M&A

M&A

-

Hildene, which partners with Crosscountry Mortgage for non-QM securitizations, is doing this deal as part of its buy of an annuity provider, SILAC.

December 8 -

The all-stock acquisition of Mountain Commerce Bancorp in Knoxville marks the Arkansas-based company's first M&A foray since 2022.

December 8 -

Absolute will add Fidelity Digital Mortgage's 55 producing loan officers to its team of roughly 190.

December 2 -

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

November 24 -

An activist investor is seeking more information on how, and when, the largest bank deal of 2025 came together.

November 18 -

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

November 14 -

Recent merger activity also includes the purchase of an Alabama title company by technology firm Propy, as experts see ongoing consolidation through 2026.

November 11 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

November 11 -

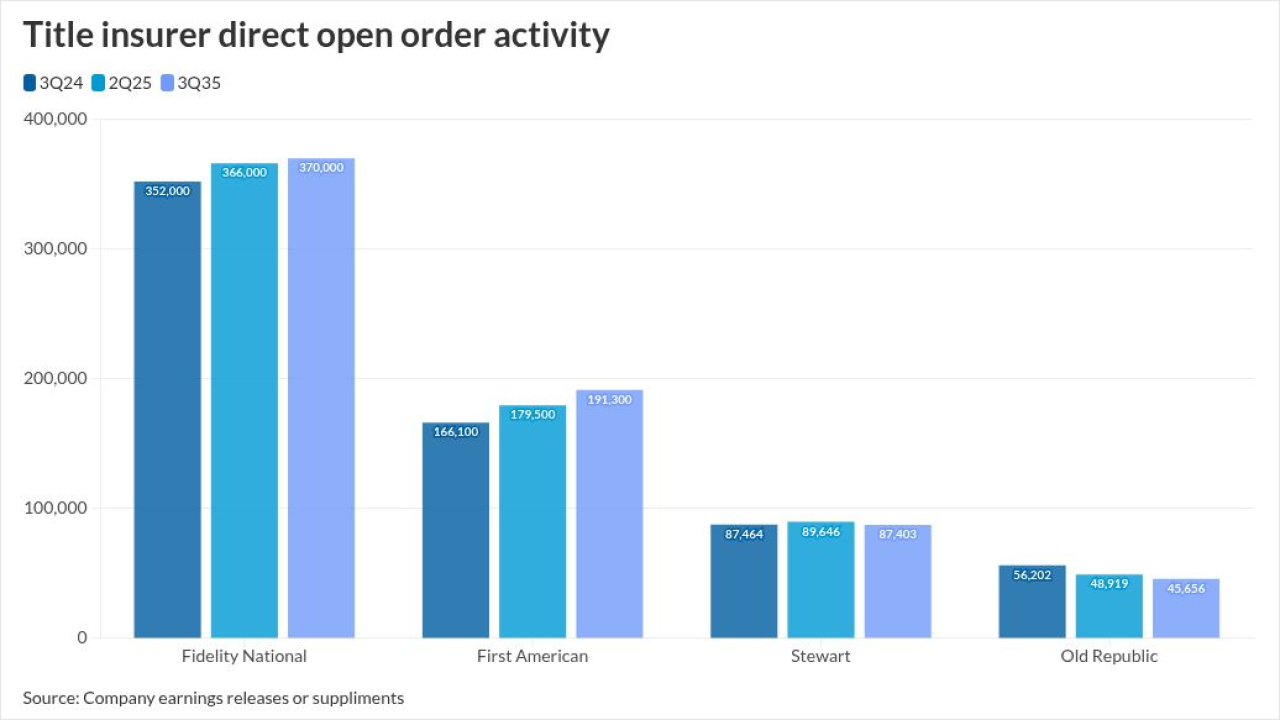

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

The acquisition complements existing lending channels at Carrington and also adds Reliance's full servicing portfolio to its platform, the company said.

October 31 -

The deal will help drive development at Mortgage Cadence, which had been a unit of Accenture, and enable new integrations and automation, according to leaders.

October 29 -

The Arkansas-based company spent nearly four years on the M&A sidelines, grappling with asset quality issues and litigation tied to its 2022 acquisition of Texas-based Happy State Bank. Now it's signed a letter of intent to buy an unnamed bank.

October 24 -

This is the second acquisition deal Old Republic has been involved in this year, after selling its title production business in January.

October 23 -

The reduction in force affects under 1% of Rocket's team, with the decision to streamline operations made following identifying overlapping roles post-merger.

October 20 -

Flagstar shareholders approved a plan to merge its holding company into the bank; Huntington tapped a new chief auditor, along with two new business leaders; First Foundation hired a new chief credit officer; and more in this week's banking news roundup.

October 17 -

Approximately three years after the one-time non-depository bought Roscoe (Texas) State Bank, Cornerstone Capital Bancorp agreed to purchase Peoples Bancorp.

October 17 -

The Cincinnati, Ohio-based bank delivered third-quarter earnings that mostly met expectations, even as it took a $200 million blow to credit.

October 17