-

David Plunkett, a 53-year-old accountant in Lynn, Mass., pleaded guilty to bank fraud this week for his part in a scheme to defraud mortgage lenders between 2006 and 2015.

February 28 -

A strong spring home purchase season is likely to further increase mortgage loan application defect risk, which already spiked in the past two months, according to First American.

February 28 -

Mortgage application defect risk was at its highest level in four years because of higher interest rates as well as natural disasters during the latter part of 2018, according to First American.

January 31 -

The government shutdown could affect mortgage origination credit quality as lenders miss some red flags normally found using data that is not currently available, according to Moody's.

January 10 -

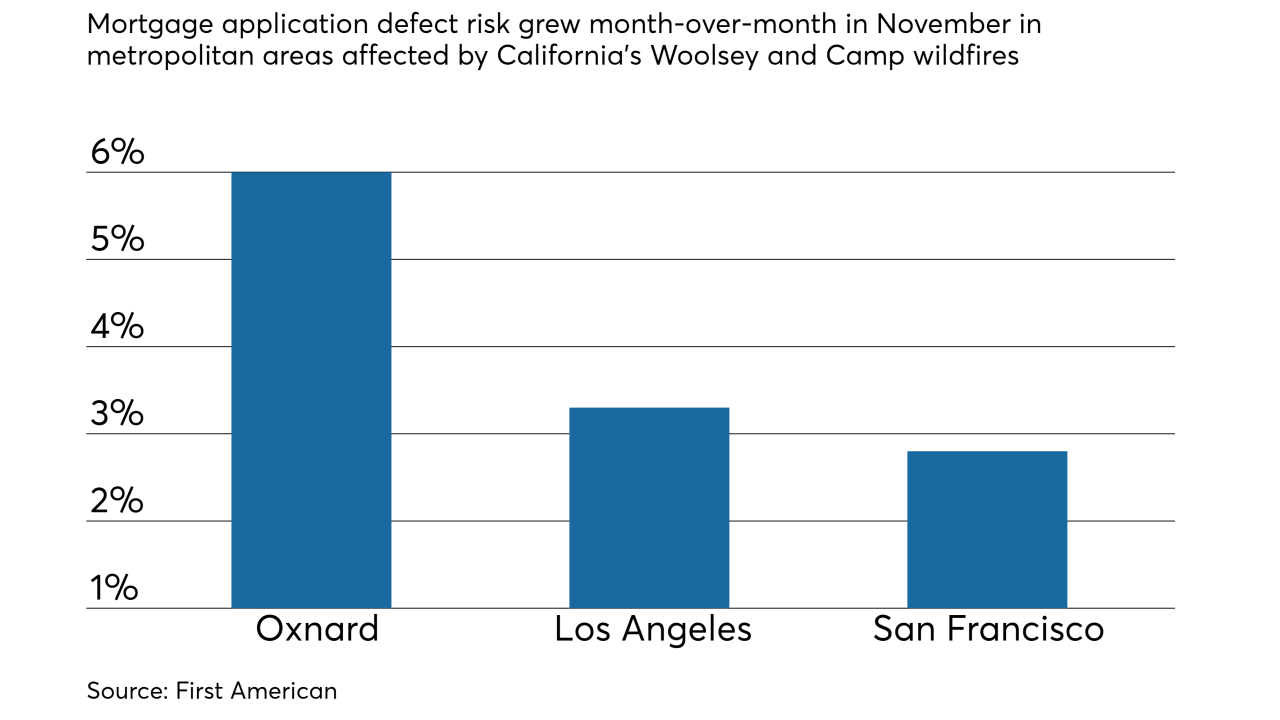

Mortgage application fraud risk continued growing for the fifth consecutive month, and the recent California wildfires are partly to blame, according to First American Financial Corp.

December 27 -

A Wilmington Township, Pa., man accused of illegally purchasing properties he formerly owned through a tax sale has pleaded guilty to a felony charge of deceptive business practices.

December 24 -

A Flora Vista, N.M., man accused of five felony charges for forging a signature on real estate paperwork then ordering an employee to dispose of property from the victim's residence has agreed to a plea agreement.

December 19 -

Five Florida Keys men ripped off the federal government and received thousands of dollars in recovery money after Hurricane Irma struck last year, the Monroe County State Attorney's Office said.

December 14 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

Wire fraud is considered a consumer and title agent issue, but the millions of dollars it's diverting from home purchase transactions make it an issue mortgage lenders need to address, too.

December 5 CertifID

CertifID -

There was an 8% year-over-year increase in mortgage loan application defect risk in California during October and that should rise further because of the wildfires that devastated the state, First American said.

December 3 -

Orlando real estate broker Geo Geovanni, 49, was found guilty in federal court of one count of conspiracy to commit bank fraud and three counts of bank fraud, the U.S. Attorney's office announced.

December 3 -

The Federal Savings Bank is trying to persuade a judge to look beyond its CEO's alleged complicity in a fraud perpetrated by President Trump's former campaign chair.

November 29 -

Two more real estate investors have admitted conspiring to rig bids at foreclosure auctions, bringing to nine the total who say they cheated at the public auctions held at South Mississippi courthouses.

November 29 -

Fintech adoption among real estate and title agents is accelerating, though their optimism on the housing market has tanked, according to First American Financial Corp.

November 27 -

The scheme's perpetrators were based in Irvine, Calif., the FTC said in a complaint filed in U.S. District Court in Maryland.

November 14 -

Three people who fraudulently obtained $9.3 million in mortgage loans involving homes in Modesto, Patterson and Lathrop, Calif., have received multiyear federal prison sentences.

November 13 -

UBS Group sold tens of billions of dollars' worth of residential mortgage-backed securities by "knowingly and repeatedly" making false and fraudulent statements to investors about the loans backing those trusts, the U.S. Justice Department said in a civil suit filed Thursday.

November 8 -

A former instructor at the Purvis Real Estate Training Institute in Fort Worth, Texas. was sentenced to 13 years in federal prison for running a Ponzi scheme that robbed investors of more than $1.2 million.

November 6 -

Growing home prices plus rising interest rates are putting a damper on mortgage lending, which pushes the market to seek out less qualified borrowers and increases the risk of fraud.

October 29 Mark Migdal & Hayden

Mark Migdal & Hayden