-

Real estate owned managers can differentiate themselves and earn more business by bringing focus back to distressed property rehabilitation.

August 31 Fay Servicing

Fay Servicing -

Banks have ramped up foreclosure activity in the past five months, with default notices, scheduled auctions and bank repossessions at their highest levels in two years. It's a positive sign that banks are finally clearing out all the distressed loans still lingering from the housing crisis. Meanwhile, banks remain cautious about new lending, partly because of regulatory actions.

August 20 -

A nascent corner of the market for Fannie Mae and Freddie Mac bonds is on a roller coaster ride despite what Morgan Stanley calls the "pristine performance" of the mortgages linked to the debt.

August 20 -

Ocwen Financial's internal review group is "independent," and the Atlanta servicer is in compliance with the national mortgage settlement, settlement monitor Joseph A. Smith said Tuesday.

August 11 -

Bank of America is offering $1.2 billion of mostly delinquent home loans, extending a series of sales by lenders seeking to pare holdings and meet demand by investment firms for soured mortgages.

August 7 -

Years after the crisis, fundamental problems in default servicing still exist and in order to move forward, servicers must reimagine their processes to better manage overall volume and spikes in demand.

August 4 ShortSave

ShortSave -

Bank of America has received approval for additional credit during the first quarter of 2015 from the independent monitor overseeing its compliance with the requirements of its mortgage settlement agreement.

July 31 -

Ocwen Financial Corp. reported lower income year-over-year as servicing revenue fell steeply, despite the gains from the sale of nonperforming loans.

July 30 -

Home Affordable Modification Program denial rates are still high, but the Treasury Department and top mortgage servicers contend that the numbers have improved.

July 30 -

The Special Inspector General for the Troubled Asset Relief Program is renewing calls for further investigation of servicers it claims may be denying too many Home Affordable Modification Program applications.

July 29 -

The bankruptcy of Wingspan Portfolio Advisors epitomizes the existential crisis facing default servicing. This once-thriving sector of the mortgage industry now finds itself declining in lockstep with the drop in loan delinquencies and foreclosures.

July 24 -

More than 10,000 mortgages were refinanced through the Home Affordable Refinancing Program in May, the Federal Housing Finance Agency reported.

July 24 -

Stewart Mortgage Information Systems is pulling the plug on its delinquent mortgage services business.

July 23 -

The methodologies and paths for proactive consumer outreach can vary dramatically depending on multiple risk factors that servicers must have a plan to mitigate.

July 21 Steel Curtain Capital Group LLC

Steel Curtain Capital Group LLC -

Fannie Mae is selling three pools of nonperforming loans totaling $788 million in unpaid principal balance, the government-sponsored enterprise announced Thursday.

July 17 -

Citigroup's second-quarter profit got a modest boost from Citi Holdings, a unit set up six years ago as a dumping ground for toxic assets. After losing billions for years, Citi Holdings has now become a minor profit source for its parent.

July 16 -

Creditors of a Dallas-based special servicer and mortgage services firm that filed Chapter 7 bankruptcy this week include technology providers, financial institutions and property management companies.

July 16 -

More government-sponsored enterprise risk-sharing transactions are on the way to join those already issued this year by Freddie Mac, Fitch Ratings said in a report issued Monday.

July 14 -

Freddie Mac has obtained two more reinsurance policies transferring risk of default on mortgages that it insures.

July 10 -

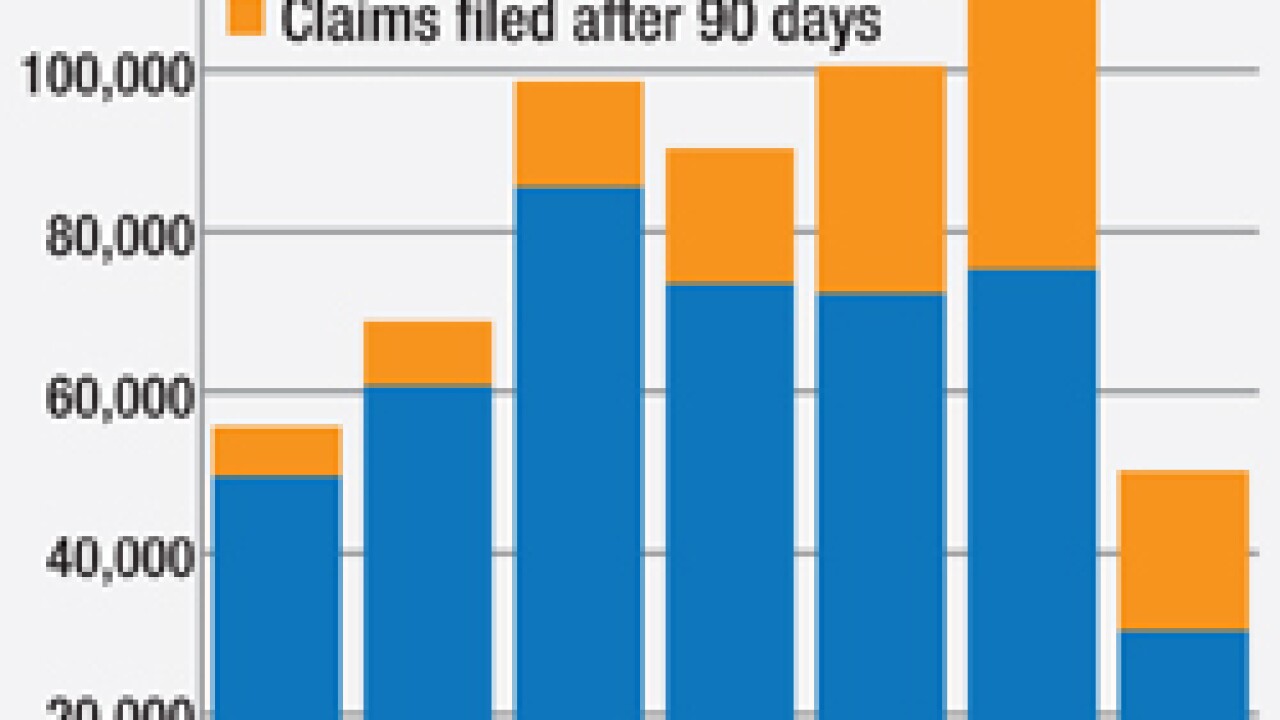

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7