-

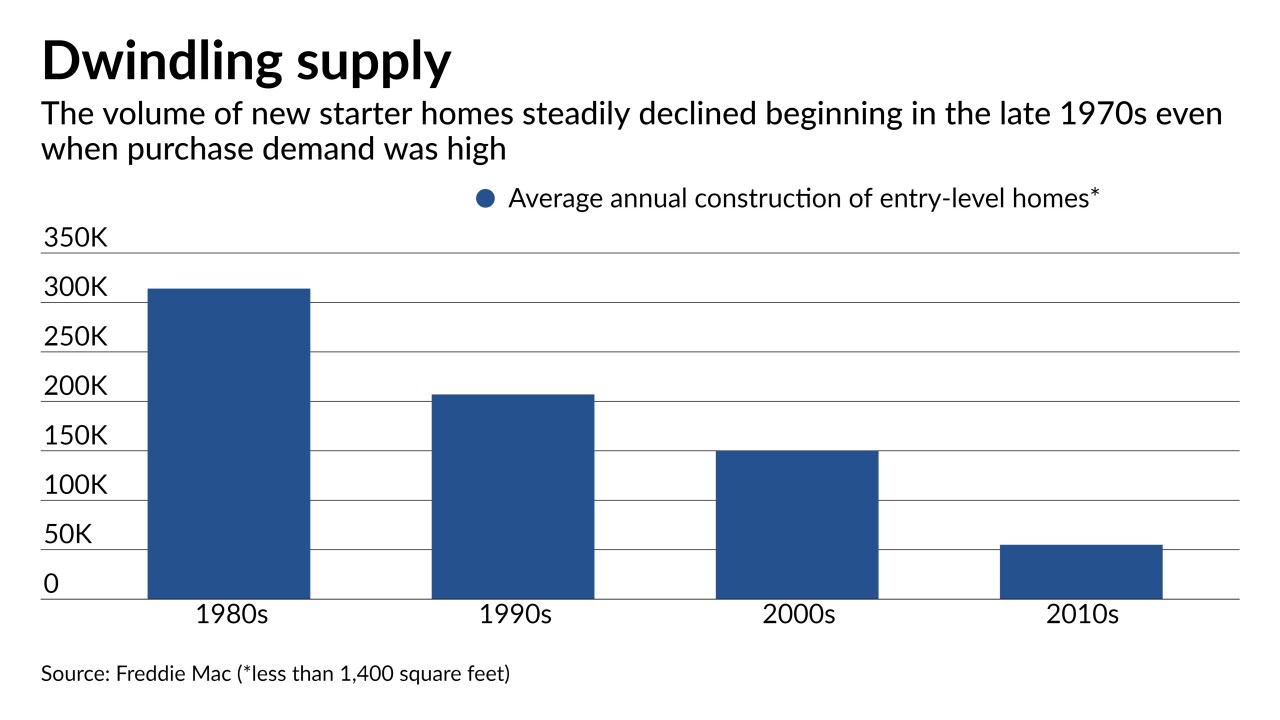

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

If you are underbanked you probably have limited access to mainstream financial services normally offered by retail banks. Many fintech startups offer alternative ways to measure credit risk, and assert that their products can help extend financial services to consumers who have not been well-served by traditional banks.

-

When both origination and forbearance demand spiked in the early weeks of COVID-19, quick thinking lenders were able to leverage their expertise and tech stacks to respond quickly.

October 22 -

The coronavirus pandemic has turned every industry on its head. For lending, it exposed the need for modernized, fully digital platforms.

October 22 -

Banks, lenders, and fintechs have been on a path toward digitizing the mortgage process from end-to-end — long before the term coronavirus entered our daily lexicon. How has the pandemic affected progress?

October 22 -

The industry says the 2017 cut in the corporate rate helped position lenders to support the economy when the pandemic hit. But a plan proposed by Democratic nominee Joe Biden could strain banks' capital investment and hiring, observers say.

October 6 -

The outbreak has completely upended whatever expectations the industry had heading into 2020. Here's key areas that have been shaped by the pandemic, some potentially forever.

June 24 -

Credit unions have seen historic mortgage growth so far this year despite the pandemic, but there are concerns some institutions may be overly relying on refinancing and not focusing enough on generating new purchase business.

June 17 -

The Home Loan bank will make zero-interest loans, match charitable donations that members make to nonprofits and small businesses, and provide additional funding for economic development grants.

May 1 -

The FHFA will allow Fannie Mae and Freddie Mac, for a limited time, to purchase loans for which the borrower has sought to postpone payments because of the economic effects of the coronavirus.

April 22 -

The central bank's sweeping actions suggest a cash shortage gripping sectors directly hit by the pandemic. Banks were supposed to be protected by Dodd-Frank but are still vulnerable to a funding domino effect.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," the regulators said.

March 22 -

The central bank said it was establishing the Commercial Paper Funding Facility to "support the flow of credit to households and businesses."

March 17 -

Companies that scored highest in this year’s Best Fintechs to Work For (a ranking compiled by our parent company, Arizent) go beyond the basics of strong pay packages, generous benefits and effective leadership to take a more holistic interest in their employees’ lives, according to the data.

February 4 -

Data from the Credit Union National Association indicates the rule has decreased lending and increased costs as institutions work to stay compliant.

January 23 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

Public orders are an effective way to discourage violations of consumer protection law, the bureau's director said at a credit union conference.

September 9 -

There are opportunities to make loans for strip malls and regional distribution centers but executives need to put the right risk management in place.

August 9 -