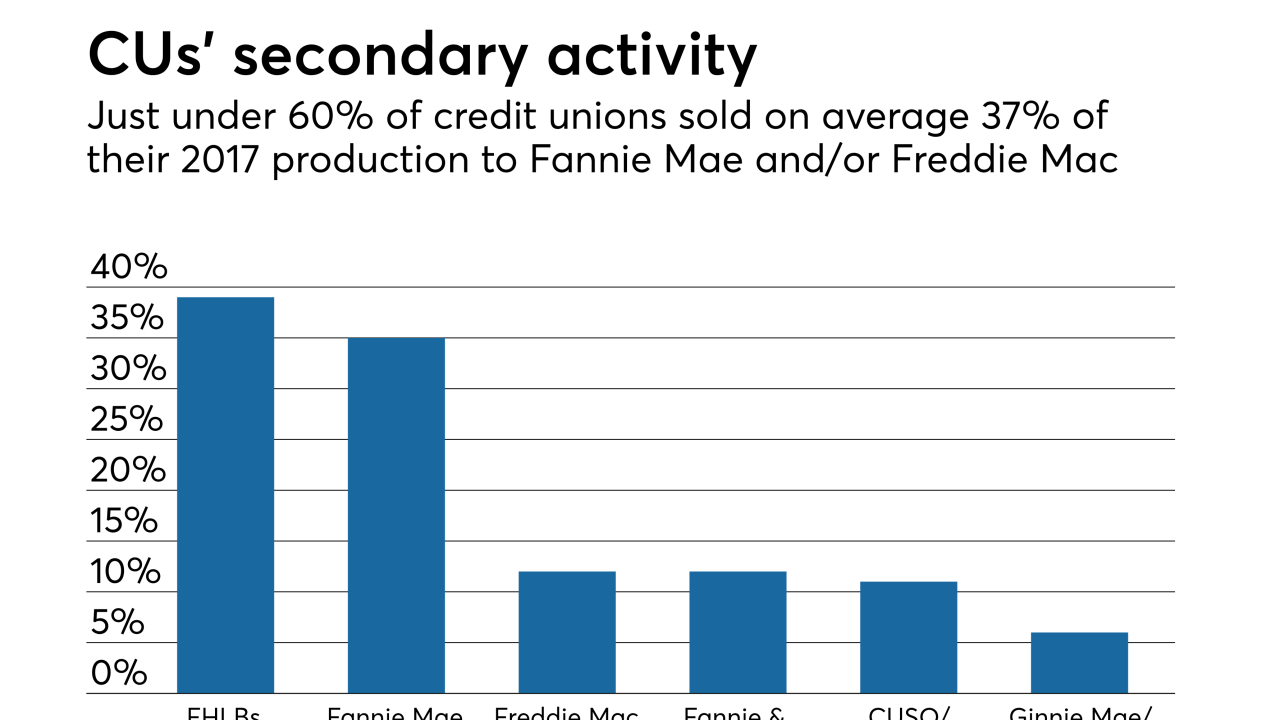

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

As the debate over housing reform heats up, policymakers should give careful consideration to a plan that recapitalizes the government-sponsored enterprises.

