-

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

Two Sacramento, Calif., defendants were found guilty of wire fraud stemming from a fraudulent real estate company that targeted members of Sacramento's Latino community, according to the U.S. Attorney's Office.

April 26 -

Homeowners in Chicago cheated by a mortgage fraud scheme are seeking to form a committee to protect their interests in the bankruptcy of Ditech Holding Corp., the company that owns their loans.

April 23 -

A trio of Los Angeles-area real estate developers were accused by the federal government of taking $1.3 billion of investor funds that was supposed to be used for hard money loans for their own use.

April 15 -

Learning to understand the risk rather than adding steps to the mortgage application process is the way to mitigate fraud.

April 10 CoreLogic

CoreLogic -

A Staten Island, N.Y., man involved in a $2.5 million real estate investment scheme that targeted investors, many of whom were elderly and some of whom had dementia, was sentenced to three years in prison.

April 8 -

A recent pyramid scheme highlights why mortgage lenders should keep an eye out for misrepresentation when reviewing electronic documents and signatures.

April 2 -

Income-related mortgage application fraud risk has the potential to increase as competition rises among buyers during the peak spring season, First American said.

March 29 -

With a second defendant pleading guilty to conspiracy, it was learned that a Watertown, N.Y., apartment complex is among dozens of rental properties in that state and several others that allegedly received $500 million in fraudulent bank loans.

March 25 -

Just minutes after his federal prison sentence was raised, Paul Manafort was charged by New York state prosecutors with residential mortgage fraud, conspiracy and falsifying business records.

March 13 -

David Plunkett, a 53-year-old accountant in Lynn, Mass., pleaded guilty to bank fraud this week for his part in a scheme to defraud mortgage lenders between 2006 and 2015.

February 28 -

A strong spring home purchase season is likely to further increase mortgage loan application defect risk, which already spiked in the past two months, according to First American.

February 28 -

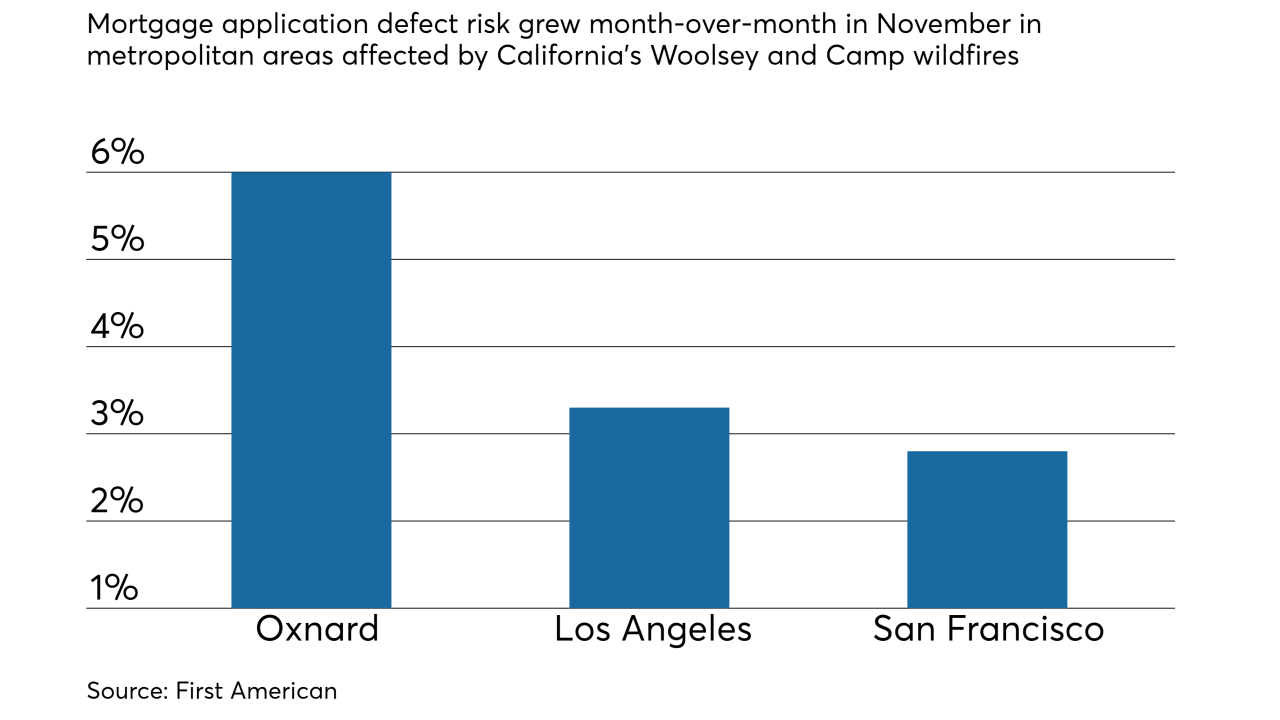

Mortgage application defect risk was at its highest level in four years because of higher interest rates as well as natural disasters during the latter part of 2018, according to First American.

January 31 -

The government shutdown could affect mortgage origination credit quality as lenders miss some red flags normally found using data that is not currently available, according to Moody's.

January 10 -

Mortgage application fraud risk continued growing for the fifth consecutive month, and the recent California wildfires are partly to blame, according to First American Financial Corp.

December 27 -

A Wilmington Township, Pa., man accused of illegally purchasing properties he formerly owned through a tax sale has pleaded guilty to a felony charge of deceptive business practices.

December 24 -

A Flora Vista, N.M., man accused of five felony charges for forging a signature on real estate paperwork then ordering an employee to dispose of property from the victim's residence has agreed to a plea agreement.

December 19 -

Five Florida Keys men ripped off the federal government and received thousands of dollars in recovery money after Hurricane Irma struck last year, the Monroe County State Attorney's Office said.

December 14 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

Wire fraud is considered a consumer and title agent issue, but the millions of dollars it's diverting from home purchase transactions make it an issue mortgage lenders need to address, too.

December 5 CertifID

CertifID