-

Among the mortgage industry investors in the product and pricing engine provider are Movement Mortgage and First American Financial.

January 26 -

And a recent slowdown in government-backed loan issuance is pushing average purchase amounts to another record high.

January 26 -

The company will leverage its diversified consumer-finance model while optimizing a traditional mortgage business with thinner margins as the business cycle turns, CEO Patti Cook said.

January 26 -

While increased activity in rentals is influencing current numbers, interest in homeownership among Gen Z could help fuel growth later this decade.

January 25 -

The mortgage lender's CEO Brett McGovern speaks on how the deal came together and how the two will work together once the deal closes.

January 25 -

However, the shortage of entry-level home listings should result in a competitive spring purchase season, the government-sponsored enterprise said.

January 24 -

While lack of inventory and high prices remain on their list of worries, rising interest rates also stand to make a greater impact.

January 24 -

The researchers found that the disparities that emerged from the analysis of 1.8 million appraisals from 2019 and 2020 were statistically significant.

January 21 -

It’s not just potential buyers and sellers holding this perception; over four-in-10 real estate agents agree with that sentiment.

January 21 -

The mortgage industry has long sought a reduction, which could make homes more affordable to entry-level buyers with limited incomes, but such a measure also would limit the agency’s claims-paying resources.

January 20 -

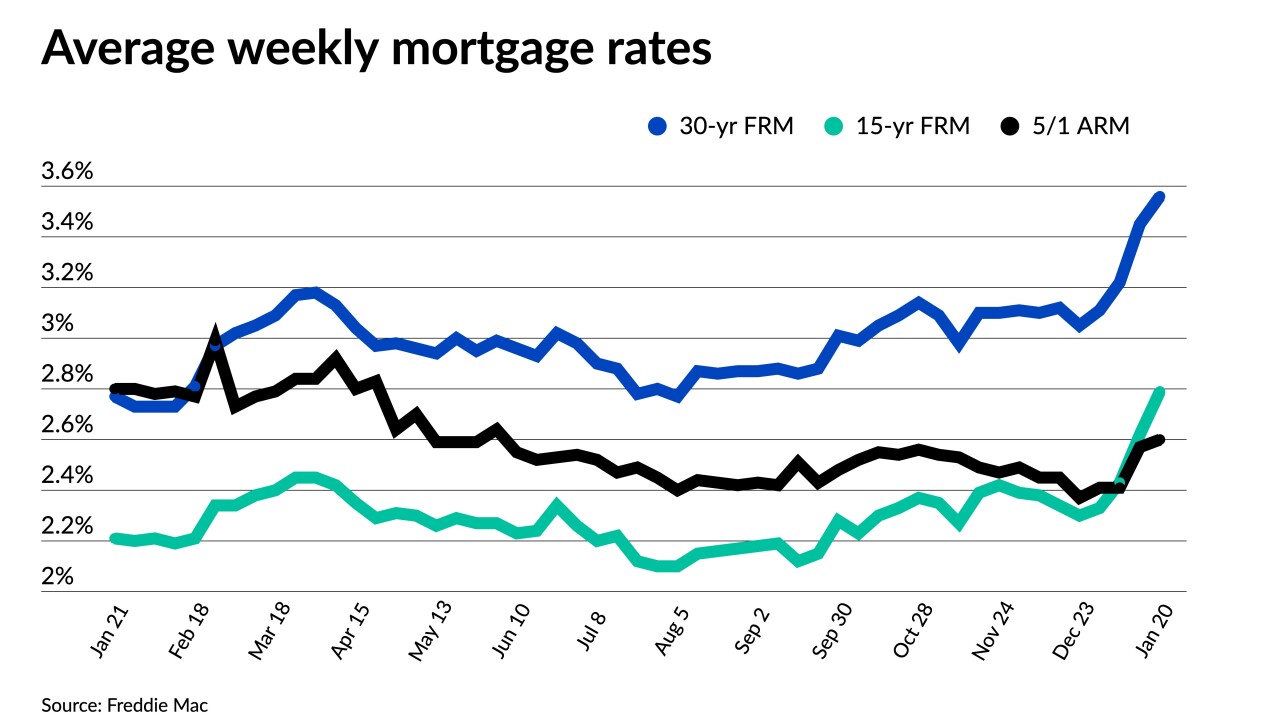

All major averages have risen to start 2022, with the 15-year surpassing the ARM.

January 20 -

December's average balance for a mortgage to purchase a newly constructed property set an all-time high, the Mortgage Bankers Association's Builder Application Survey found.

January 20 -

Influencer loan officers are aiming to reach the largest emerging group of homebuyers, one super-short video at a time.

January 20 -

Home valuation professionals have had mixed feelings about automation out of concern that some forms could result in less accurate assessments.

January 19 -

The new offering’s loan structure is designed to hedge against digital currency's price volatility.

January 19 -

Modest reductions were made to the 2021 and 2022 outlooks, although the government-sponsored enterprise did boost purchase expectations for this year.

January 19 -

But a surge in purchases led overall mortgage volumes to a weekly gain and pushed average loan size to a new record.

January 19 -

The settlement is a reminder that officials who oversee the loan officer licensing system do actively police the fulfillment of professional requirements by loan officers.

January 18 -

While the normal holiday season pattern contributed to the December drop-off, potential buyers also need to make offers on multiple properties before winning a home, Redfin said.

January 18 -

Average prices were up 15% compared to the same month in 2020.

January 14