-

Increases in values were more likely to stick across the Central U.S, while pandemic boomtowns experienced the biggest declines in median housing costs, according to Realtor.com.

January 4 -

Prices were up by less than 9% year-over-year, according to CoreLogic's report.

January 3 -

The demographic of buyers between ages 25 to 41 also topped demand for repeat home purchases, a metric different from second-home and investor acquisitions.

December 30 -

House hunting activity also slowed in December, with home tours declining 69% from the start of the year, a Redfin report found.

December 30 -

NexBank will provide a line of credit of $200 million, $68 million lower than what it supplied in 2022.

December 29 -

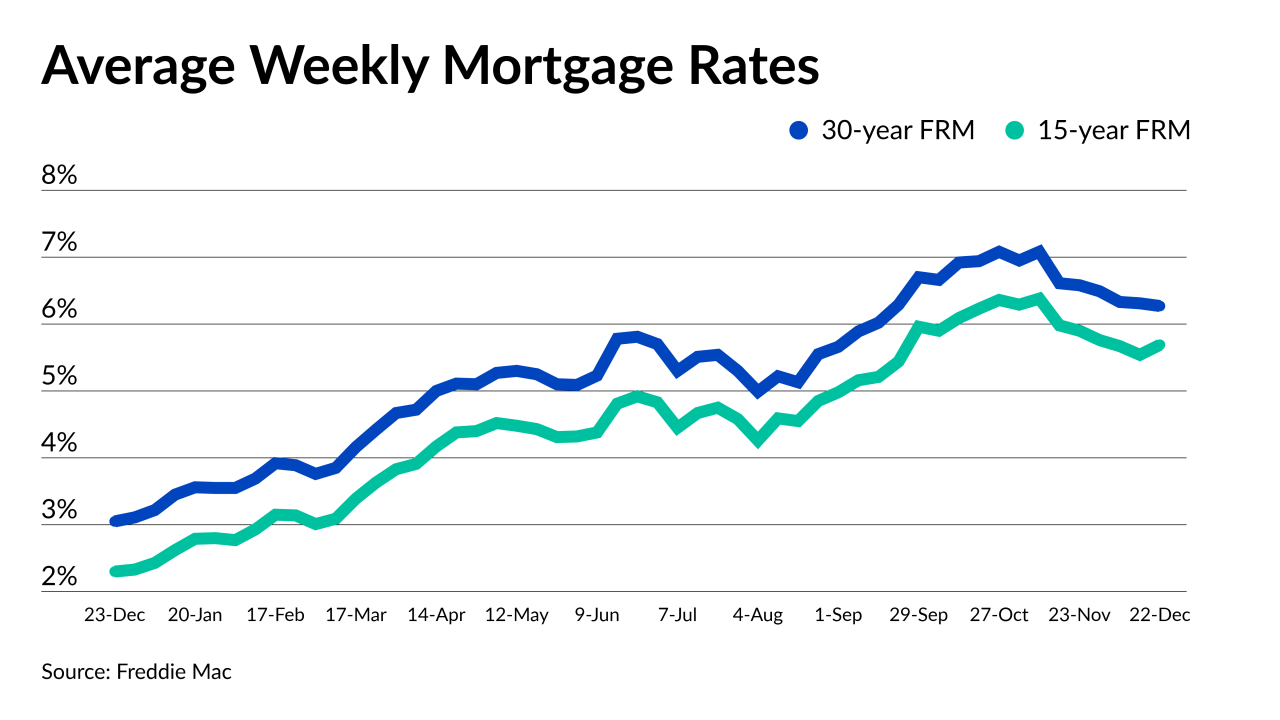

The 30-year fixed rate surged 15 basis points from a week earlier but ends 2022 at more than twice its mark from a year ago.

December 29 -

The laws will go on the books later next year as part of an effort to provide builders with new tools to deal with the California's lack of land for new residential construction.

December 29 -

Special purpose credit programs, down payment assistance and potential mortgage insurance premium cuts came into focus over the past year.

December 29 -

Sales of high-end homes fell 38.1% year-over-year, per a Redfin report.

December 28 -

Kindred Home Loans will serve buyers of properties in Dallas and San Antonio markets.

December 27 -

Eligible borrowers in Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia can apply.

December 27 -

Prices fell 0.5% from September, the fourth consecutive monthly decline for a seasonally adjusted measure of home prices in 20 large cities, according to the S&P CoreLogic Case-Shiller index.

December 27 -

Prospective borrowers can secure significant square footage for often below $300,000 in these mostly Midwest cities, according to industry veterans.

December 26 -

A mid-month retreat in 30-year mortgage rates back below 7% along with an increase in builder incentives may have helped support demand.

December 23 -

Some companies are making them available for a broader range of mortgage products, and one also offers a future no-fee refinance option.

December 23 -

Mortgage-purchase applications were 4.6% higher in December from a month ago, per a Redfin report.

December 23 -

Many have called for a heavy analysis if not an outright denial of the transaction by the government, but this could finally move the needle, said former Obama Administration official and former head of the MBA David Stevens.

December 22 -

The partnership will expand UHM reach to new markets in Florida, Michigan, Ohio, North Carolina and California.

December 22 -

But the 15-year interest rate rose last week, in line with 10-year Treasury yields, as bond investors used a quiet week to reflect on broader trends.

December 22 -

The average monthly payment dropped by more than one percent from October.

December 22