-

Despite the rising number of COVID infections, investors made no moves that would apply downward pressure.

January 6 -

While some in the industry support the change, mortgage broker trade group AIME called on the agency to reconsider it.

January 5 -

Refinances also decreased, with rising rates contributing to the slowdown.

January 5 -

Originations of home equity conversion mortgages surged nationwide at the end of the year, with December numbers near a 4-year high.

January 4 -

For the past five months, single-family house prices were up by at least 18% compared to monthly averages in 2020, but by next November, increases should sink below 3%, CoreLogic said.

January 4 -

But low mortgage rates and higher wages are allowing borrowers to meet conforming loan underwriting terms — at least for now.

December 30 -

The 30-year average climbed six basis points after falling to a monthly low a week earlier.

December 30 -

When finalized, the sections to the Single Family Housing Policy Handbook 4000.1 will replace some 150 Mortgage Letters issued over the years.

December 29 -

About 40% of likely purchasers are delaying or cancelling their activity, a Redfin survey found.

December 29 -

The past year was noteworthy for many reasons — and within the mortgage industry, some might even argue that 2021 was even more momentous than the 12 months preceding it. What all can agree on, though, is that the ongoing pandemic continued to reshape the lending landscape. As 2022 approaches, we look back on a few of this year’s running themes.

December 29 -

The lender’s controversial leader Vishal Garg will remain on break but retain his post after disparaging laid-off employees, Aurora Acquisition Corp. confirmed in a Securities and Exchange Commission filing.

December 28 -

In October, those factors outweighed a smaller rise in annual wage growth, and the gap will keep widening, according to a new First American Real House Price Index report.

December 27 -

The average 30-year rate dropped seven basis points to 3.05%.

December 23 -

While 2021 projections are unchanged from November, they are 2% higher than what the organization's economic forecast in October.

December 23 -

Rising Covid-19 cases in the U.S. and overseas could create supply chain and labor headwinds in the coming months, slowing construction and leading to further inventory shortages.

December 23 -

-

In four of the six periods in the last 30 years where mortgage rates increased significantly, sales also grew, First American said.

December 22 -

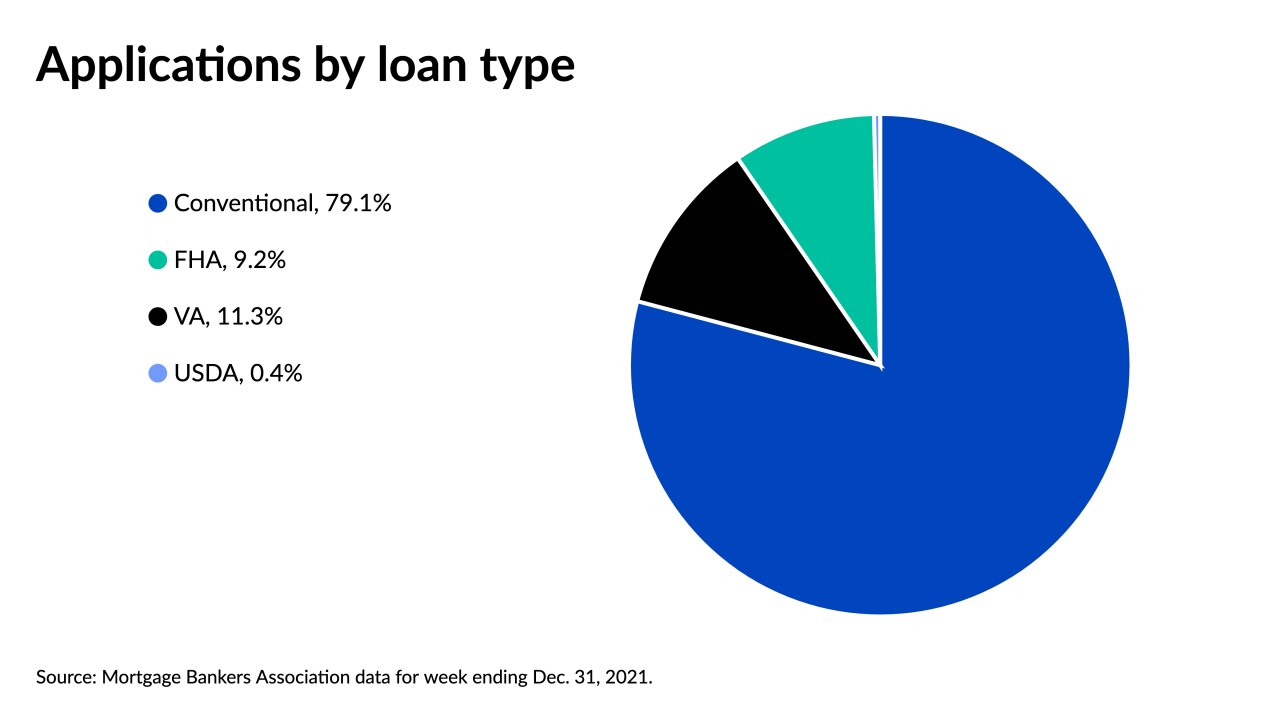

While the overall number of applications dropped last week, average mortgage sizes shot up across all categories.

December 22 -

The government-sponsored enterprise has 45 days to submit a plan on how it intends to meet the increased target for 2022 through 2024.

December 21 -

Recent existing home sales have been stronger than expected, but next year could see a market held back by the inventory shortage and higher rates.

December 20