M&A

M&A

-

Mortgage debt outstanding remains below pre-crisis levels and home equity is growing, even as overall consumer debt is on pace to surpass its previous 2008 peak by $1 trillion, according to LendingTree.

June 25 -

Ruoff Financial will make its first push into banking with the purchase of SBB Bancshares.

June 19 -

Blue Lion Capital, which has been a vocal critic of the Seattle company's strategy, also wants management to consider selling its MSR portfolio.

June 15 -

Century Communities has acquired the 50% of regional builder Wade Jurney Homes it didn't already own to boost its mortgage and title operations and reach more first-time homebuyers.

June 15 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

Citizens Bank's $511 million acquisition of Franklin American Mortgage will beef up the bank's servicing portfolio and diversify its origination business at a time when higher interest rates have put a damper on refinance volume.

May 31 -

The Rhode Island regional agreed to buy Franklin American Mortgage. With the acquisition it would have one of the nation's 15 largest bank-owned mortgage platforms.

May 31 -

Ocwen Financial Corp.'s Chief Financial Officer Michael Bourque has resigned, becoming the second top executive to leave the company after it agreed to acquire PHH Corp.

May 29 -

Capitol Federal Financial has mostly relied on mortgages throughout its history. Its acquisition of a commercial lender will change that.

May 11 -

Mutual of Omaha Bank's purchase of Synergy One Lending will add reverse mortgages to its product line.

May 10 -

PHH Corp. took a net loss in the first quarter but was able to surpass minimums for net worth and available cash necessary for Ocwen Financial to acquire the company.

May 9 -

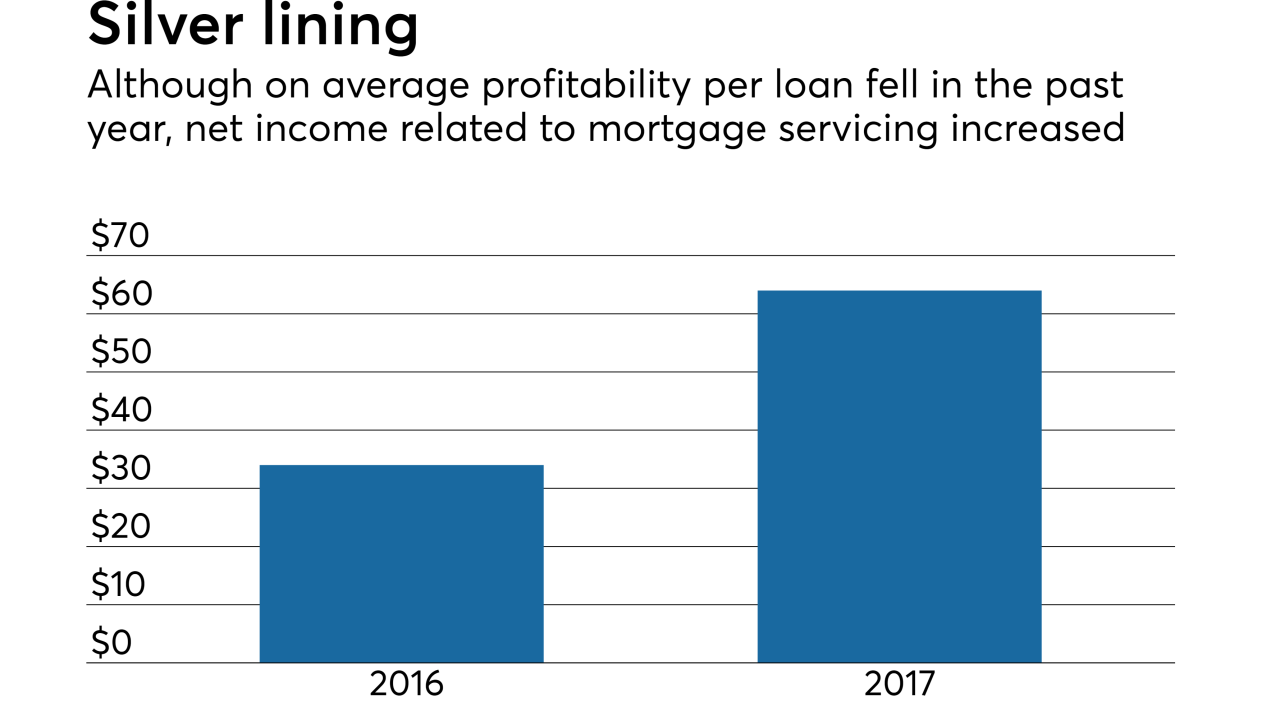

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Ron Faris plans to retire as head of Ocwen Financial and pass on his position to former PHH Corp. CEO Glen Messina around the time Ocwen acquires PHH.

April 19 -

CoreLogic, which has already acquired several appraisal technology and services vendors, snagged another one with its purchase of a la mode technologies.

April 12 -

There is an oncoming liquidity crisis that will force consolidation in the mortgage industry as margins tighten and funding sources dry up.

March 28 -

Radian Group is adding 40-state title insurer and settlement services company Entitle Direct to its operations in a move aimed at complementing the geographic reach of its existing title agency.

March 28 -

Joseph Tomkinson, who first pared down and then rebuilt Impac Mortgage Holdings in the aftermath of the housing crisis, is stepping down as the company's chairman and CEO.

March 21