M&A

M&A

-

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

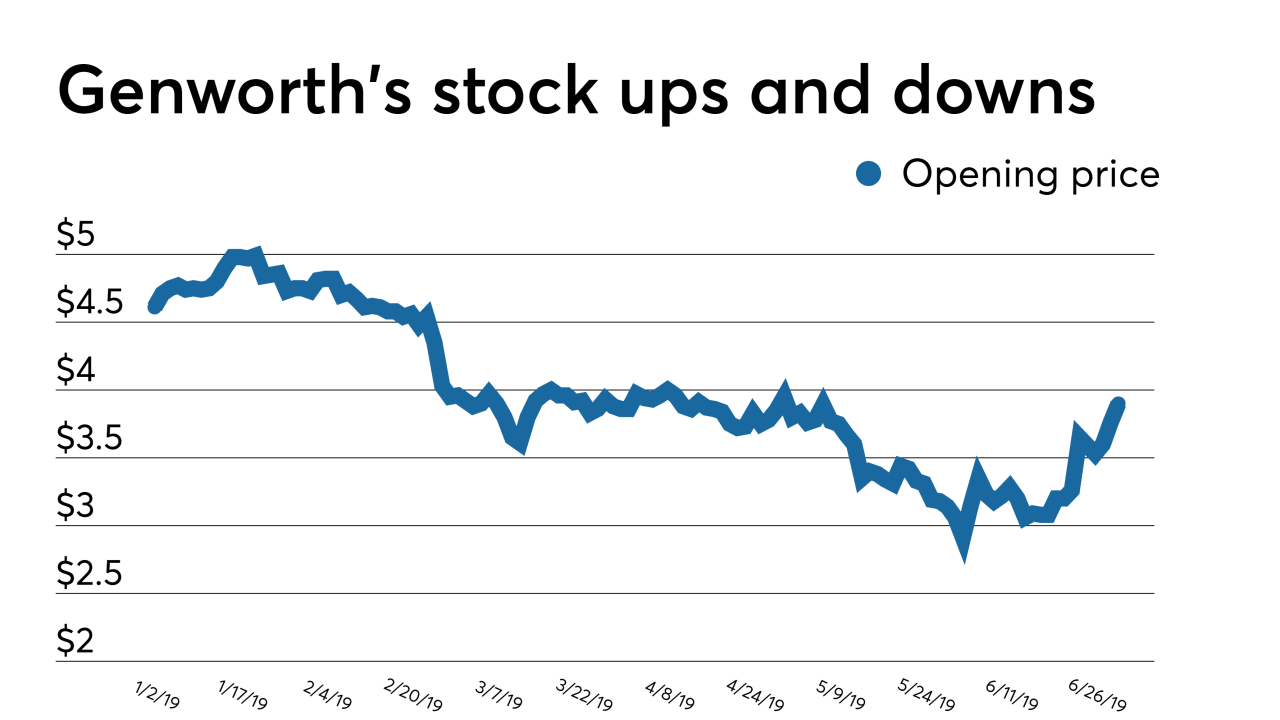

The oft-delayed sale of Genworth Financial might need new approvals from U.S. insurance regulators if and when it disposes of its Canadian mortgage insurance stake.

July 31 -

New Residential Investment Corp. took a $32 million net loss in the second quarter as it diversified its business lines and repositioned to protect its mortgage servicing rights from falling rates.

July 30 -

Title insurers benefited from the increase in origination volume — especially refinancings — during the second quarter, as open order counts increased compared with one year prior.

July 25 -

New York Attorney General Letitia James is monitoring how the bankrupt Ditech Holding Corp. handles borrower-sensitive issues like foreclosure proceedings, and is backing the involvement of a consumer creditors' committee.

July 23 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

Stearns Holdings and certain subsidiaries have filed for Chapter 11 bankruptcy as part of a restructuring agreement that could reduce debt, increase Blackstone's stake in the company and preserve jobs.

July 9 -

Genworth Financial is marketing its stake in Genworth MI Canada in a possible last-ditch effort to save the long-delayed proposed acquisition by China Oceanwide.

July 1 -

FB Financial is selling its correspondent lending channel to Rushmore Loan Management Services, which will complete the bank holding company's restructuring of its mortgage business.

June 27 -

Ditech Holding Corp. has entered into purchase agreements with New Residential Investment Corp. and Mortgage Assets Management, in which each would acquire certain assets in the company's Chapter 11 bankruptcy.

June 18