February 16 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

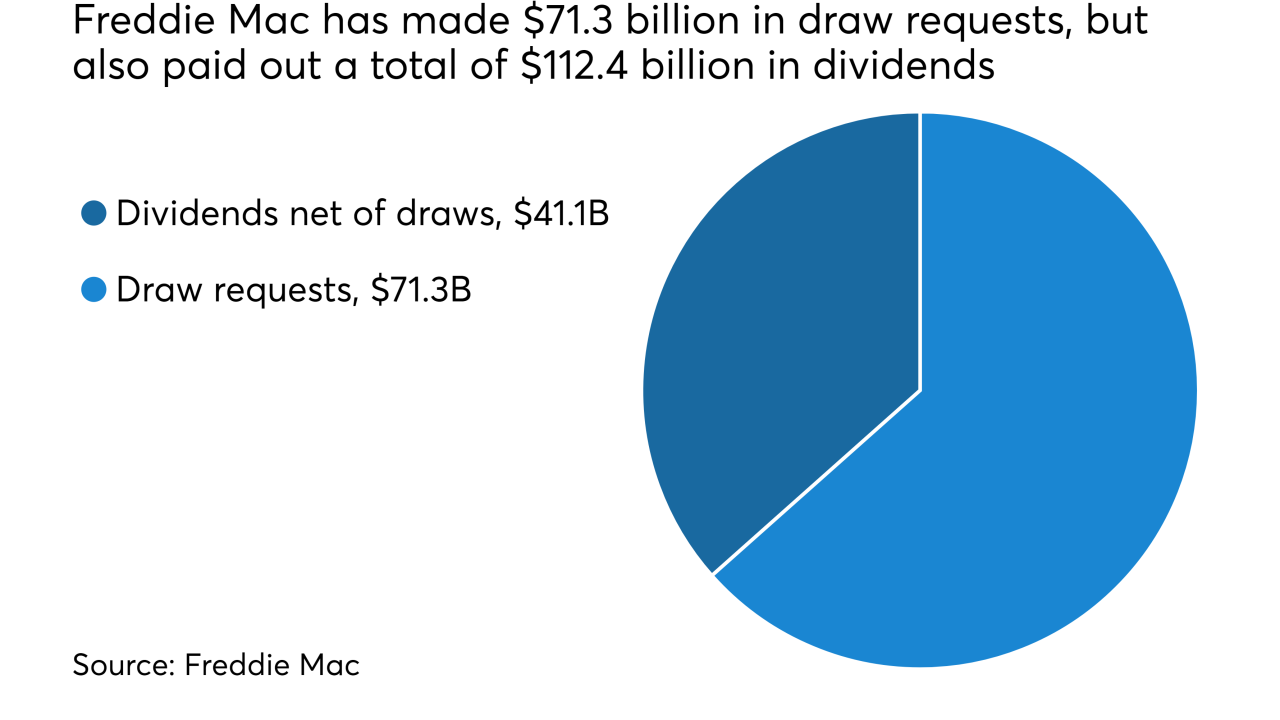

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Tax reform caused Fannie Mae to burn through retained earnings that had been approved just two months ago and to post a fourth-quarter loss. CEO Timothy Mayopoulos argued it was a one-time event that overshadowed strong fundamentals.

February 14 -

Fannie Mae will request an infusion of taxpayer money for the first time since 2012 because of an unintended but anticipated side effect of the corporate tax cut signed into law in December.

