-

Discrimination claims and data breaches are just some of the issues the industry has faced this year.

July 29 -

The court found the sale of a property held by a limited liability company violated bankruptcy-related restrictions because a resident with a Chapter 7 petition was involved.

July 7 -

The misdemeanor plea deals for three co-defendants do not add to troubles for an upstate New York developer facing federal felony charges in what once was called a "wide-ranging mortgage fraud scheme."

April 7 -

Wells Fargo won an early round in a lawsuit accusing the bank of running a predatory mortgage lending scheme in the Atlanta area before the 2008 financial crisis and continuing to discriminate against minorities for more than a decade afterward.

March 29 -

The New Jersey-specific case could be a sign of how the combined effect of federal debt-collection rules and state regulations may further complicate a compliance-sensitive environment for the industry.

February 24 -

The U.S. Treasury Department defeated a blue-state challenge to a rule that exempts buyers of high-interest loans from state interest rate caps.

February 8 -

The ruling overturns a summary judgment in a class action lawsuit filed by refinance customers between 2004 and 2009 in West Virginia over alleged inflated property values.

January 12 - LIBOR

The Federal Reserve told a judge not to scrap Libor as requested by consumers in a lawsuit because it would pose a risk to financial stability and undermine years of global planning for a transition to a new benchmark for borrowing rates.

August 16 -

The defendants face 133 felony counts that include allegedly stealing identities to commit mortgage fraud between 2014 and 2020, resulting in the theft of $15 million.

May 7 -

Federal Savings Bank, the Chicago bank that lent millions of dollars to Paul Manafort under its founder and former longtime CEO, has now sued the former Trump campaign chairman and his wife, seeking to foreclose upon his mansion in the Hamptons.

March 17 -

The decision provides more clarity to noteholders in the state about when the six-year statute of limitations to bring a foreclosure action begins.

February 23 -

A federal judge denied the Office of the Comptroller of the Currency's motion to have the case thrown out, saying concerns about the agency's rulemaking process to reform the Community Reinvestment Act have merit.

February 1 -

The company also reported a large fourth-quarter loss that reflected a significant increase in its loan-loss provision.

February 1 -

The complaint unsealed Monday alleges three individuals and several companies they owned or controlled engaged in False Claims Act violations involving short sales of properties that had Federal Housing Administration-insured mortgages.

January 5 -

The CFPB issued two rulemakings in 2020 that the financial services industry and consumer advocates hoped would finally clarify key issues over how collectors contact debtors and deal with legacy debts. But both sides want the incoming Biden administration to make further changes.

January 5 -

The agency's rule outlines steps collectors must take to inform consumers about an outstanding debt, and prohibits companies from pursuing lawsuits after a statute of limitations has ended.

December 18 -

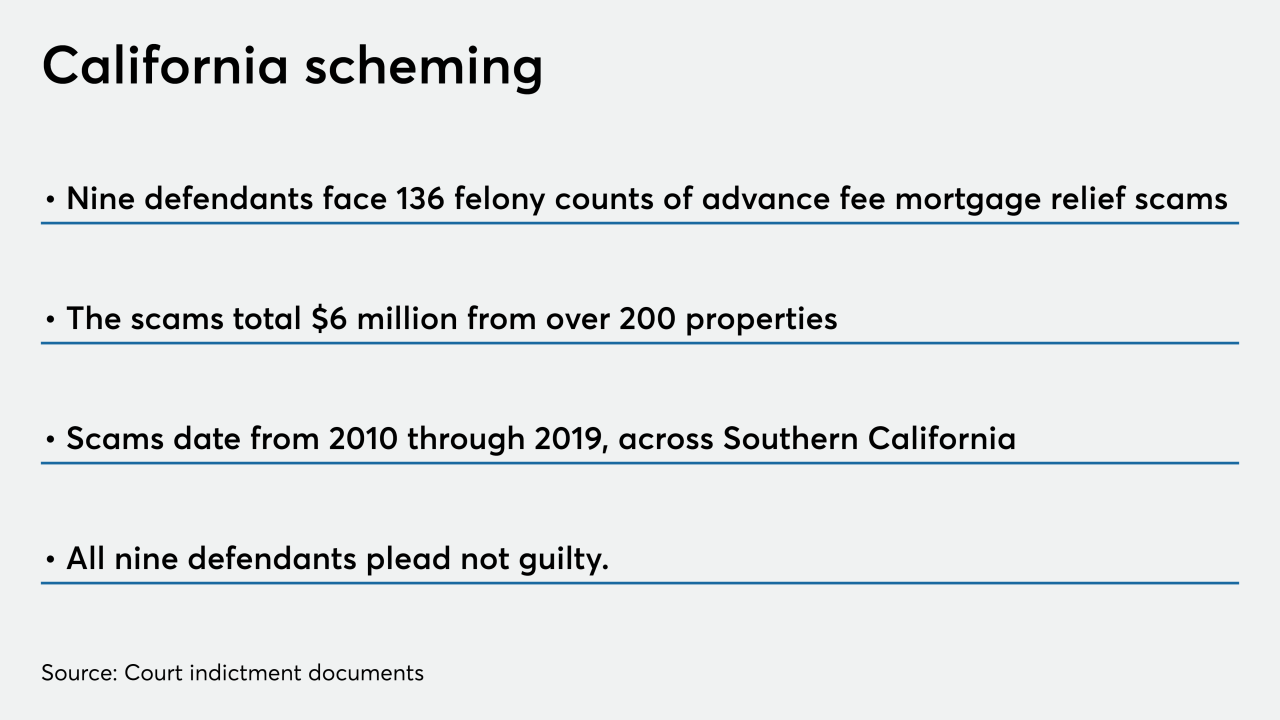

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

A former home mortgage consultant with the company alleges she was subjected to a lower compensation structure, awards and benefits compared to her male counterparts.

August 12 -

The mortgage REIT's external manager responded by filing a new lawsuit against it, calling the move "baseless and retaliatory."

July 23