-

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

Banks have not yet finished with the wave of lawsuits stemming from the financial crisis. There are ways they can better ward off those threats next time around.

April 4 Bilzin Sumberg

Bilzin Sumberg -

The investigation targeted 36 residential mortgage-backed securities deals involving $31 billion worth of loans, more than half of which defaulted, according to the Justice Department.

March 29 -

Banks say that an appeals court’s decision to ease restrictions will allow them to warn customers more easily when loans are past due or accounts have been compromised. But consumer groups argue that the decision gives financial firms license to market their products more aggressively and could lead to more harassing phone calls over unpaid debts.

March 20 -

Quicken Loans affiliate Amrock Inc. is appealing a jury verdict ordering it to pay $706.2 million to analytics company HouseCanary in a legal dispute over a software licensing agreement.

March 19 -

The Consumer Financial Protection Bureau finalized a rule on Thursday that gives mortgage servicers more latitude in sending periodic statements to borrowers in bankruptcy.

March 8 -

There's been a legislative bottleneck since the the crisis-era law went into effect, but Congress has moved forward on a handful of significant changes.

March 6 -

The war of words between acting Consumer Financial Protection Bureau Director Mick Mulvaney and Sen. Elizabeth Warren, D-Mass., the agency's architect, is escalating.

February 23 -

The Puerto Rico-based bank failed in 2015. The FDIC, its receiver, is seeking unspecified economic and punitive damages from 16 lenders, including Bank of America, Barclays and Credit Suisse.

February 21 -

Ditech Holding Corp. promoted Jeffrey Baker to interim CEO of the company, replacing Anthony Renzi who left the company.

February 21 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

The statutory clock on Mick Mulvaney serving as acting head of the Consumer Financial Protection Bureau is under a year, but the administration's path to getting a full-time director confirmed by the Senate has never looked rockier.

February 12 -

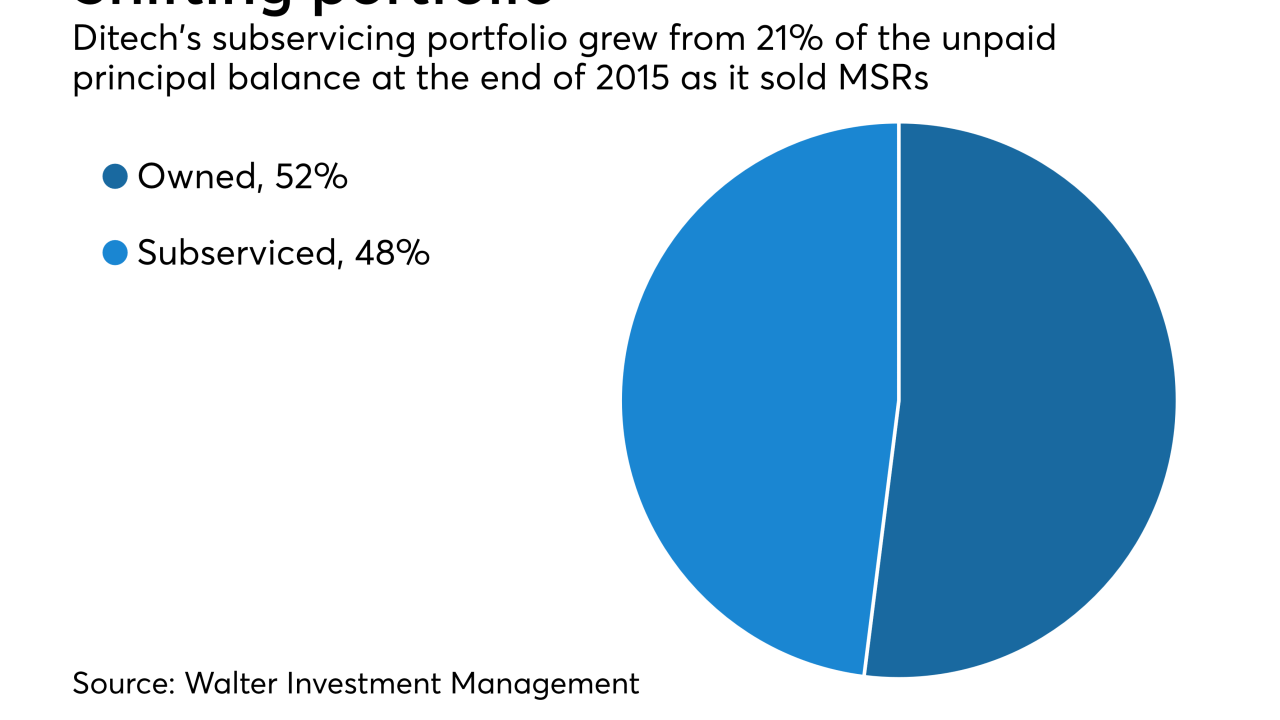

Walter Investment Management Corp. plans to emerge from Chapter 11 bankruptcy and start trading again under a new name in a matter of days.

February 8 -

A group led by the National Fair Housing Alliance is suing Deutsche Bank, Ocwen Financial Corp. and Altisource Portfolio Solutions, alleging real estate owned properties in minority communities do not receive the same level of upkeep and maintenance as REO houses in white neighborhoods.

February 2 -

In his decision Thursday, U.S. District Judge Paul Gardephe said the lawsuit brought by the Lower East Side People's Federal Credit Union lacked standing.

February 2 -

Anthony Renzi, the former Freddie Mac executive brought in to try and right the ship at Walter Investment Management Corp., will be leaving the company once a replacement is found.

February 2 -

A federal appeals court handed a major victory — and a significant defeat — to the CFPB by upholding its constitutional structure while also slapping down the agency's practice of making new interpretations of law through enforcement actions.

January 31 -

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

The decision by the appeals court means that a president can only fire the head of the Consumer Financial Protection Bureau for cause. But the ruling also scrapped the CFPB's massive fine against a nonbank mortgage lender.

January 31 -

In a strongly worded memo to staff of the Consumer Financial Protection Bureau Tuesday, acting Director Mick Mulvaney indicated the bureau will value the concerns of companies it regulates to the same extent as consumers.

January 23