February 14 -

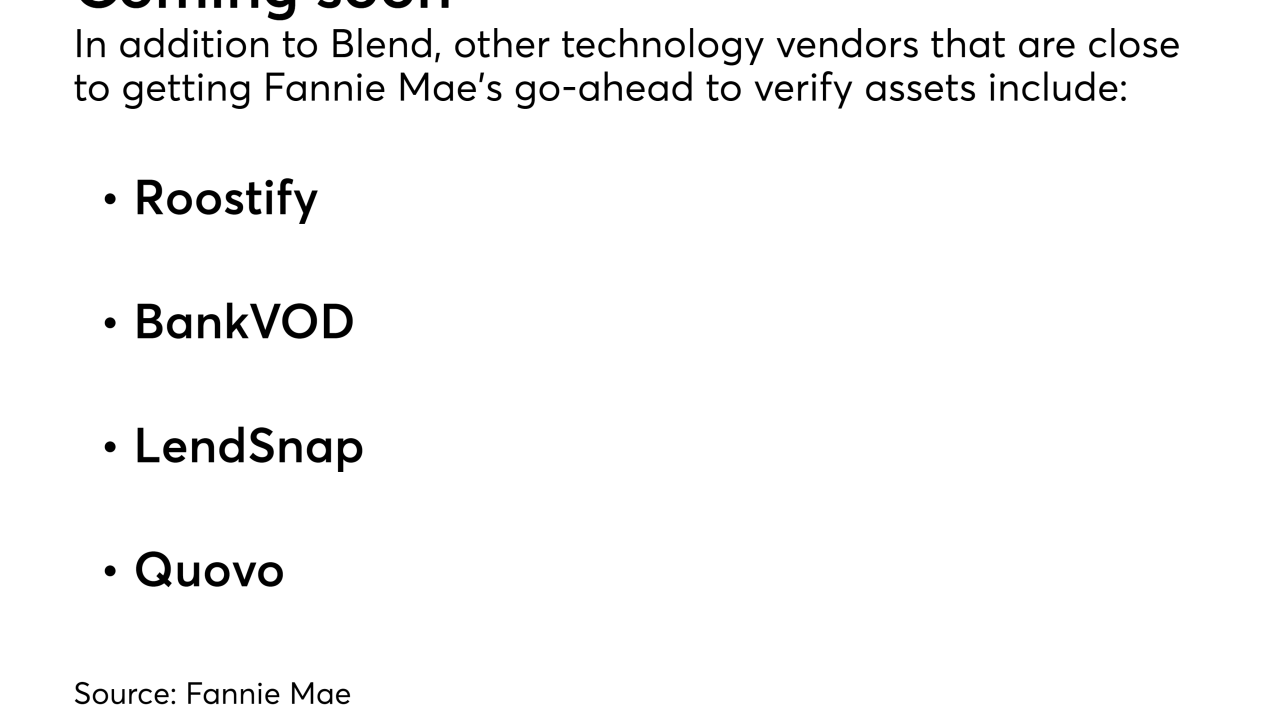

Fannie Mae is doing more to expand its list of Day 1 Certainty report suppliers, naming Blend as the first online point of sale system to directly offer asset validations.

February 13 -

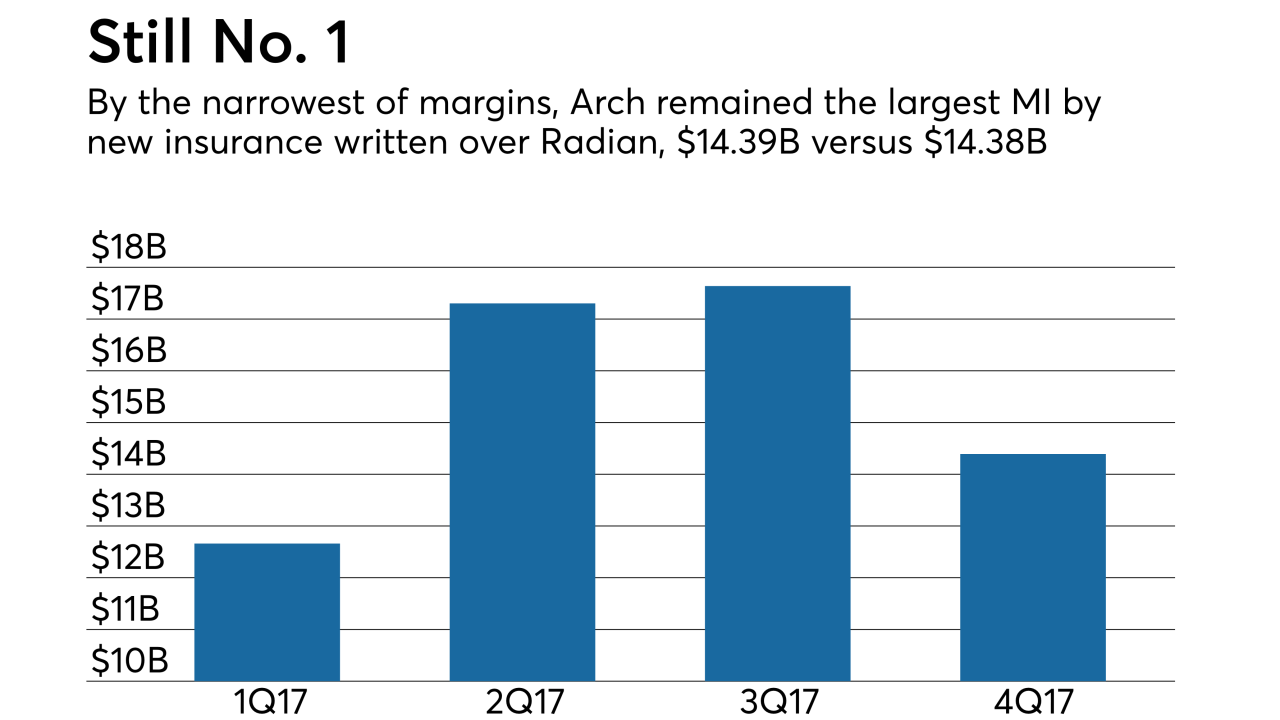

Arch Capital Group's mortgage insurance subsidiary increased its cushion under the secondary market capital standards in the fourth quarter even as its delinquent inventory grew.

February 13 -

The Trump administration’s 2019 budget highlights the administration’s goal of reining in the post-crisis regulatory apparatus, with proposed cuts for several agencies including the Consumer Financial Protection Bureau.

February 12 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Nine lenders have been warned by the U.S. that they will be kicked out of a top mortgage program within months unless they find ways to stop costly rapid refinances of veterans' loans.

February 8