-

Just a day after the Dodd-Frank Act's fifth anniversary, Senate Banking Committee Chairman Richard Shelby launched a new attempt to make significant changes to the law, attaching his regulatory relief bill to legislation that would provide funding for financial services agencies.

July 22 -

The Consumer Financial Protection Bureau named Meredith Fuchs, the agency's general counsel, to fill the bureau's No. 2 leadership soon to be vacated by Steven Antonakes.

July 22 -

WASHINGTON The Senate Finance Committee voted Tuesday for a measure that would extend a temporary 10-basis point hike in Fannie Mae and Freddie Mac guarantee fees for an additional four years.

July 22 -

The Consumer Financial Protection Bureau has issued its final rule for the "Know Before You Owe" mortgage disclosure rule, which is also known as TILA-RESPA or TRID.

July 21 -

From CFPB and TRID to QM and ATR, the barrage of new abbreviations emanating from the Dodd-Frank Act has only been matched by the enormity of the changes it made to the mortgage industry. Here are 10 ways that the landmark financial reform legislation has reshaped the mortgage industry since becoming law five years ago.

July 21 -

Treasury Secretary Jack Lew said Monday that the Obama Administration will continue to defend the Dodd-Frank Act amid Republican efforts to water down the law, even as one of its namesakes suggested changes to it may be necessary.

July 20 -

Richard Green, director of the University of Southern California's Lusk Center for Real Estate, will serve as a senior FHA advisor on housing finance policy for one year.

July 20 -

As new foreign bank regulations push financial institutions to shed risk-weighted assets, companies like Barclays and RBS are reducing their roles in the mortgage-backed securities market. But reduced competition in this sector is bad for liquidity.

July 20 Clutch Group

Clutch Group -

The efforts of Fannie Mae and Freddie Mac shareholders to claw back the value of their investments by suing the U.S. Treasury have not elicited much support on Capitol Hill.

July 16 -

House Financial Services Committee Chairman Jeb Hensarling is planning to push legislation that would rein in the Federal Reserve Board.

July 16 -

Incorporating bill and rental payment data into consumer credit scores would be a boon for underserved Americans. New legislation in Congress could help credit reporting agencies realize this goal.

July 16 U.S. House of Representatives

U.S. House of Representatives -

The Consumer Financial Protection Bureau's massive collection of consumer data continued to raise concerns with lawmakers on Wednesday despite assurances from the agency's director that the data is anonymized.

July 15 -

Three Democratic members of Congress called on the Department of Housing and Urban Development to reissue the proposal for public comment with changes.

July 15 -

The House passed a bill Tuesday that could ease the regulatory burden on community and regional banks with mortgage servicing businesses.

July 14 -

The "deceptive" in Unfair, Deceptive, or Abusive Acts or Practices includes negligence, as demonstrated by a recent Consumer Financial Protection Bureau enforcement action.

July 14 Offit | Kurman

Offit | Kurman -

Some housing professionals have grown reluctant to participate in the Federal Home Loan Banks' Affordable Housing Program, objecting to burdensome requirements and rules that are inconsistent with other funding sources. It's time for the Federal Housing Finance Agency to make some updates.

July 13 Prospect Federal Savings Bank

Prospect Federal Savings Bank -

Two mortgage servicers have agreed to join a group of peer institutions in following a series of guidelines to address zombie properties in New York State, Gov. Andrew Cuomo announced Thursday.

July 9 -

Mortgage professionals brave enough to bring mortgage fraud to light deserve the same level of protections as workers in other businesses, rather than be subjected to a patchwork of laws designed for other industries.

July 9 The Employment Law Group PC.

The Employment Law Group PC. -

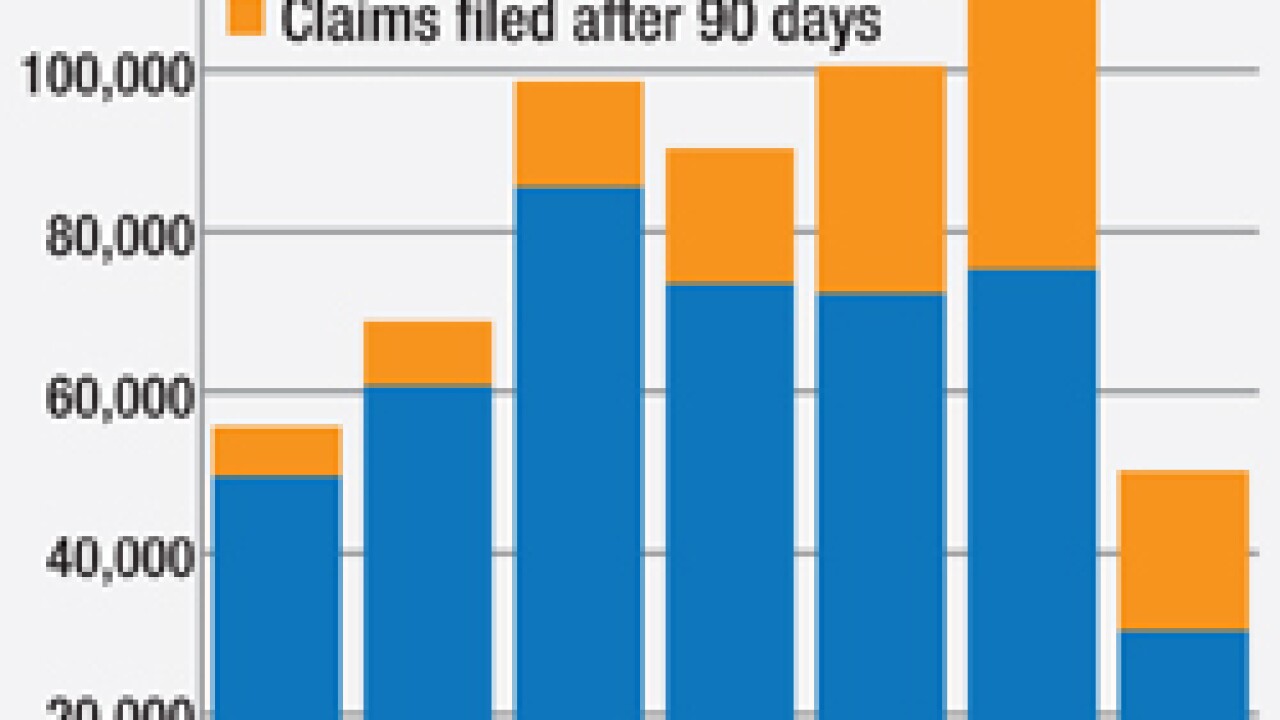

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7 -

Nearly 25 years after a landmark deal and two subsequent legislative overhauls, glitches in the credit reporting system remain widespread. But while regulators and law enforcement officials are again raising the stakes for the credit reporting industry, critics fear it may not be enough.

July 7