-

As conservator, FHFA Director Mel Watt has substantial leeway to remake the government-sponsored enterprises without congressional input. Here's one way he might do so.

February 7 -

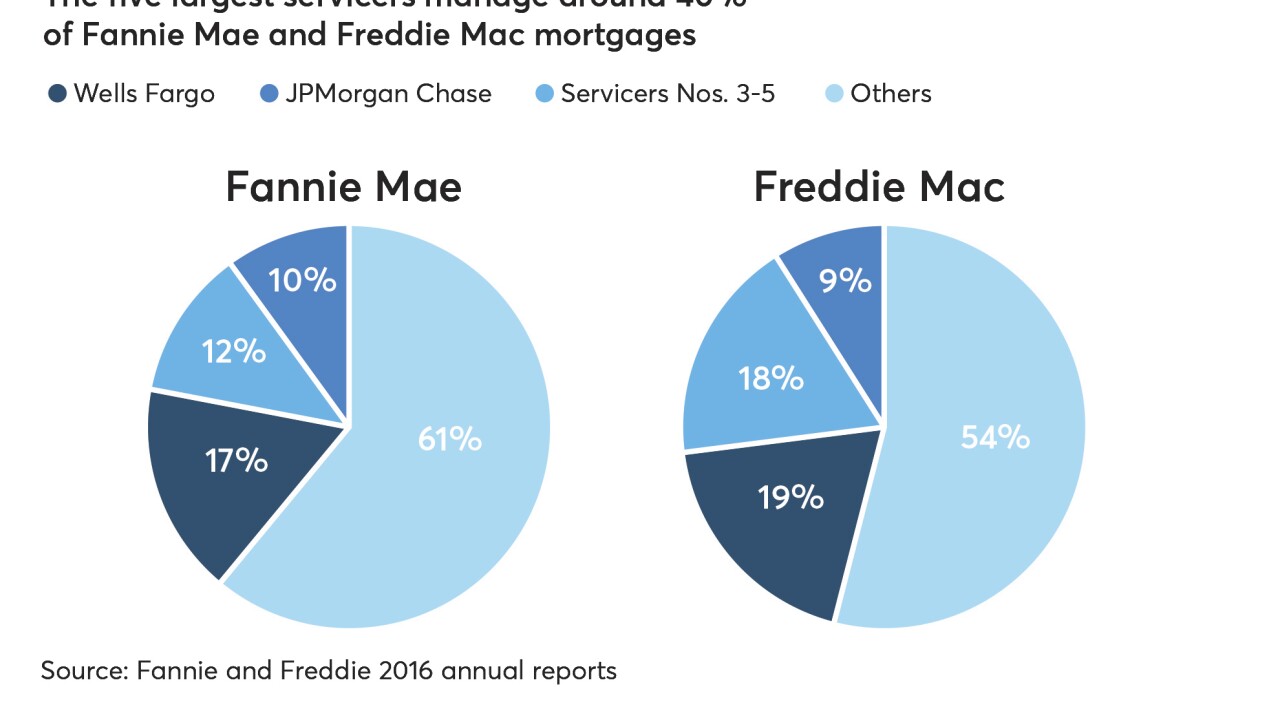

Wary of concentration risk, secondary market participants are backing initiatives to give more players a piece of the action.

