-

The deal, issued through the California Housing Finance Agency, is the first multifamily tax-exempt deal to qualify for the GSE's Green Rewards program.

November 21 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

Next week's $500 million taxable revenue bond deal is backed by a 1% surcharge on annual incomes higher than $1 million.

November 14 -

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

Impac Mortgage Holdings generated $1.4 million in net income during the third quarter in earnings that were favorable compared to a string of losses in the past year.

November 8 -

The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

November 8 -

Zillow Group reported third-quarter revenue that beat estimates as growing sales in its online marketing and home-flipping businesses sent shares higher in late trading.

November 8 -

Taylor Morrison Home Corp. has agreed to buy William Lyon Homes in a deal that would combine the two companies' in-house mortgage divisions and make the resulting entity the fifth-largest U.S. homebuilder.

November 6 -

Black Knight and PennyMac Financial Services are suing each other in separate disputes linked respectively to the latter's creation of a servicing platform and the former's dominant position in the market.

November 6 -

The housing bond measure, the largest of its kind in San Francisco's history, comes as the ballooning wage inequality has sent the city's homeless population skyrocketing 17% over the last two years.

November 5 -

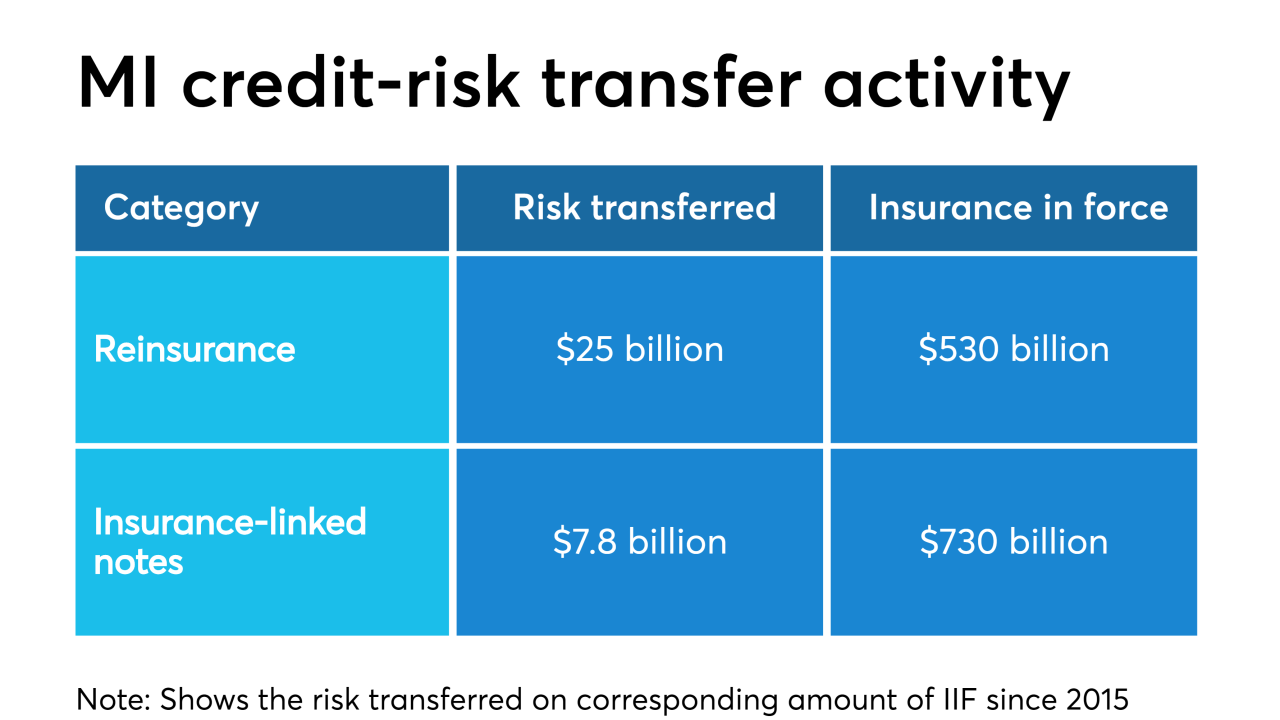

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Ocwen Financial's cost-cutting initiatives are bearing fruit toward returning to profitability, management said, although the company's third-quarter loss was slightly higher than the same period one year ago.

