-

Shifting policy stances and a renewed focus on housing finance reform from the White House could make 2018 a breakout year for Congress to finally resolve the conservatorship of Fannie Mae and Freddie Mac.

December 26 -

Fannie Mae and Freddie Mac have new technology-driven initiatives planned for 2018 that are expected to help lenders improve the borrowing experience for home buyers and make full use of the government-sponsored enterprises' credit box.

December 26 -

Most housing finance companies are preparing to fight for a dwindling number of loans and operate on thinner margins.

December 26 -

The announcement Thursday that Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mel Watt agreed to let Fannie Mae and Freddie Mac each build a $3 billion capital buffer avoided a potential crisis.

December 21 -

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Updated dynamic and interactive versions of Fannie Mae and Freddie Mac's redesigned Uniform Residential Loan Application are out.

December 20 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

The Home Affordable Refinance Program recorded a 45% drop in volume in October from the previous year as it continunes to wind down, according to the Federal Housing Finance Agency.

December 15 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

Fannie Mae is starting to relocate staff in the Dallas area into a new office and will soon move its Washington, D.C., headquarters.

December 8 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

Farmer Mac has terminated President and CEO Timothy Buzby for violating company policies not related to its financial and business performance.

December 7 -

Freddie Mac on Thursday priced the first transaction to result from its pilot in the single-family rental market.

December 7 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

Cutting payments helps stave off default, but principal reduction on underwater loans and lower consumer debt levels are less effective, according to JPMorgan Chase Institute's new study of post-crisis modifications.

December 5 -

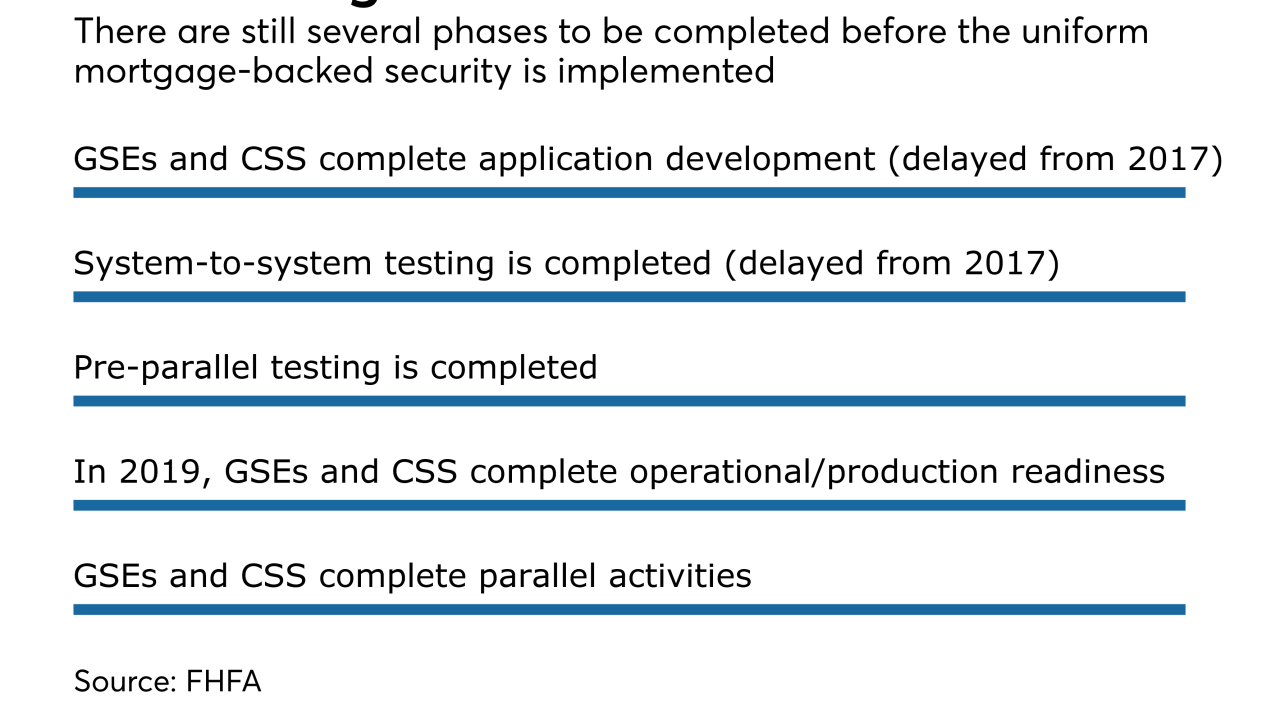

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1