-

The key to housing finance reform is a new securitization model that allows the private sector to price and absorb the majority of housing credit risk.

September 29 PennyMac Financial Services

PennyMac Financial Services -

Interest rates for mortgages decreased from July to August, according to the most recent data from the Federal Housing Finance Agency.

September 29 -

Home prices in 20 U.S. cities rose 5% in July from the same month a year earlier, propelled by improving demand and limited supply.

September 29 -

Home prices nationwide rose 0.4% from June to July, according to Black Knight Financial Services.

September 28 -

In this slowing economic recovery, the housing market is showing signs of resilience but still faces long-term challenges, according to a report from Stifel Nicolaus & Co.

September 28 -

Fifth Third's mortgage division has launched the Community Reinvestment Mortgage Special, a program designed to cover closing costs for mortgage customers buying or refinancing homes in low-income areas.

September 28 -

Contract signings to purchase previously owned homes unexpectedly declined in August for just the second time this year, signaling residential real estate might have difficulty building on recent momentum.

September 28 -

Roughly 60% of borrowers who used a mortgage to buy a home in Des Moines during the first half of 2015 were aged 25 to 34.

September 28 -

Fannie Mae will be facing more competition in the HFA market as Freddie Mac and the FHLBs become more active.

September 25 -

In the communities hardest hit by the housing crisis, some credit policy loosening will be needed to help the recovery, according to Pro Teck Valuation Services.

September 25 -

Sales of single-family homes and condos are on pace to reach an eight-year high this year, according to RealtyTrac's U.S. Home Sales Report for August.

September 25 -

Officials signaled that Hudson City Savings Bank's nearly $33 million settlement over redlining charges is only the first in what is likely to be a string of other cases.

September 24 -

Inclusionary housing policies can help reduce economic discrimination in neighborhoods that are gentrifying rapidly, according to a think tank's report.

September 24 -

Federal officials on Thursday ordered Hudson City Savings Bank to pay more than $27 million to resolve redlining allegations, the largest order of its kind and one that is likely to put larger banks on notice that redlining cases will be aggressively pursued.

September 24 -

The U.S. housing market continues to slowly stabilize, according to Freddie Mac's latest Multi-Indicator Market Index.

September 24 -

Purchases of new homes jumped in August to a seven-year high as Americans took advantage of historically low mortgage rates.

September 24 -

The Consumer Financial Protection Bureau's method for detecting disparate impact discrimination can overestimate potential bias, resulting in higher payments for lenders cited by the agency, according to internal CFPB documents.

September 23 -

Senior home equity rose by $117 billion in the second quarter, compared to the previous quarter, according to the National Reverse Mortgage Lenders Association.

September 23 -

Mortgage applications rose 14% on rate decreases, compared to one week earlier, on a seasonally adjusted basis for the week ending Sept.18, according to the Mortgage Bankers Association.

September 23 -

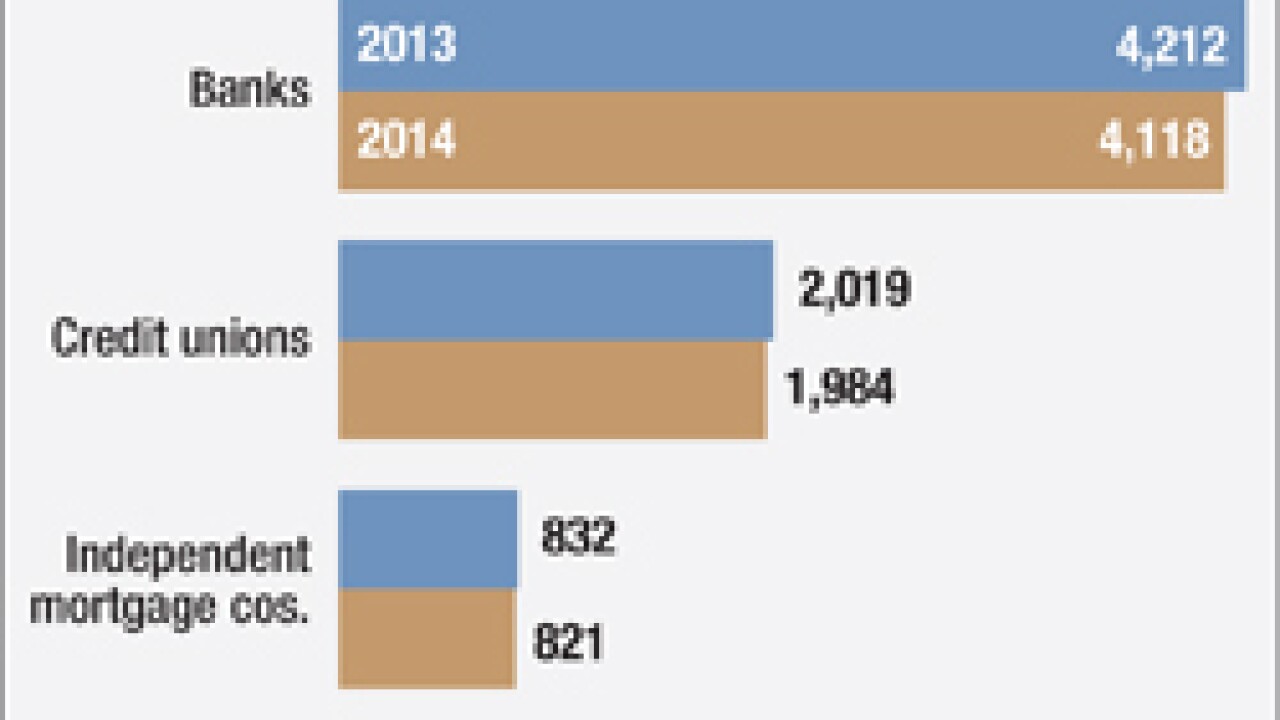

Although new HMDA data shows no negative effects from CFPB mortgage rules that went into effect last year, industry representatives argue it isn't showing the full picture.

September 22