-

A Texas lawyer pleaded guilty to his role in an elaborate $5 million mortgage fraud scheme involving pricey beach homes, according to the U.S. Attorney's Office in Houston.

May 1 -

The bank holding the mortgage on a home owned by a Wichita, Kans. woman accused of embezzling millions from two physician-owned medical businesses and her estranged husband has stated foreclosure proceedings.

April 25 -

March's increase in foreclosure starts was a direct result of the end of the moratorium for borrowers affected by Hurricanes Harvey and Irma, Black Knight said.

April 19 -

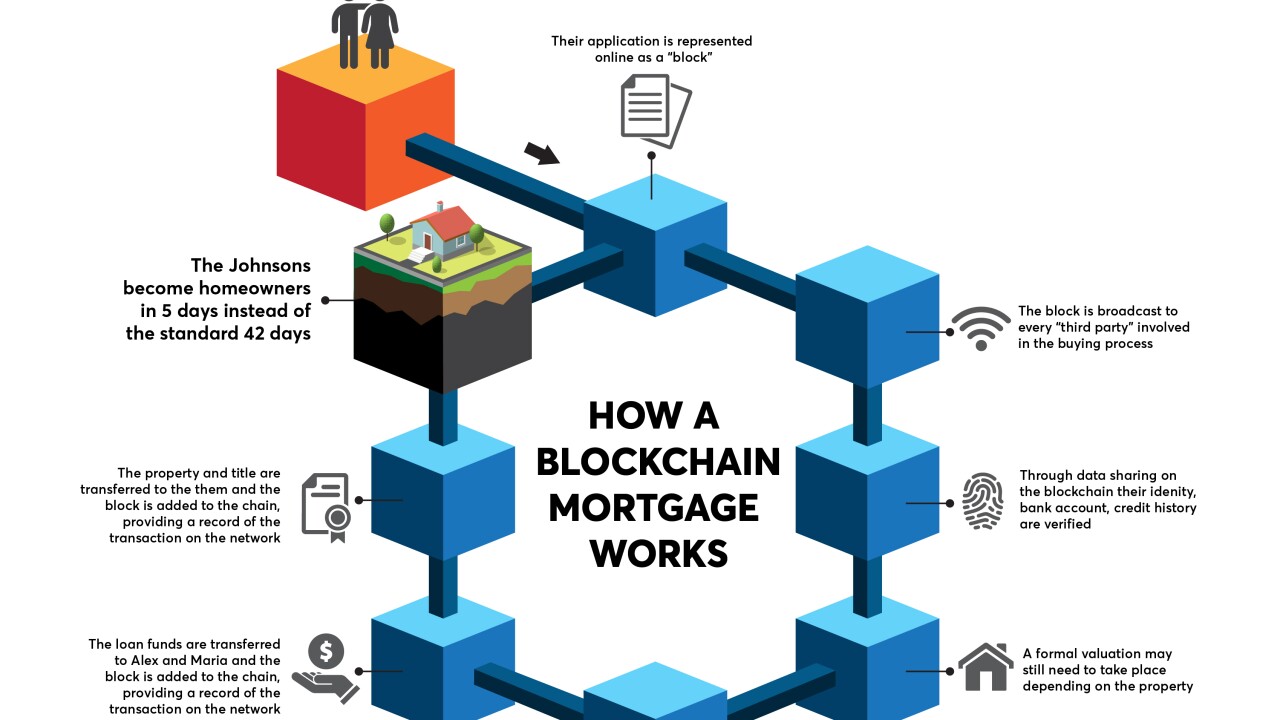

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

MGIC Investment Corp.'s first-quarter net income beat analysts' estimates due to favorable loss development and that should be seen with the other private mortgage insurers.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

Despite soaring home prices, other factors needed to inflate a housing bubble are absent from the real estate market. But experts warn falling home values and rising mortgage defaults are inevitable, even if conditions naturally cool off.

March 28 -

Fannie Mae and Freddie Mac had a 9% increase in total foreclosure prevention actions taken during 2017 as a result of three September hurricanes, according to the Federal Housing Finance Agency.

March 26 -

There was a modest decline in hurricane-related delinquent mortgages in February, a sign that there are lingering problems in the affected markets.

March 22 -

There's too much momentum and too little debt for rising interest rates to derail the U.S. economic expansion or drive up the cost of home ownership.