November 5 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

Record originations helped Mr. Cooper Group generate its first full-quarter profit since its formation through a merger between WMIH and Nationstar last year.

October 31 -

Denmark is set to change its laws to stop property investors from ratcheting up rents, as the center-left government made clear it wants to target Blackstone Group and companies like it.

October 30 -

The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

October 25 -

The latest round of earnings reports from home lending businesses and vendors continue the positive vibe for the sector as most reported year-over-year improvement in profitability.

October 24 -

The unexpected rise in refinancings during the third quarter affected mortgage industry business results in a mostly positive fashion for the period.

October 23 -

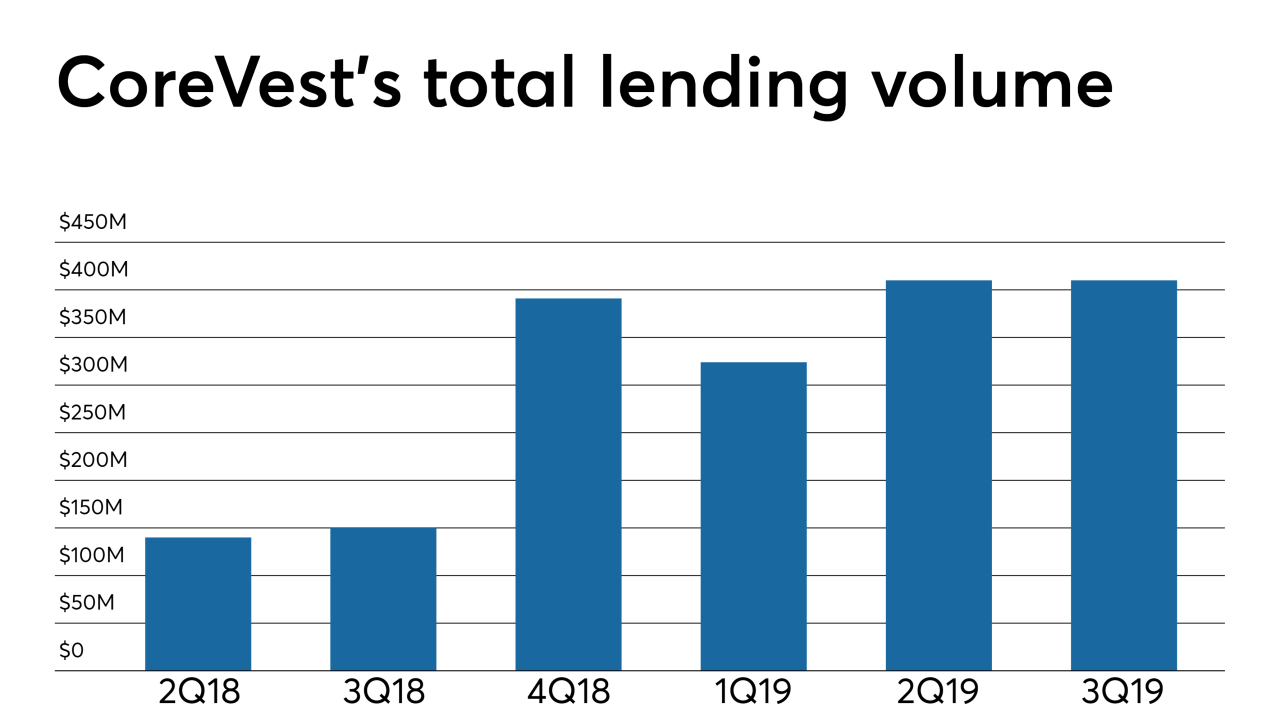

Redwood Trust is adding to its single-family rental lending business by purchasing CoreVest American Finance Lender from its management team and affiliates of Fortress Investment Group.

October 16 -

Bank of America's total first-mortgage originations rose while its home equity production decreased in the third quarter.

October 16