-

Federal officials on Thursday ordered Hudson City Savings Bank to pay more than $27 million to resolve redlining allegations, the largest order of its kind and one that is likely to put larger banks on notice that redlining cases will be aggressively pursued.

September 24 -

The Consumer Financial Protection Bureau's method for detecting disparate impact discrimination can overestimate potential bias, resulting in higher payments for lenders cited by the agency, according to internal CFPB documents.

September 23 -

From due diligence and portfolio analysis to strategies for compliance and raising capital, the rapidly-evolving market for buying and selling distressed mortgage assets has created both challenges and opportunities for investors, servicers and portfolio managers.

September 23 -

Although new HMDA data shows no negative effects from CFPB mortgage rules that went into effect last year, industry representatives argue it isn't showing the full picture.

September 22 -

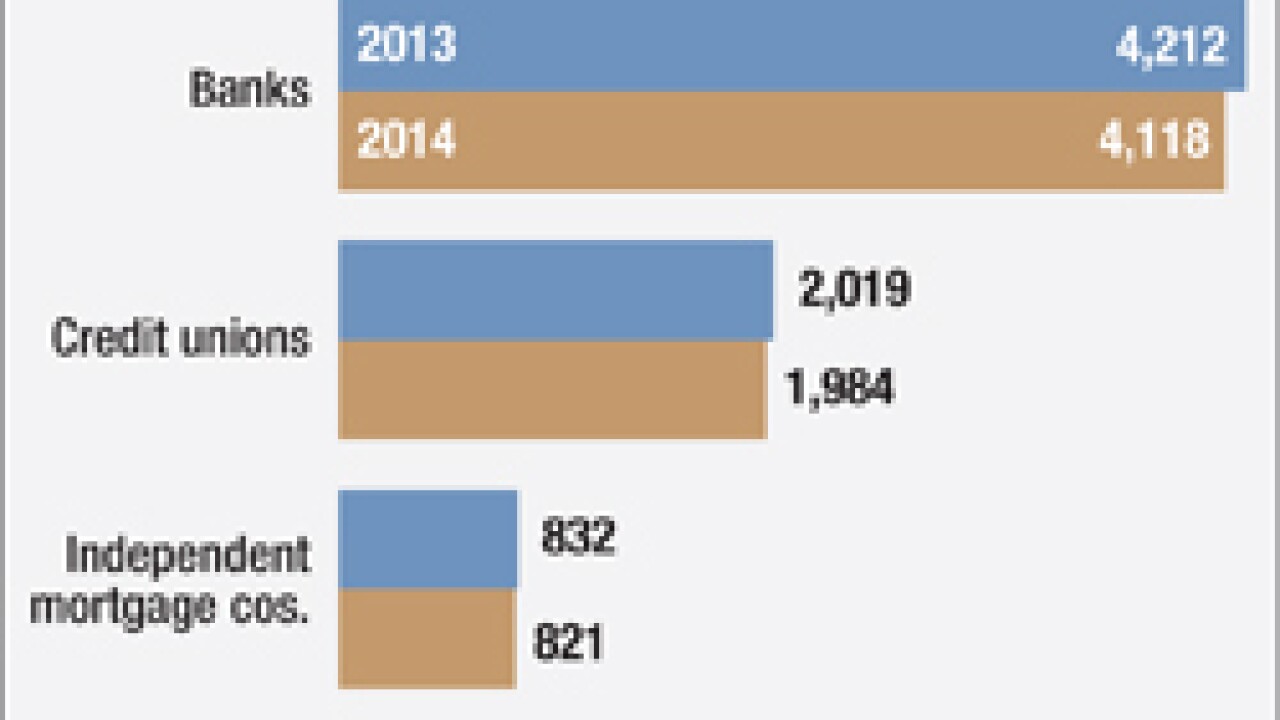

The number of mortgage originations dropped 31% to 6 million in 2014 due largely to a decline in refinancing as interest rates increased, according to a report issued Tuesday by the Federal Financial Institutions Examination Council.

September 22 -

Despite pledges last year to move aggressively to implement new credit scoring models at the government-sponsored enterprises, the Federal Housing Finance Agencys effort appears to have stalled.

September 21 -

The Consumer Financial Protection Bureau finalized a rule Monday that will make it easier for some community banks to make qualified mortgages.

September 21 -

Banks that want more explicit regulatory guidance on rules requiring managers to keep "skin in the game" with deals for collateralized loan obligations may be forced to keep waiting.

September 21 -

Lenders should be excited about the TILA-RESPA Integrated Disclosures because it will help them provide better customer service and new opportunities to engage and educate borrowers.

September 21 Altisource

Altisource -

WASHINGTON A bipartisan group of senators reintroduced a bill Wednesday that would prohibit lawmakers from using certain housing finance fees to offset unrelated government spending.

September 17 -

The window for moving financial services regulatory relief through Congress is rapidly closing, but there appears to be little hope that the partisan tensions that have stalled the process will ease in time.

September 16 -

A report to examine the conditions surrounding last years unrest in Ferguson, Mo., is calling for officials to strengthen poor minority communities access to banking services and restrict the prevalence of predatory lending to reduce crime and poverty.

September 16 -

The Consumer Financial Protection Bureau could be doing more to "enhance the accuracy and completeness" of entries into its consumer complaint database, according to the agency's Inspector General.

September 16 -

The Senate passed a bipartisan bill late Tuesday that would cap executive pay at Fannie Mae and Freddie Mac.

September 16 -

License numbers for loan officers, real estate agents and settlement agents will be required on one of the new TILA-RESPA integrated disclosure forms, raising questions about whether they could trigger investigations of possible illegal marketing services agreements.

September 15 -

California lawmakers passed legislation to change the way communities wind down their shuttered redevelopment agencies, leaving cities and their advocates trying to tally the effects of the last-minute bill.

September 15 -

Brian Webster, the Consumer Financial Protection Bureau's mortgage originations program manager who has worked on a number of technology-related policy and research initiatives, is leaving the agency to join Wells Fargo Home Mortgage.

September 14 -

Sen. Elizabeth Warren is withdrawing her support for a Republican bill that had been on the fast track to bar the Treasury Department from selling Fannie Mae and Freddie Mac preferred shares, according to a person familiar with the matter.

September 14 -

The Justice Department's announcement that it would target individual executives at banks and other companies that are being investigated for wrongdoing has sparked a debate about whether the move is actually substantive or instead just designed to boost the agency's public image.

September 10 -

Comptroller of the Currency Thomas Curry said banks could consider loan-to-value ratios above 90% to help revitalize areas hurt by the housing crisis.

September 9