March 14 -

Though early-stage mortgage delinquencies inched up in December 2017, the serious mortgage delinquency rate hit its lowest point for the month of December since 2006.

March 13 -

With the exception of the troubled retail sector, delinquency rates across property types supporting commercial mortgage-backed securities were flat to declining in February compared with January.

March 12 -

The Federal Agricultural Mortgage Corp. reported significant gains in new business volume, but also realized a big jump in 90-day delinquencies.

March 9 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

Lonnie Brantley Jr. avoided prison by striking a plea deal for lying to federal housing regulators during an investigation into his troubled mortgage lending business.

March 2 -

Mortgage borrowers 60 days or more late with their payments declined both quarter-to-quarter and year-over-year, as recession-era defaults work their way out of the system.

February 20 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

National MI set a record for new insurance written in the fourth quarter, but its parent company reported a net loss for the period due to tax reform.

February 16 -

Serious delinquency rates were up sharply in November in both Texas and Florida compared to a year ago, while lower in all other states but Alaska, according to CoreLogic.

February 13 -

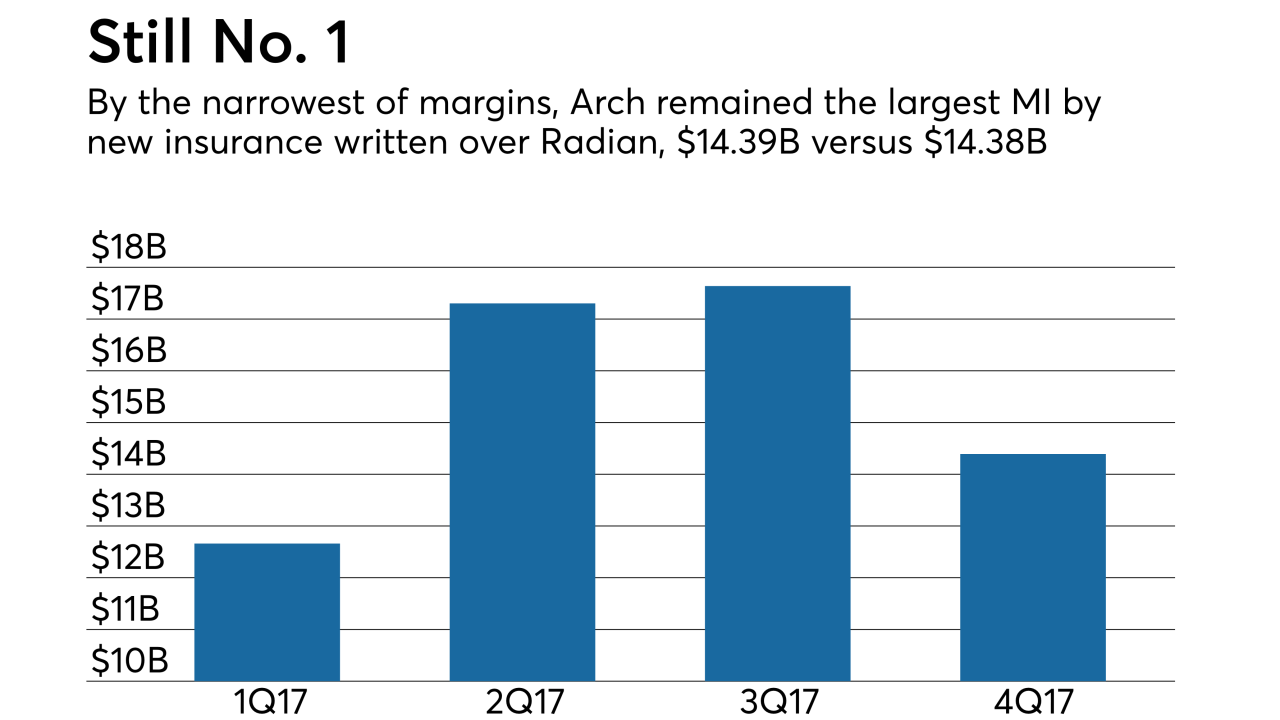

Arch Capital Group's mortgage insurance subsidiary increased its cushion under the secondary market capital standards in the fourth quarter even as its delinquent inventory grew.

February 13