-

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

The wholesale lender's net income of nearly $330 million factored in a $170.5 million hit from a reduction in its mortgage servicing rights fair value.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The two fintechs look to streamline document capture and credit decisioning for lenders.

November 8 -

More aggressive pursuit of government-related agencies’ affordable housing mission is expanding product availability, but government intervention can be a double-edged sword.

November 8 -

All six companies, however, remained highly profitable, as the delinquency and forbearance outlook is favorable for the possibility of rising claims payments.

November 5 -

Sue Barber takes over the position after leading its Northeast division.

November 5 -

Plans to taper rate stimulus could further dampen industry employment, depending on the extent to which decreased volume is offset by staffing needs driven by the shift to work-intensive purchase loans.

November 5 -

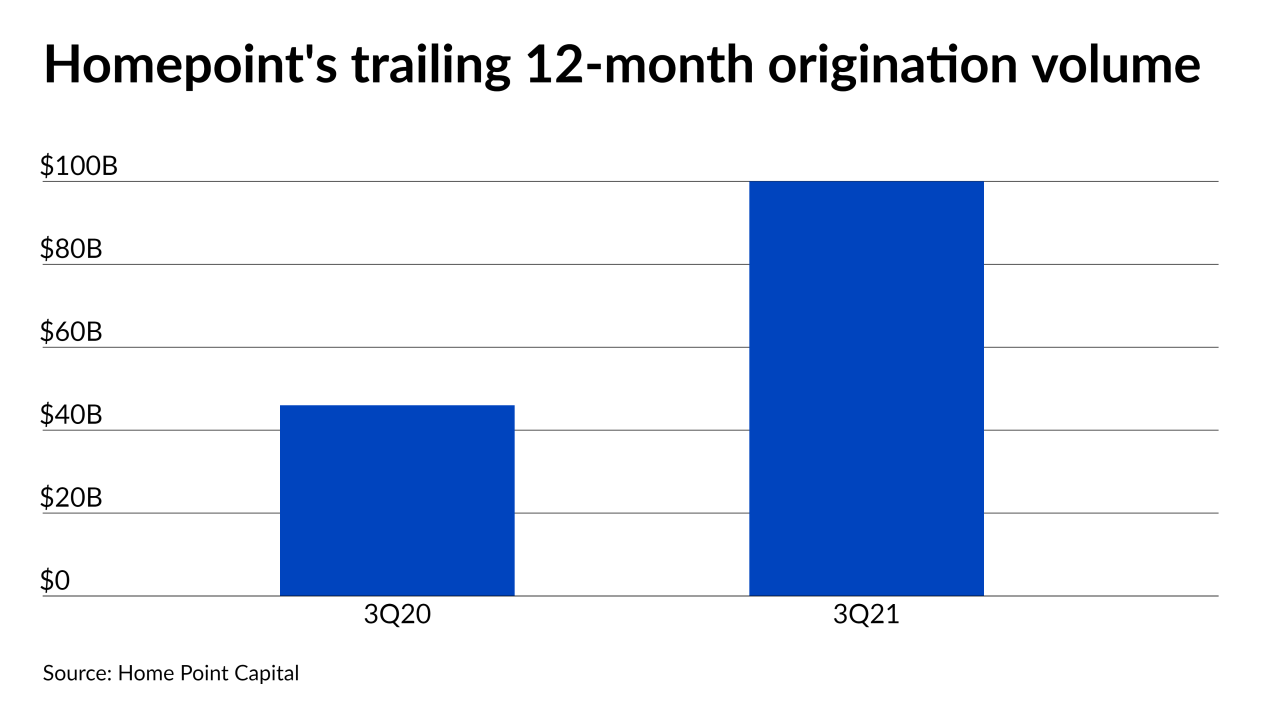

While the company produced $88 billion during the period, it had a major margin squeeze in its TPO Pro channel.

November 5 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5 -

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

But the Fed’s taper announcement has the industry planning for increases throughout 2022.

November 4 -

The partnership with Esusu, which the athlete’s venture capital firm invested in earlier this year, could help renters build credit histories, broadening their housing options, improving loan performance and incentivizing originations.

November 3 -

Applications related to Zillow Offers made up 70% of the mortgage lender's purchase business in the third quarter.

November 3 -

Purchases also dropped on a weekly basis, but still show signs of strong demand.

November 3 -

The transaction expands the investment management company’s portfolio of mortgage and real estate companies, which includes Selene, Deephaven and Progress Residential.

November 2 -

After closing its merger with Caliber, the company also hopes to pare down expenses by at least 10%.

November 2 -

But the number of prospects remains at the high end of its pre-pandemic range.

November 2 -

Values are predicted to increase by just a fraction of the rate they had in 2020, CoreLogic said.

November 2 -

The company, which was accused of cutting corners in originations by a former top executive, produced $32 billion in the third quarter and is guiding between $26 billion and $31 billion in the fourth.

November 1