M&A

M&A

-

The merger of equals, which received a chilly reception from investors when it was announced in July, closed faster than analysts had expected.

January 2 -

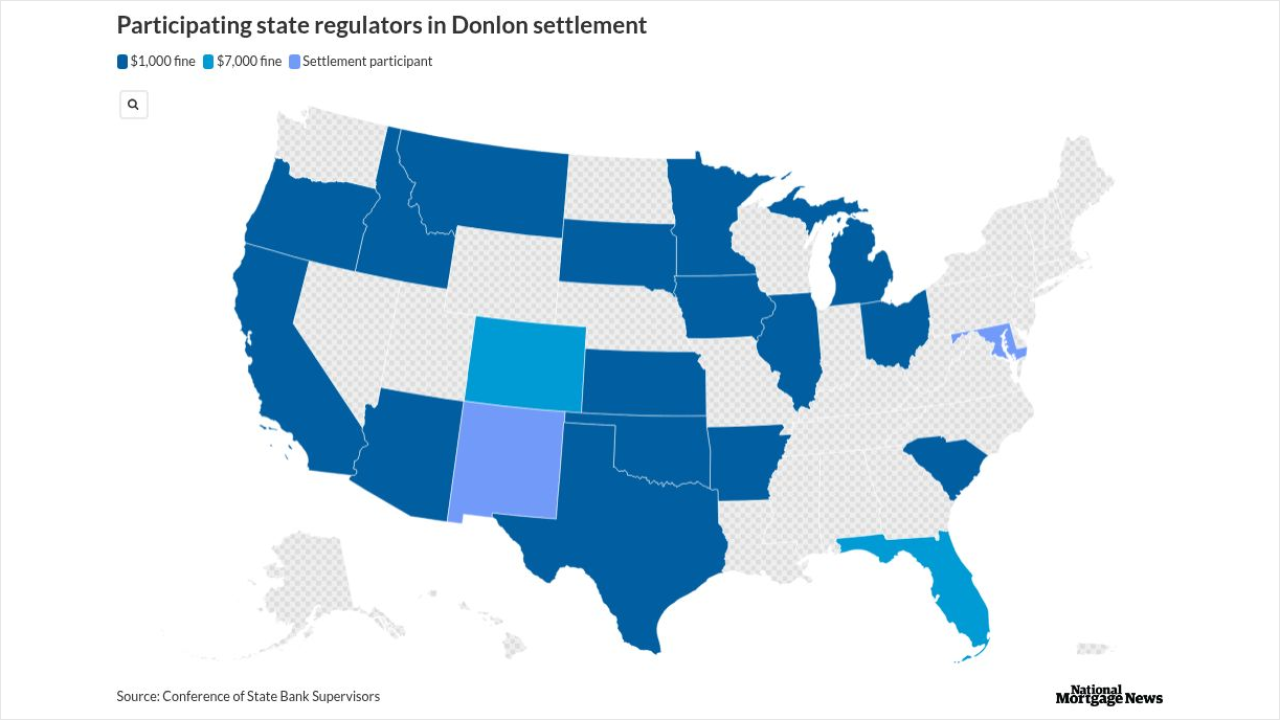

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

The latest announcement comes two months after an initial round of staff reductions following approval of Rocket's acquisition of the company.

December 29 -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

December 22 -

The Dallas bank turned down another offer because it thought it could get a higher price from Fifth Third, and also could ink an agreement faster, according to Comerica's latest regulatory filing.

December 18 -

The deal significantly grows United Wholesale Mortgage's servicing portfolio, and it will increase the float on its common stock, making it more investable.

December 17 -

The provider of actuarial-related services is bringing a company that provides mortgage servicing rights analytics and risk management into the fold.

December 8 -

Hildene, which partners with Crosscountry Mortgage for non-QM securitizations, is doing this deal as part of its buy of an annuity provider, SILAC.

December 8 -

The all-stock acquisition of Mountain Commerce Bancorp in Knoxville marks the Arkansas-based company's first M&A foray since 2022.

December 8 -

Absolute will add Fidelity Digital Mortgage's 55 producing loan officers to its team of roughly 190.

December 2 -

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

November 24 -

An activist investor is seeking more information on how, and when, the largest bank deal of 2025 came together.

November 18 -

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

November 14 -

Recent merger activity also includes the purchase of an Alabama title company by technology firm Propy, as experts see ongoing consolidation through 2026.

November 11 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

November 11 -

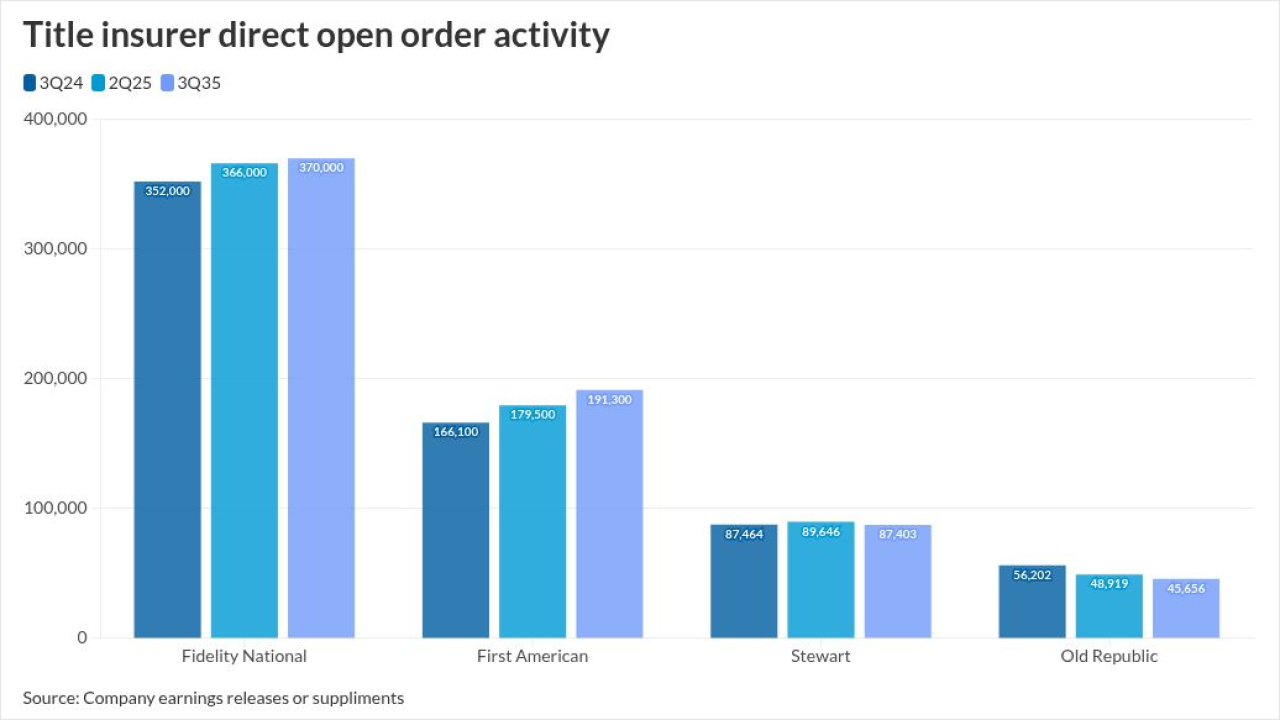

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10