-

Radian Group has improved the capital cushion at its mortgage insurance subsidiary through enhanced reinsurance arrangements and providing cash and marketable securities.

January 18 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

Default rates in second mortgages and bank cards rose notably in December, suggesting consumers are having trouble managing increased spending.

January 17 -

Despite the overall mortgage delinquency rate being down in October, early-stage mortgage delinquencies increased following an active hurricane season, according to CoreLogic.

January 9 -

Genworth Financial's acquisition by a Chinese insurance company, which has already been delayed several times, might be in peril following the failure of another cross-border merger to gain approval.

January 4 -

PHH Corp. agreed to a $45 million settlement to resolve allegations from 49 states and the District of Columbia that it engaged in "foreclosure process abuses" involving "inconsistent signatures" in its servicing business from 2009 to 2012. The settlement comes as the nonbank mortgage company continues its legal challenge to a separate regulatory action by the CFPB.

January 3 -

The largest residential mortgage servicers will get even larger in 2018, benefiting from consolidation and the outsourcing of servicing rights acquired by companies without their own platforms.

December 26 -

Development company NRP Group has sued the owner of the Lone Star Brewery for not refunding a $550,000 deposit after a deal to buy land for an apartment complex at the site fell through.

December 26 -

The seven largest national banks held less than 5% of loans that were delinquent at the end of the third quarter, the Office of the Comptroller of the Currency said Friday.

December 22 -

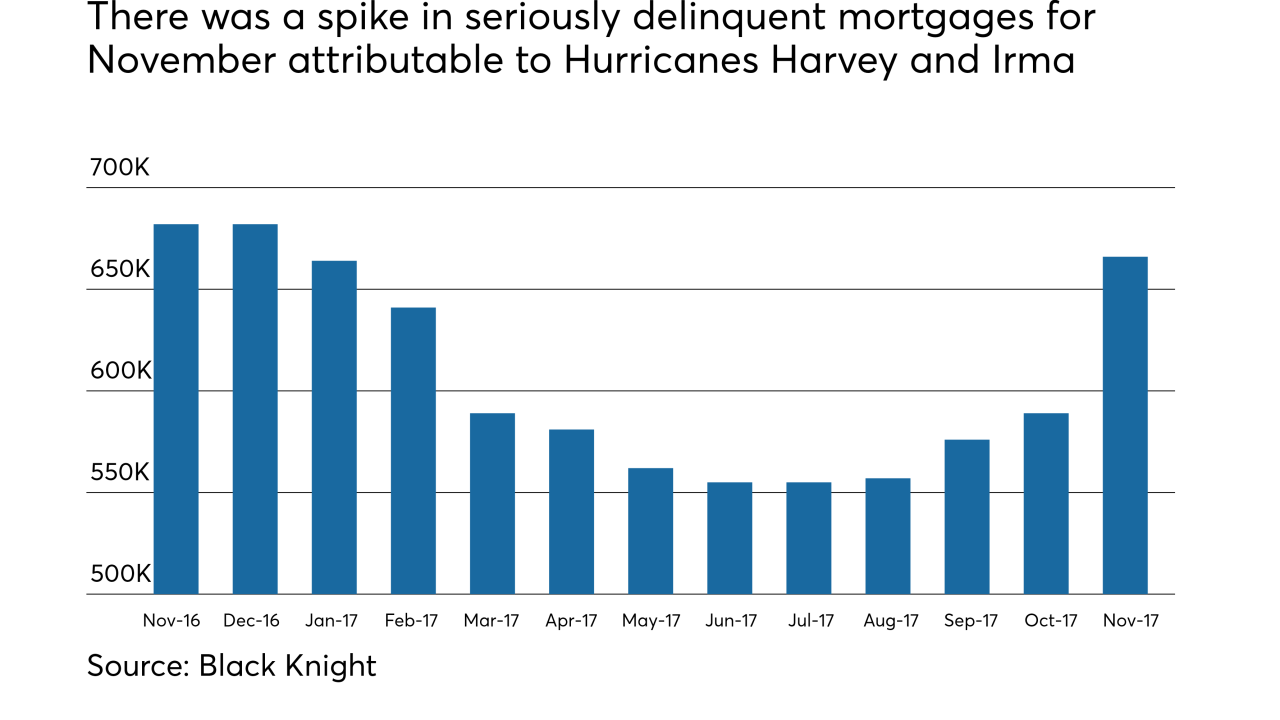

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

The Home Affordable Refinance Program recorded a 45% drop in volume in October from the previous year as it continunes to wind down, according to the Federal Housing Finance Agency.

December 15 -

PHH Mortgage was the first mortgage servicer to be fined by the New York Department of Financial Services for failing to maintain a "zombie" property.

December 14 -

Early-stage mortgage delinquencies had their largest year-over-year gain during September in over eight years, a direct result of Hurricanes Harvey and Irma.

December 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

Fannie Mae is starting to relocate staff in the Dallas area into a new office and will soon move its Washington, D.C., headquarters.

December 8 -

Cutting payments helps stave off default, but principal reduction on underwater loans and lower consumer debt levels are less effective, according to JPMorgan Chase Institute's new study of post-crisis modifications.

December 5 -

For the second time in less than a decade, the owner of roughly 1,800 acres of agricultural land in Upcountry Maui once envisioned for housing is trying to avoid foreclosure.

November 30 -

The Federal Housing Administration's recent actuarial report has added more fuel to the fire over concerns about reverse mortgages, including their effect on the overall FHA insurance fund and a rise in foreclosures.

November 22 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

Late payments from borrowers living in areas hardest hit by Hurricanes Harvey and Irma were responsible for October's increase in loan delinquencies.

November 21