-

A 75-year-old Florida real estate developer was sentenced to six months in prison after admitting he lied to banks to keep money flowing so he wasn't forced to scuttle an oceanfront hotel and condominium in Vero Beach.

August 29 -

Wire fraud committed through business email compromise schemes has emerged as a serious threat to mortgage and real estate transactions. Defending against these scams requires a comprehensive strategy that includes technology, training and nonstop vigilance.

August 27 -

Fraudsters can track a home sale from the moment it goes on the market until the deal closes, make these transactions a ripe target for business email compromise scams that seek to intercept wire transfers and steal from legitimate participants in a deal.

August 27 -

Post-crisis measures made it harder for rogue borrowers and employees to commit fraud. Now, a new threat has emerged from scammers posing as title agents, real estate professionals and more.

August 24 -

A mortgage fraud scheme involving fake employment records, initially thought to be contained to Southern California, is occurring statewide, Fannie Mae said in a new fraud alert.

August 9 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

The five-year legal odyssey of former Jefferies Group managing director Jesse Litvak, the first person charged in a federal crackdown on questionable bond-trading tactics, came to an end as prosecutors said they don't intend to try him a third time.

July 30 -

Five potential witnesses against Paul Manafort, including accountants and bankers, were identified Monday as a U.S. judge gave the former Trump campaign chairman's lawyers more time to review tens of thousands of documents handed over to them in recent weeks.

July 25 -

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6 -

The Royal Bank of Scotland is paying $20 million to settle an investigation by the Illinois attorney general related to the bank's marketing and sale of residential mortgage-backed securities.

July 5 -

PricewaterhouseCoopers was ordered to pay the Federal Deposit Insurance Corp. more than $625 million for negligence in the audit of Colonial BancGroup Inc., an Alabama bank holding company that failed during the financial crisis.

July 3 -

The son of a Lake Worth, Fla., man arrested this month in an alleged rent-fraud scam is wanted for acting as an accomplice in the crime, the Palm Beach County Sheriff's Office said.

June 29 -

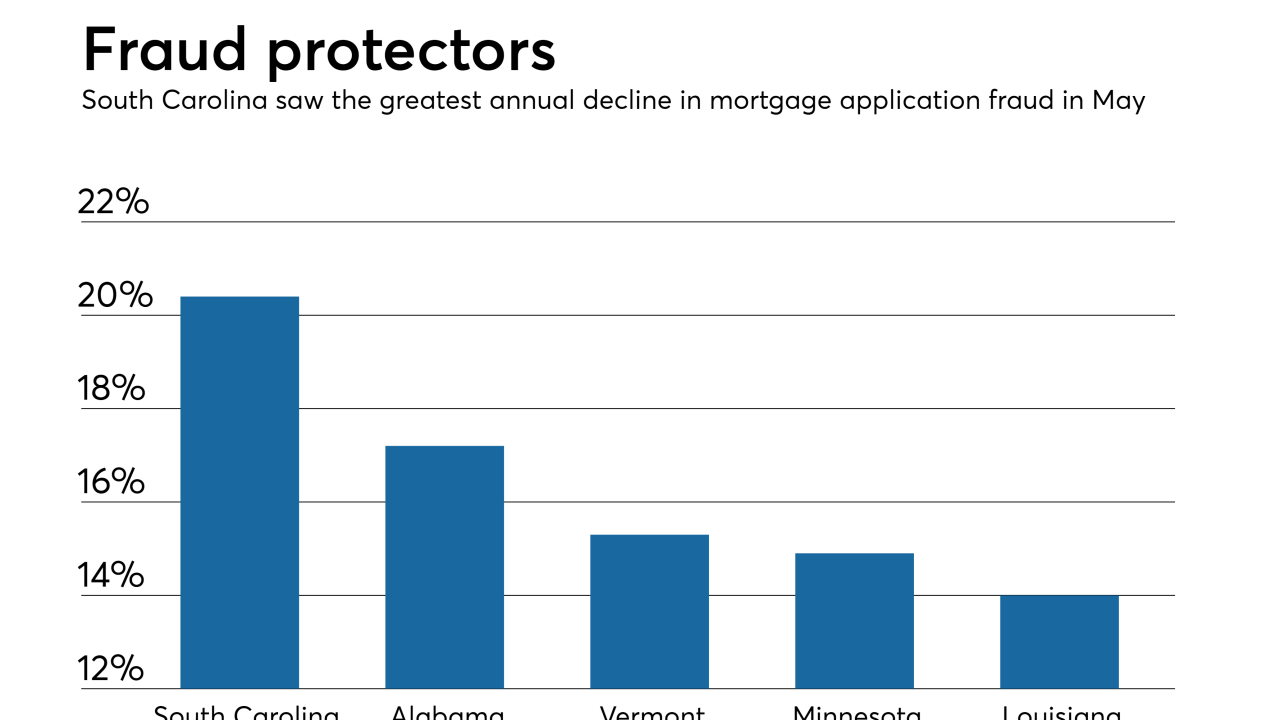

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22 -

One-time Modesto City Council candidate Robert Farrace, an attorney and real estate broker, was sentenced to two years in federal prison for defrauding real estate lenders.

June 19 -

The man authorities called the mastermind behind a complex mortgage fraud scheme targeting distressed properties was arrested June 7 in South Carolina and charged with being a fugitive in violation of probation.

June 18 -

Federal law enforcement authorities have arrested 74 people in this country and abroad, accusing them of participating in a wire fraud scam whose victims included real estate attorneys and settlement service providers.

June 12 -

Federal authorities charged a third real estate investor with bribery-related offenses in a long-running corruption probe of the process through which the Philadelphia Sheriff's Office sells seized and foreclosed properties.

June 8 -

Two Orange County, Calif., men were to federal prison for their part in a mortgage scheme that led to the fraudulent purchase of more then 100 condominium units and $10 million in losses.

June 7 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30