February 6 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

February 2 -

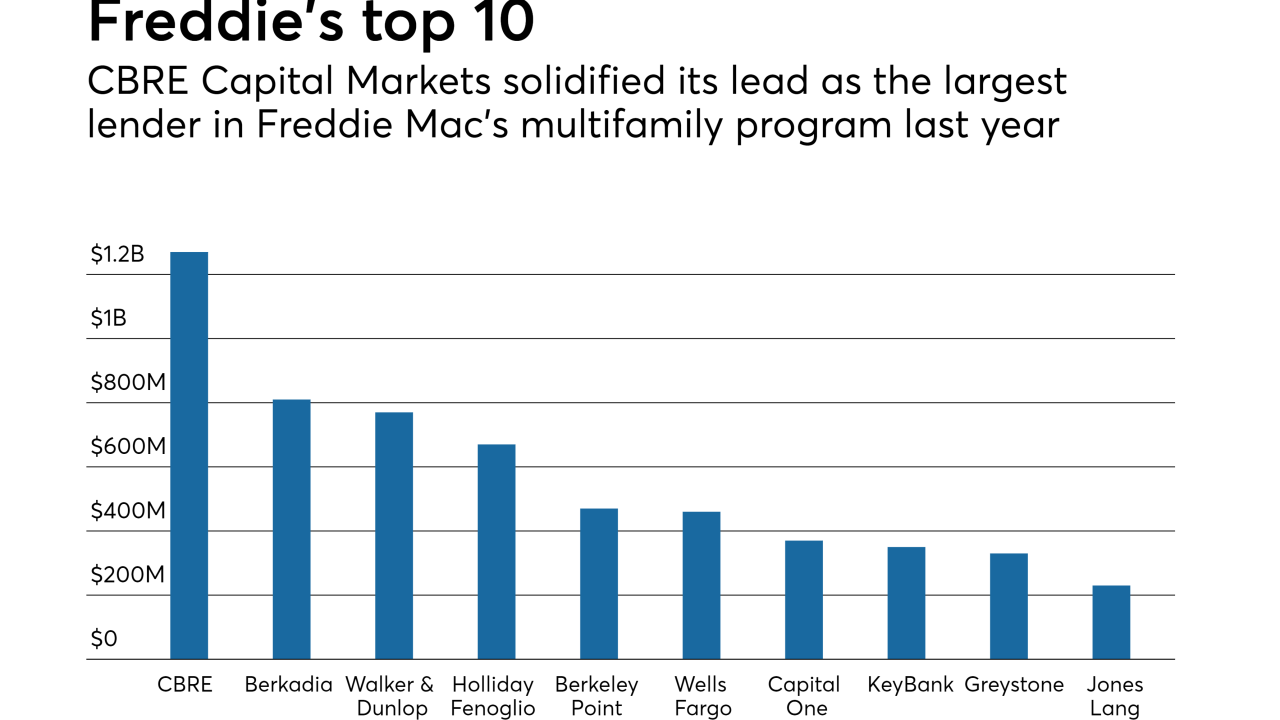

The top five Freddie Mac multifamily lenders remained stable year-to-year, in contrast to the shakeup in competitor Fannie Mae's rankings.

February 2 -

From government grants to automating branch management tasks, lenders are using their knowledge of real estate, finance, and government incentives to maximize the resources they invest in facilities.

January 29 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

The Community Home Lenders Association sent a letter to the Senate Banking Committee on Wednesday laying out its priorities for GSE reform.

January 24 -

Supporters of an unreleased bill to revamp the housing finance system say the plan strikes a middle ground that can gain support from both sides of the aisle.

January 24 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Updated Fannie Mae requirements clarify that lenders need to conduct an independent internal audit, something that might require additional investment by nonbanks to set up.

January 19 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18 -

FHFA Director Mel Watt said Fannie Mae and Freddie Mac should be reincorporated as private entities and the government must provide an explicit guarantee for catastrophic losses in the secondary mortgage market.

January 17 -

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11 -

Housing finance reform proposals could make it challenging for community banks and credit unions to serve rural mortgage markets, according to a report issued Wednesday by Brookings and the Center for Responsible Lending.

January 10 -

The Senate Banking Committee is expected soon to release a bipartisan bill that would significantly reshape the housing finance market, but key issues remain unresolved.

January 8 -

Consumer confidence in the housing market during December was better than it was 12 months prior but weaker than in November.

January 8 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

A group of reinsurers has committed to provide up to $650 million of coverage for credit risk on some $21 billion of 30-year, fixed-rate loans that the government-sponsored agency will acquire over the next two years.

January 4 -

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior.

January 2 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26