-

The bankruptcy of Wingspan Portfolio Advisors epitomizes the existential crisis facing default servicing. This once-thriving sector of the mortgage industry now finds itself declining in lockstep with the drop in loan delinquencies and foreclosures.

July 24 -

More than 10,000 mortgages were refinanced through the Home Affordable Refinancing Program in May, the Federal Housing Finance Agency reported.

July 24 -

Stewart Mortgage Information Systems is pulling the plug on its delinquent mortgage services business.

July 23 -

The methodologies and paths for proactive consumer outreach can vary dramatically depending on multiple risk factors that servicers must have a plan to mitigate.

July 21 Steel Curtain Capital Group LLC

Steel Curtain Capital Group LLC -

Fannie Mae is selling three pools of nonperforming loans totaling $788 million in unpaid principal balance, the government-sponsored enterprise announced Thursday.

July 17 -

Citigroup's second-quarter profit got a modest boost from Citi Holdings, a unit set up six years ago as a dumping ground for toxic assets. After losing billions for years, Citi Holdings has now become a minor profit source for its parent.

July 16 -

Creditors of a Dallas-based special servicer and mortgage services firm that filed Chapter 7 bankruptcy this week include technology providers, financial institutions and property management companies.

July 16 -

More government-sponsored enterprise risk-sharing transactions are on the way to join those already issued this year by Freddie Mac, Fitch Ratings said in a report issued Monday.

July 14 -

Freddie Mac has obtained two more reinsurance policies transferring risk of default on mortgages that it insures.

July 10 -

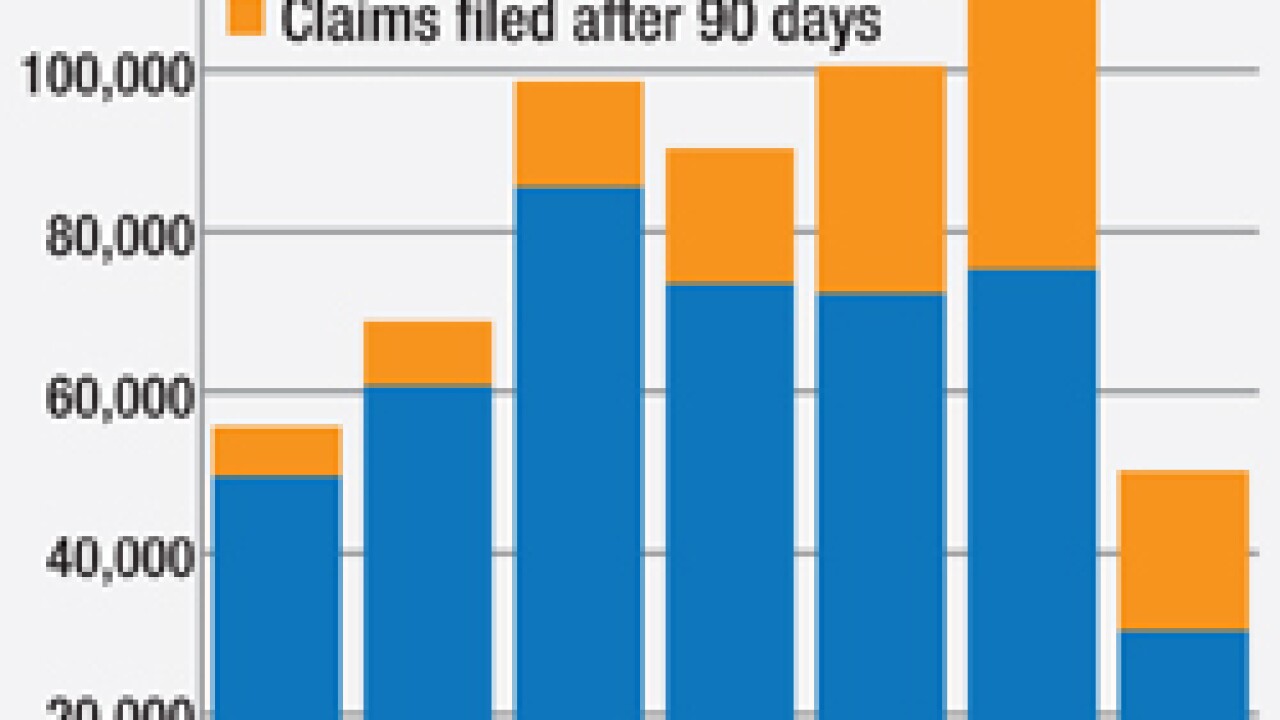

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7 -

The Federal Housing Administration's new loan defect "taxonomy" may give lenders better clarity on the quality assurance reviews of FHA loans, but it is not a shield from possible enforcement action by the Department of Justice and other regulators.

June 30 -

Mortgage-fraud risk appears to have normalized, as the overall rate of fraud declined in 2014 and there has been a shift to specific fraud types on the local level, according to Interthinx.

June 25 -

A flood of ex-homeowners may be ready to re-enter the mortgage market over the next five years, according to a TransUnion report.

June 18 -

Six servicers were cited for a range of infractions, including a failure to respond to requests for loan modifications and not doing enough to prevent foreclosures. Punishment was harsh for Wells Fargo and HSBC, which are banned from acquiring mortgage servicing rights and entering into new servicing contracts.

June 17 -

A new analysis from CoreLogic found that 254,000 homes regained equity in the first quarter, meaning there are now 44.9 million mortgaged properties (representing 90% of the total) that are above water as of March 31.

June 17 -

A new Department of Housing and Urban Development policy will make it easier for servicers to transfer certain reverse mortgages back to HUD instead of foreclosing on widowed nonborrower spouses.

June 12 -

A decade after home sales peaked, 15.4% of owners in the first quarter owed more on their mortgages than their properties were worth.

June 12 -

Foreclosures might seem like yesterday's news, but banks are still busy with the cleanup phase of the housing crisis. The situation is producing some herky-jerky housing statistics, and prompting calls for more reforms in states like New York still suffering from stalled dockets and blight.

June 9 -

Three states Florida, New York and New Jersey held almost 30% of all seriously delinquent and active foreclosure homes nationwide in April, according to Black Knight Financial Services.

June 8 -

The title insurance industry in the United States looked a whole lot better in 2014, according to a recent study by Fitch Ratings.

June 5